World’s Largest Gold Producer Sees Production Fall 10%

Commodities / Gold and Silver 2017 Nov 07, 2017 - 03:24 PM GMTBy: GoldCore

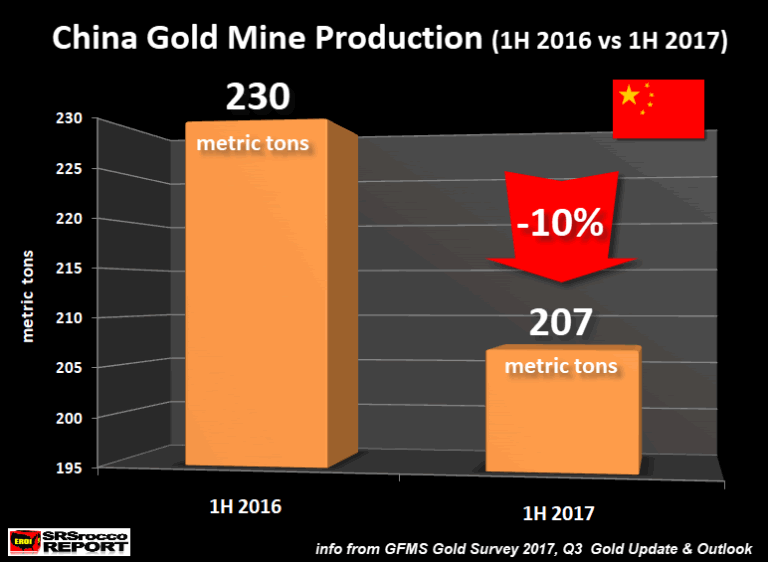

– Gold mining production in China fell by 9.8% in H1 2017

– Gold mining production in China fell by 9.8% in H1 2017

– Decreasing mine supply in world’s largest gold producer and across the globe

– GFMS World Gold Survey predicts mine production to contract year-on-year

– Peak gold production being seen in Australia, world’s no 2 producer

– Peak gold production globally while global gold demand remains robust

Editor Mark O’Byrne

Gold production in the world’s largest gold producer and buyer fell by nearly 10% in the first half of 2017 in what may be another indication of peak gold.

Chinese mine production registered the largest drop globally to total 207 tonnes in the first half of 2017, down 23 tonnes, or 9.8% year-on-year. In the same period last year the country produced 230 metric tons.

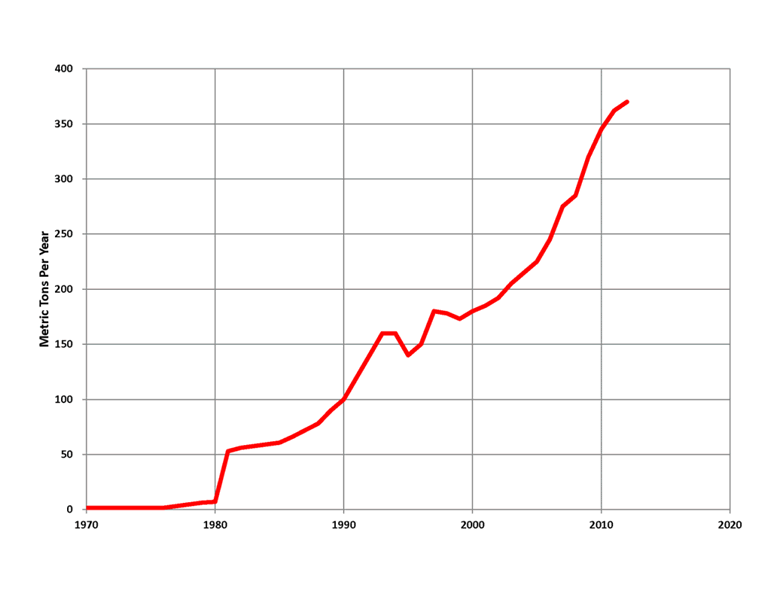

China mined production of gold (Wikipedia)

The issue of declining gold supply in China is not expected to improve. The GFMS World Gold Survey expects Chinese gold supply to fall by 14% this year from the 2014 peak. Their latest update explains:

Based on limited updated quarterly production reports and annual production guidance, we expect mine production to contract year-on-year in Q3 2017. We expect losses in China to accelerate as capacity is curtailed further. Industry consensus points to a considerable drop in Chinese mine production for the year as a whole.

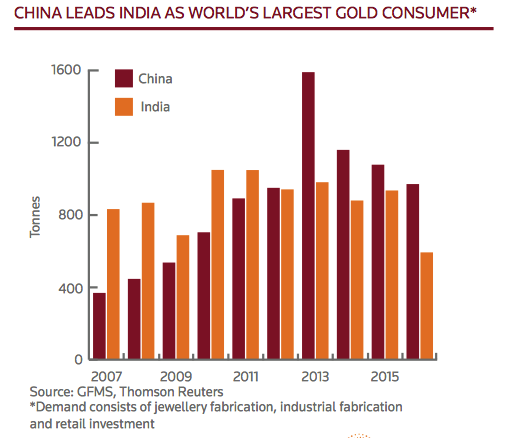

This fall in supply could have significant implications for global gold supply given the country’s leading role in the gold market. In 2016 the country produced 453t, 160t or 56% more than the second highest gold producing nation of Australia. It also leads global gold demand, beating India in the last five years.

These numbers could be an indication that we are reaching peak gold, if we haven’t already. Given the country relies heavily on domestic gold supply – a shortage of gold supply at home will force the country to import more from abroad, putting pressure on global supply with a likely rise in prices. A situation made worse by the fact that many other gold producing nations are also suffering from falling production levels – including world’s no 2 gold producer Australia.

Not just a crack in the China

In the first quarter of the year the ten largest Chinese gold mining companies accounted for 41.4% of the country’s total production. China is very reliant on their domestic gold supply and points to problems further down the line of meeting its high levels of gold demand.

At the beginning of the year China was the only major gold mining nation to have increased production in recent years, now it has joined its contemporaries in seeing falling production. The main reason for the fall in China’s gold supply isn’t on account of falling demand or prices:

The government’s escalating efforts to fight pollution and increase attention to environmental protection. As a result, output from the country’s nonferrous smelters fell by 30% or 14 tonnes in tandem with a 2% drop in ‘mine-produced gold’ to total 65 tonnes.

Declining supply is not a problem unique to China. It is a common problem in gold producing nations. At the beginning of the year GFMS noted that global mine supply in the first quarter of the year reached a total of 756 tonnes, one tonne below the same period in 2016.

The largest drop was in South America and Asia, which slipped by a combined 4% with China, Mongolia, and Peru suffering the top three country-level decreases. Oceania posted a fractional drop following severe weather conditions in Australia.

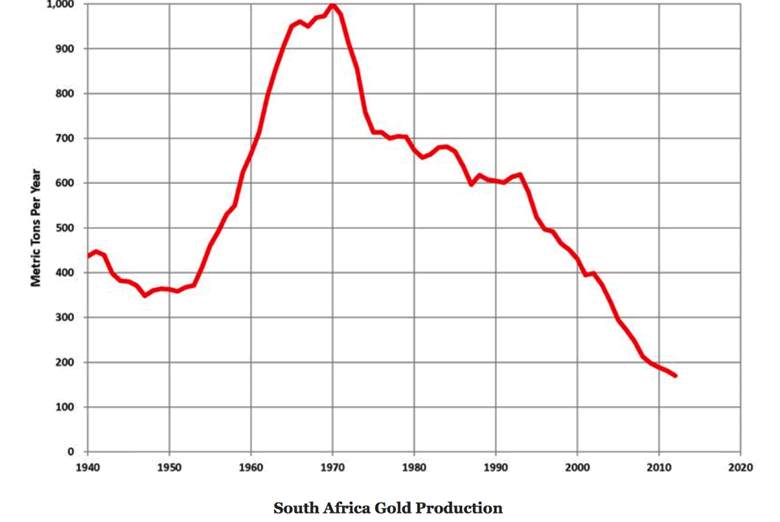

This is not a new problem. Just a quick glance at South Africa’s mining figures and one can see why it has has been a key point of concern for those monitoring global gold supply. It was once the leading producer, accounting for more than 40% of the total mined gold on earth.

We have been warning that it is the ‘canary in the gold mine’ as its 80% plunge in production point to a future of gold shortages and peak gold.

Earlier this quarter the Chairman of the World Gold Council Randall Oliphant expressed concern that the world might have already produced the most gold in a year that it ever will, on account of increasing gold demand and declining supply.

“We’re not going to fall off a cliff in the near term, but in the same time it’s really hard to see how we’re going to produce enough gold to meet all this demand.”

Peak gold here as uncertainties reach peak levels

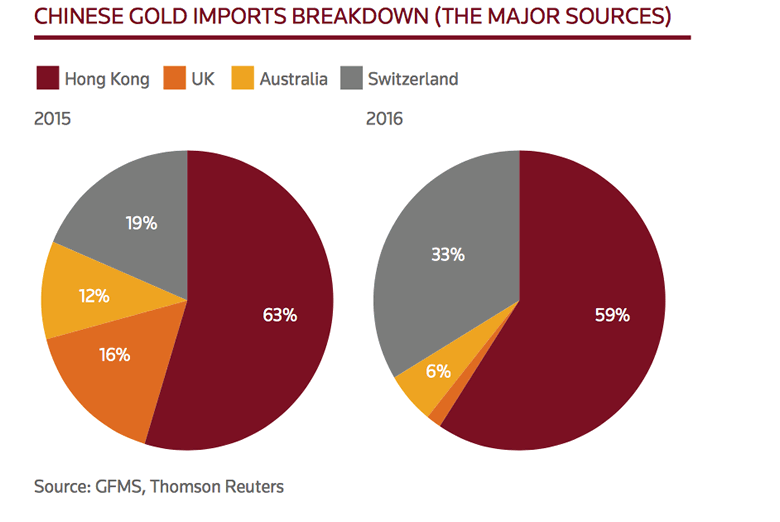

China does not export any of its domestically produced gold, but even this is not enough to satisfy demand from both investors and the official sector. Last year the country imported 1,281 tonnes of gold, from four key countries.

In the short term, China may well be able to increase imports in order to satisfy domestic demand. It may struggle to increase its own production. However, in the long-term this is not a sustainable solution. Gold mines are finite and supply relies on an ever-growing number of new mines being discovered. Something which we can no longer rely on, as Pierre Lassonde recently explained:

If you look back to the 70s, 80s and 90s, in every one of those decades, the industry found at least one 50+ million ounce gold deposit, at least ten 30+ million ounce deposits and countless 5 to 10 million ounce deposits. But if you look at the last 15 years, we found no 50 million ounce deposit, no 30 million ounce deposit and only very few 15 million ounce deposits.

Gold demand shows no sign of abating. As uncertainties increase across the world demand for physical gold increases. It is because of uncertainties that Oliphant believes that there will not be enough gold to satisfy demand. He sees risks in the political and economic system, combined with robust demand from India and China as the key drivers for increased gold demand and higher prices.

“All this uncertainty seems very fertile ground for people to get into gold.”

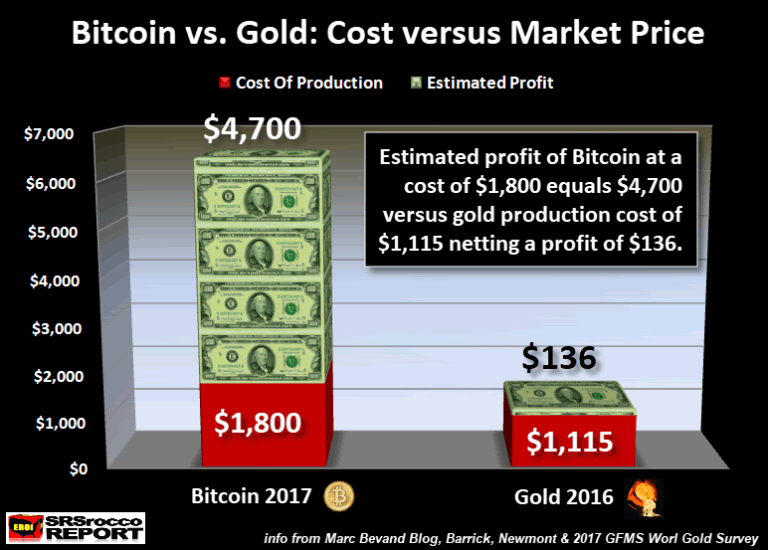

Diversify into actual physical gold before peak gold sees gold surge like bitcoin

We are at a key inflection point in gold history. There is an unstoppable force of global gold demand hurtling towards the inevitable and immovable object that is finite and diminishing gold supply.

Who wins? Gold investors. Gold will always be in demand for as long as governments cause uncertainties both politically and economically. Short of alchemy there is nothing anyone can do to discover more gold as quickly as governments can destroy our confidence in the system and the value of our savings.

Important developments such as these highlight the importance of not investing in paper, ETF or digital gold but buying actual gold bullion and ensuring that you own allocated and segregated physical gold bars and coins. If we have reached or are close to peak gold, investors do not want to find themselves on the wrong side of an ETF or digital gold redemption gone wrong.

Gold Prices (LBMA AM)

07 Nov: USD 1,276.35, GBP 970.92 & EUR 1,103.28 per ounce

06 Nov: USD 1,271.60, GBP 969.72 & EUR 1,095.61 per ounce

03 Nov: USD 1,275.30, GBP 976.24 & EUR 1,094.59 per ounce

02 Nov: USD 1,276.40, GBP 965.09 & EUR 1,095.92 per ounce

01 Nov: USD 1,279.25, GBP 961.48 & EUR 1,099.52 per ounce

31 Oct: USD 1,274.40, GBP 964.21 & EUR 1,095.60 per ounce

30 Oct: USD 1,272.75, GBP 966.91 & EUR 1,093.80 per ounce

Silver Prices (LBMA)

07 Nov: USD 17.01, GBP 12.95 & EUR 14.70 per ounce

06 Nov: USD 16.92, GBP 12.90 & EUR 14.59 per ounce

03 Nov: USD 17.09, GBP 13.05 & EUR 14.67 per ounce

02 Nov: USD 17.08, GBP 12.98 & EUR 14.66 per ounce

01 Nov: USD 16.94, GBP 12.74 & EUR 14.55 per ounce

31 Oct: USD 16.82, GBP 12.72 & EUR 14.45 per ounce

30 Oct: USD 16.74, GBP 12.69 & EUR 14.39 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.