Bitcoin, Ethereum, How To Trade Cryptos Safely

Currencies / BlockChain Oct 26, 2017 - 08:26 PM GMTBy: Avi_Gilburt

In our previous article, we briefly described, in layman’s terms, the technology underlying cryptocurrency. Then we described how to get started with your first cryptocurrency purchase. In this article we want to characterize the crypto trade so you can begin a journey toward successful trading. Cryptocurrency is a very volatile asset and perhaps the most volatile asset we have seen. We expect it to remain this way for some time.

In our previous article, we briefly described, in layman’s terms, the technology underlying cryptocurrency. Then we described how to get started with your first cryptocurrency purchase. In this article we want to characterize the crypto trade so you can begin a journey toward successful trading. Cryptocurrency is a very volatile asset and perhaps the most volatile asset we have seen. We expect it to remain this way for some time.

On any given day, we might see certain cryptos move 100% or more. 10% moves in small cap coin are quite pedestrian. 3-5% daily moves in the larger coins are common. Therefore, the returns, both positive and negative, outstrip the stock market by many fold.

Furthermore, it is a market that never shuts down due to automation, as exchanges trade 24 hours a day, 7 days a week. There is nothing like waking up one morning to find out traders in another country had pushed the market more than you expected- for a gain or a loss.

Contrary to the ‘get rich quick with crypto’ talk pervading the media, we suggest that most traders put very little of their overall asset value at risk in this market.

Accelerated Pace

We also characterize the crypto market as operating on an accelerated time scale. While using our Fibonacci Pinball method works quite well through all time frames, it simply moves much faster than any other market.

To put the speed of this market in context, Coinbase founder, Fred Ehrsam, gave an interesting perspective in a recent interview. During the interview, he was asked whether cryptos were in a bubble. In response, he said he’s seen several boom and bust cycles in only his seven years in the business.

That’s right. Several boom and bust cycles in seven years.

Looking over the chart of Bitcoin, which started in 2010, we find two bear market drops of over 90%. 30% to 50% drops over a month or more have been very common.

Ryan got his feet wet trading Ether very early in its history. Within months of his first trade in early 2016 it was three multiples higher. Yet, by December 2016, it lost 60% in a six month bear market . Ryan exited his positions at the time after it broke bull market support. Ryan re-entered the market in the $7 to $10 dollar region after it presented with a new impulsive structure. It is now hovering around $300.

Through the lens of the Elliott Wave Principle we call the current rally under way in Ether the third wave, based upon our Fibonacci Pinball method. We derived the targets as shown in 1 in Fig. 1 using this method.

Fig. 1 chart of Ethereum wave 1, 2, and 3.

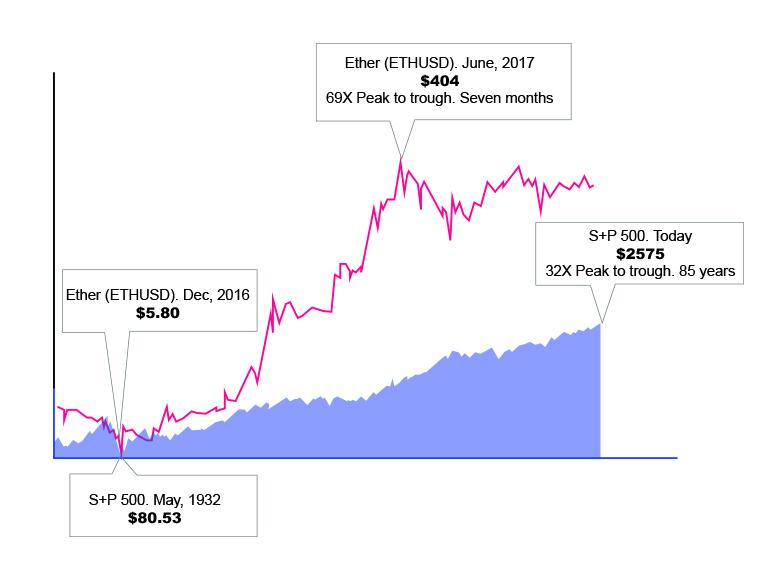

Let’s compare the third wave in Ethereum, still in progress, to the great bull run of the stock market. We are comparing 84 years in the S+P to just over six months in Ether. And, in that six months, as you can see, Ether has outperformed the S+P500 by many fold. This evidences the accelerated return in time, but one must realize that also means the ‘busts’ come with similar acceleration.

Fig1. S+P500 vs. Ether Equal return comparing their two time scales

How You can Succeed

Ryan learned early that the best to way to manage this volatility is to start small. He personally started with $500 and readily recommend new subscribers to our service consider a similar modest start. If you can manage the trade well, you can grow that immensely. More is not needed, but one may choose to add as they develop a comfort with the market.

Elliott Wave and CryptoCurrency

The key to trading this market well is to identify points where the market may turn. We use Elliott Wave analysis to do this in cryptos just as in any other asset.

Sentiment rules all markets and Elliott Wave is the best discerner of market sentiment I have come across. If you believe there is no fundamental value in cryptocurrencies, then you must believe that these markets are purely sentiment driven. Furthermore, the Fibonacci Pinball rules we use have worked quite well identifying support and resistance levels in cryptocurrency.

Of course, newer assets have little price history to build the most confident count, but we’re tracking many older large cap coins with very reliable counts.

Among the smaller cap coins, Ryan is seeking out the next coin that can enter a massive third wave to rival that of Ether’s and Bitcoin’s monstrous climbs. He has identified a few candidates we are tracking them in our small cap portfolio. Once the chart is ripe enough for higher confidence, we will consider writing a public article on the specific coin.

Conclusion

Cryptocurrency is a very volatile asset. Before one jumps in with large positions, it is better to get a feel for trading this asset. One must also understand that we will see boom and bust cycles in crypto currency just as any asset. And, finally, we use the Elliott Wave Principle to guide us through those cycles identifying key levels that can turn the market.

Next up….Is Bitcoin in a bubble?

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

© 2017 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.