The Next Chair of the Fed and Gold

Commodities / Gold and Silver 2017 Nov 02, 2017 - 05:22 AM GMTBy: Arkadiusz_Sieron

Janet Yellen’s term as Federal Reserve chair ends on February 3rd. President Trump is expected to announce the new Federal Reserve Chair very soon, perhaps even this week. He said that we’ll get to know his choice before a tour in Asia in early November. Since that has not taken place so far, we would like to prepare you for the outcomes of Trump’s possible decisions. Moreover, we will analyze which candidate would be the best for the gold market.

Janet Yellen’s term as Federal Reserve chair ends on February 3rd. President Trump is expected to announce the new Federal Reserve Chair very soon, perhaps even this week. He said that we’ll get to know his choice before a tour in Asia in early November. Since that has not taken place so far, we would like to prepare you for the outcomes of Trump’s possible decisions. Moreover, we will analyze which candidate would be the best for the gold market.

The list of pretenders is rather short:

1) Gary Cohn;

2) Kevin Warsh;

3) Janet Yellen;

4) John Taylor;

5) Jerome Powell

We will start with Gary Cohn, as his odds are the smallest, just about 2 percent, according to PredictIt. This is because Cohn, who is the president’s chief economic adviser, has neither formal economics background nor experience in central banking. He also worked years for Goldman Sachs, making a decent fortune, which may be not welcomed in Senate, and especially not by the Democrats. Last but not least, he criticized Trump’s response to the protests in Charlottesville. It’s difficult to categorize him as hawk or dove, as very little is known about his view on monetary policy. But as he is pragmatist and stands not very far from Yellen’s stance, his choice – which is very unlikely – would not significantly affect the gold market (but there might be some volatility at the beginning until his views would become clear for the investors – and because it would surprise markets).

Kevin Warsh has greater chances – PredictIt assigns him a 11 percent probability of becoming the next Fed chair. He was an economic adviser to President George W. Bush from 2002 to 2006 and a Fed governor from 2006 to 2011, so his experience is better suited than Cohn’s. Warsh’s impact on the gold market could be significant as he is considered to be among the most hawkish of the contenders. He opposed the second round of quantitative easing, so he might try to accelerate the quantitative tightening a bit. He will also support the deregulation of the financial industry. Hence, his choice would increase the interest rates, a bearish factor for the gold prices. Indeed, when he led the polls two weeks ago, the short-term interest rates moved higher.

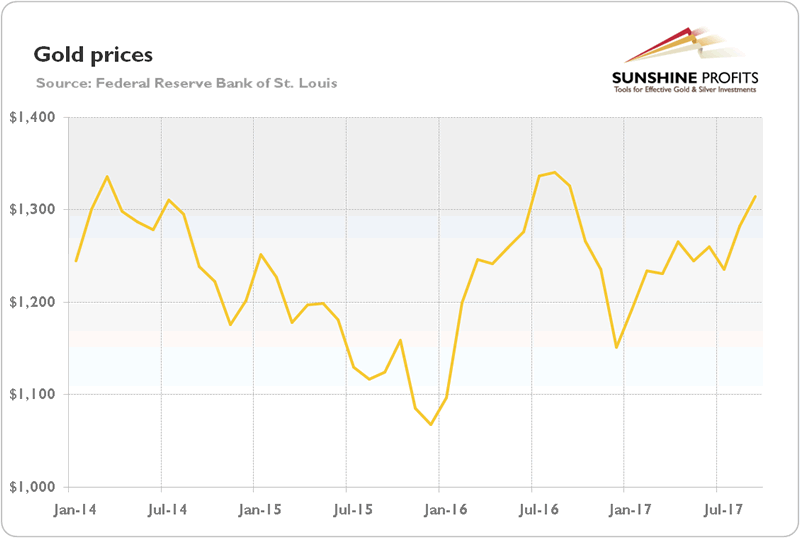

Janet Yellen has about 19 percent odds to be reappointed as the Fed chair. It would be in line with tradition, and we would not be surprised if Trump eventually nominates her after all this fuss. He said that he liked low interest rates, so dovish Yellen (who is actually not so dovish, given her focus on tightening) could be fine. However, Yellen’s Democratic views, opposition to less discretionary monetary policy and far-reaching deregulation of the financial sector might be serious obstacles to her being picked. Her choice would not shake the gold market, as it would keep the status quo. And from the long-term point of view, Yellen should be, well, neutral for the yellow metal, which could remain in the sideways trend (big price swings could still happen, but gold would not be likely to stay away from the current price levels for long). As the chart below shows, the price of gold is now very close to the level seen in February 2014, when Yellen was appointed.

Chart 1: Gold prices during Yellen’s term (London P.M. Fix, monthly average).

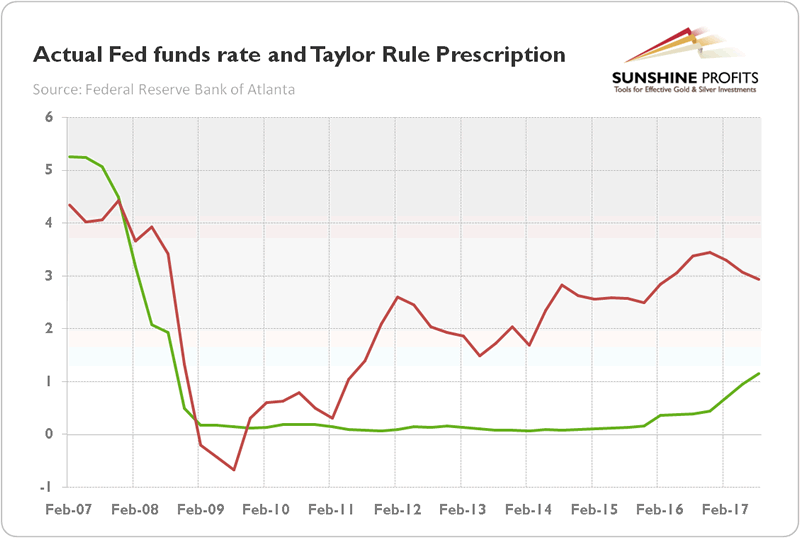

As we write these words (October 21), John Taylor’s odds are the same as Yellen’s. However, he has recently gained momentum after press reports that Stanford University economist impressed Trump and his team during a meeting at the White House. Actually, the White House spokeswoman told reporters on Friday that Trump was considering nominating John Taylor for either the Chair or the Vice Chair (and Powell for the Fed’s second top job). Taylor’s nomination would be very interesting and could have a lasting impact on the gold market. This is because he is a strong supporter of a rule-based framework for interest rates policy. Have you heard about the Taylor rule? Yup, it was created by our candidate. And the key thing is that this rule suggests that rates are still far too low. Far, far too low: according to Taylor’s model, the Fed should raise its policy rate to about 3 percent (or even higher, as there are several versions of Taylor’s rule) from 1.15 percent currently, as one can see in the chart below.

Chart 2: Actual Fed funds rate (green line) and Taylor Rule prescription (red line) over the last ten years.

We are skeptical as to whether Taylor – if nominated – would immediately hike interest rates to the level suggested by his rule. Nevertheless, his belief in a rule-based monetary policy makes him a hawk (in the eyes of markets). Hence, his nomination would support the U.S. dollar and real interest rates, which would be bad news for the gold market.

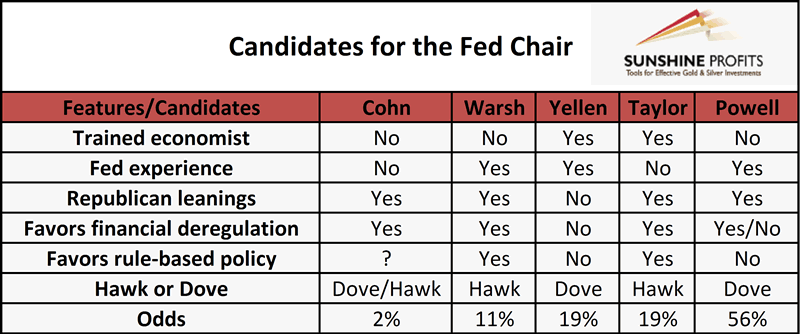

And finally, Jerome Powell – the front-runner in the race – with odds as high as 56 percent. He is the current Federal Reserve Governor, so he has needed experience and he would provide continuity. And he is allegedly favored by Treasury Secretary Steven Mnuchin. How would his nomination impact the gold market? Well, not so much. First, he leads the polls, so that choice would not surprise the market. Second, he has been in line with Yellen. Actually, he never dissented at the Fed, so his nomination would result in a de facto keeping of the status quo. The only difference is that Yellen is a Democrat, while Powell is a Republican – but it might be crucial for Trump and his team. The brief comparison between the candidates is presented in the table below.

Table 1: Comparison between candidates for the next Fed Chair.

To sum up, Trump is going to announce the next Fed chair in the coming days. Taylor and Warsh are the most hawkish (the worst candidates for gold), while Yellen and Powell the most dovish (theoretically, the best for gold, but keeping the status quo should not affect the markets significantly). Cohn is somewhere in the middle, but he is practically out of the equation. Currently, Powell decisively leads (but his nomination is not a done deal). Hence, any other choice could surprise markets and affect the price of gold. Taylor is behind him and there are rumors that these two may now rule the Fed. Indeed, it makes sense: Powell as the Fed Chair could provide continuity and would continue his gradual approach to normalizing policy, while Taylor as the Fed Vice Chair would please monetary hawks and supporters of the rule-based monetary policy among Republicans. That scenario is already priced in to a significant extent, so the initial effect on the gold market may be limited. However, in the medium-term, the Fed would be more hawkish than under Yellen and Fischer, which is negative for the gold prices at the margin.

And one final remark: it is of course important who leads the Fed. But investors should not overestimate the importance of the upcoming nomination. The FOMC is a collegial body and the next Chair will face the same dilemmas as Yellen. The Fed Chair plays as the conditions allow him (or her). It may be one of the most important jobs in the world, but even the Fed chair cannot control the economy – and the broad macroeconomic outlook will be the most important driver of the gold prices. Stay tuned!

PS. At the beginning of November, Powell’s chances increased even further. His nomination will be more dovish event than Taylor’s nomination, as Powell will continue Yellen’s gradual approach to tightening and cautious approach toward monetary policy. However, investors should not forget that John Taylor is expected to become the Fed Vice Chair. Why is it important for the gold market? Well, Powell-Taylor duo will be more hawkish than Yellen-Fischer, which is not good news for the yellow metal.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.