Markets are Warning, But No Major Sell Signal

Stock-Markets / Financial Markets 2017 Nov 08, 2017 - 03:24 PM GMT

SPX futures are challenging the upper trendline of the Broadening Wedge formation. Should it break through, the next level of support appears to be the lower Diagonal trendline at 2570.00. These supports are what makes the decline appears controlled and manageable. However, once beneath them, the decline becomes stronger as the SPX hones in on the next target indicated by the formations. For example, the Ending Diagonal formation, once triggered, is often completely retraced, with a target near 2400.00.

SPX futures are challenging the upper trendline of the Broadening Wedge formation. Should it break through, the next level of support appears to be the lower Diagonal trendline at 2570.00. These supports are what makes the decline appears controlled and manageable. However, once beneath them, the decline becomes stronger as the SPX hones in on the next target indicated by the formations. For example, the Ending Diagonal formation, once triggered, is often completely retraced, with a target near 2400.00.

The smaller Broadening formation was relabeled as an Orthodox Broadening Top due to the near-horizontal lower trendline. If so, the first decline may stop at the Cycle Bottom support at 2499.76. We should remain flexible to allow for the possible conflicts between formations. It will become clear in the end.

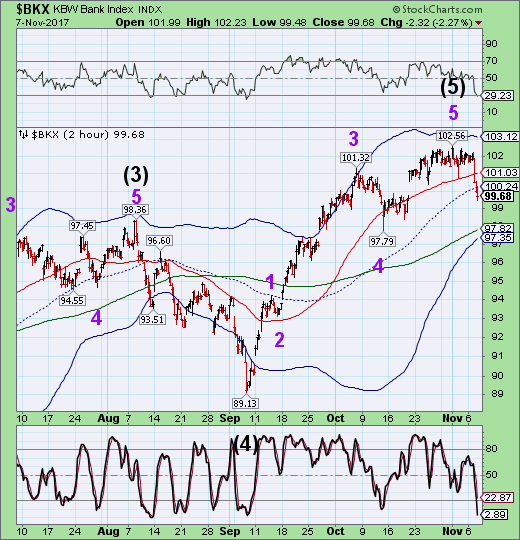

BKX has violated two of its supports and is reportedly lower this morning. If BKX follows the Cycles Model, it should bounce at the 2-hour Cycle Bottom at 97.35. A good short entry may be to sell the bounce, which may go back to Short-term resistance at 101.03.

ZeroHedge reports, “U.S. equity futures are little changed as European and Asian shares retreated, led by sliding bank stocks and a drop in the dollar as doubts over republican tax cuts and ongoing bond curve flattening hurt sentiment and prompted fresh questions over the viability of the US expansion.

Investor concerns also returned to geopolitics as Trump continued his tour of Asia with a mission of rallying the world to stand up to the North Korean threat. Calling out by name Russia and China, he said Wednesday that all responsible nations must join forces to deny Kim Jong Un’s regime any form of support. As Bloomberg reports, Trump is also expected to discuss trade with his Chinese counterpart, Xi Jinping. But the biggest overnight catalyst was a renewed fear about the fate of GOP tax cuts, as fresh doubts emerged about tax reform progress after the Washington Post reported Senate Republican leaders were considering holding cuts back by a year, while they are also said to be considering repealing deductions for state and local taxes.”

NDX futures are flat this morning. The first actionable entry may be at the top of a bounce off the larger Orthodox Broadening Top trendline near 6200.00. The 6335.00 target for NDX was off a Fibonacci calculation going back to October 2002 (181 months), which is also a major Cyclical Pivot point.

RUT appears to be on a sell signal after more than a month of deterioration. However, there may be a final push higher, as there is no apparent Wave 5. However, should it decline beneath the 50-day Moving Average, there may be a bearish reading that is unrecognized at the present.

VIX futures are modestly higher, but no breakout yet. We’re looking for a breakout above the 50-day.

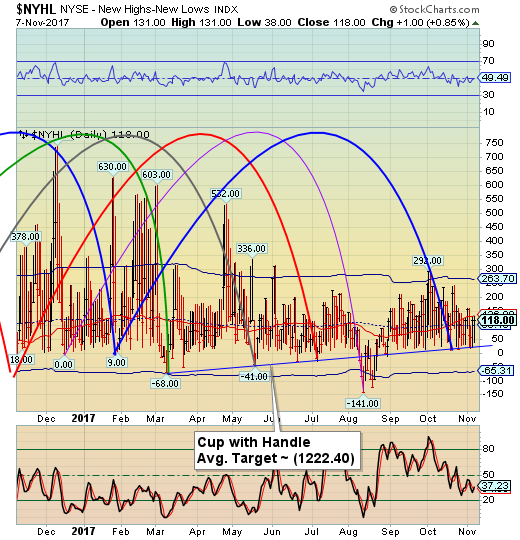

The NYSE Hi-Lo Index is stubbornly staying above the trendline and closed above the mid-Cycle support/resistance at 99.19. Just closing beneath the mid-Cycle resistance doesn’t appear to give us a viable signal any more. The low to break down under is 17.00 with an absolute 0.00 giving a confirmation.

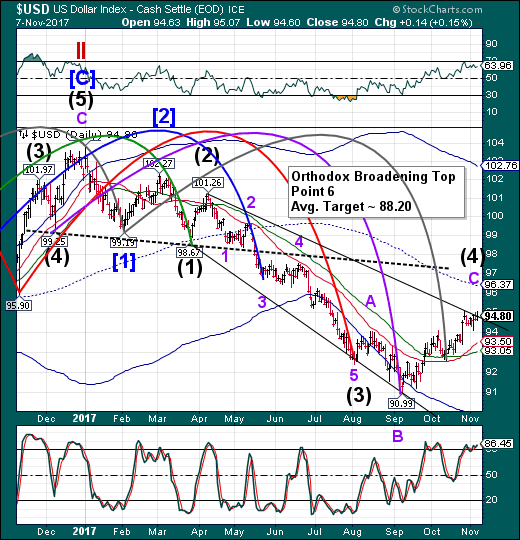

USD futures are marginally lower, but must break down beneath 94.00 to give an indication of a reversal. The Cycles Model suggests a potential Master Cycle low may occur on November 24-27.

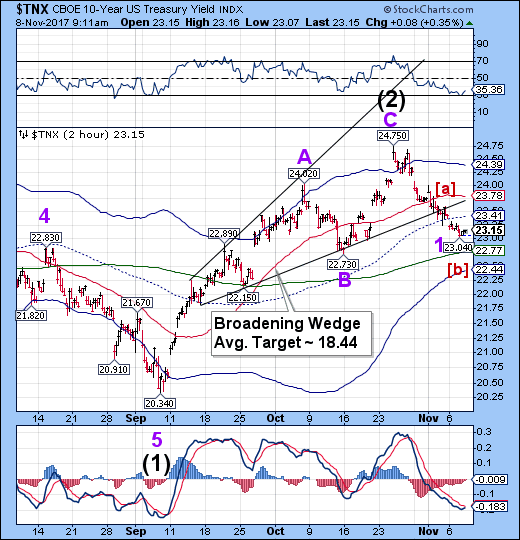

TNX may have begun its bounce back to the Broadening Top trendline.

ZeroHedge reports, “In the first of this week's three auctions, the Treasury sold $24 billion in 3 Year paper in a medicore, tailing auction, which stopped at 1.75%, a 0.2bps tail to the 1.748% when issued, and the highest yield since 1.776% in April 2010.

In addition to the tail, the internals were also mediocre, with the Bid to Cover of 2.76 below last month's 2.83, and also below the 2.88 6 month average as well as under the slightly smaller 2.84 for the four prior Refunding auctions. Total bids amounted to $69.1bn for $26.9bn in notes for sale vs the 6 previous auction average of $71.8b in bids for average of $26.6b in notes sold.”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.