SPX Trying to Digest a Whopper of a Monthly Labor Report

Stock-Markets / Stock Market 2017 Nov 03, 2017 - 03:28 PM GMT SPX futures are flat, trying to digest a big letdown in the BLS October Employment Situation Report. To make matters worse, 216,000 of the 261,000 reported new jobs are from a hypothetical model called the CES Birth/Death Model.

SPX futures are flat, trying to digest a big letdown in the BLS October Employment Situation Report. To make matters worse, 216,000 of the 261,000 reported new jobs are from a hypothetical model called the CES Birth/Death Model.

ZeroHedge reports, “Well, with virtually everyone expecting a 300K+ payrolls number after last month's negative hurricane-distorted print, and with whispers of a 400K print floating around, it only made sense that not only would payrolls disappoint, printing at 261K, one standard deviation below the 310K consensus estimate (and that even with a whopping 89,000 waiters and bartenders added)”

The reaction at the open will bear close scrutiny.

NDX futures are challenging Cycle Top resistance at 6258.83 and are threatening to make a new high.

The DJIA is likely in the same position, expecially after making a new high yesterday. However, there is a technical resistance at 23541.00 that may put a stop to the rally.

VIX futures made a new low this morning and I have recorded it on the chart. They have recovered somewhat and may open flat. It remains to be seen what the final numbers are for the day if the VIX does not revisit the morning lows.

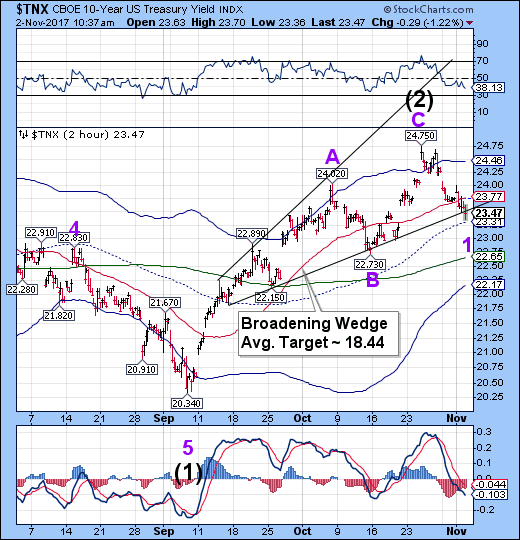

TNX remains beneath the Broadening Wedge trendline. It would be possible to see a muted retracement, but that will remain a question until the trading day develops.

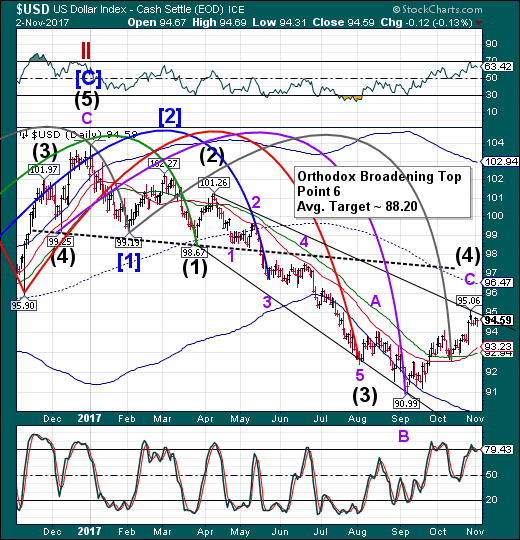

The USD futures are modestly lower than the close, but after an overnight ramp that took it to 94.75. It remains beneath the trendline and appears poised to decline in the near term. USD peaked in strength last Friday and appears that it may decline into the end of next week, in the near term.

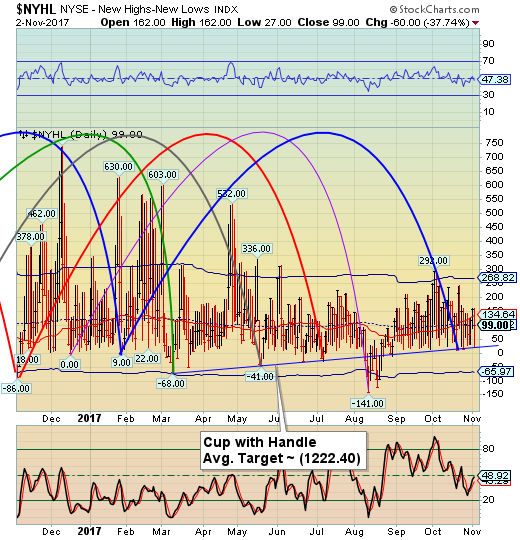

The nYSE Hi-Lo Index closed beneath its mid-Cycle resistance at 101.42 yesterday. The close was a close call, so we will be monitoring the Hi-Lo during the day today. The key will be a decline beneath the trendline near 25.00.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.