Stock Market Critical Supports are Being Challenged

Stock-Markets / Stock Market 2017 Nov 13, 2017 - 05:03 PM GMT SPX futures appear to be challenging the Ending Diagonal trendline near 2575.00 and Short-term support at 2578.41. The decline to the 50-day Moving Average at 2540.61 may be considered underway once those supports are broken. A break of the 50-day Moving Average in European stocks may trigger the same response in US stocks.

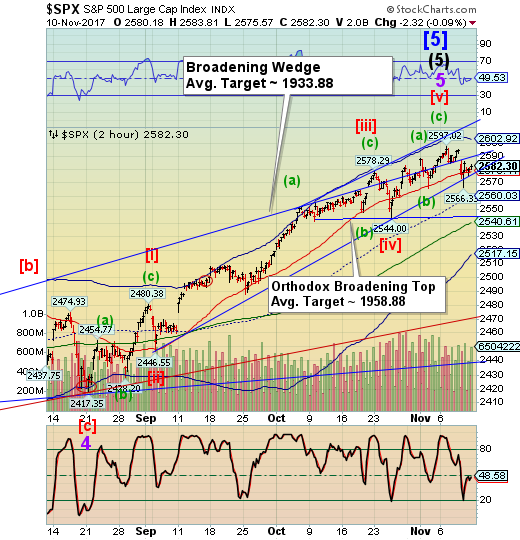

SPX futures appear to be challenging the Ending Diagonal trendline near 2575.00 and Short-term support at 2578.41. The decline to the 50-day Moving Average at 2540.61 may be considered underway once those supports are broken. A break of the 50-day Moving Average in European stocks may trigger the same response in US stocks.

ZeroHedge reports, “S&P futures gave up early gains and were trading down -0.2%, as Donald Trump completes his first Asian tour and as pressure mounts on U.K. Prime Minister Theresa May, sending the pound plunging. European stocks fell, tracking many Asian shares as the Nikkei plunge accelerated.

In Europe, the Stoxx 600 fell as much as 0.4%, resuming last week’s pull-back. 17 of 19 industry groups fall, with financial services, retail and banking shares leading the selloff; the broad European index is down 2.7% from the intraday high hit on Nov. 1. The Stoxx 600 drop also triggered a key technical level, with the Stoxx 600 sliding below the 50-DMA for first time since early September, while the Stoxx 600 Bank index dropped below the 200 DMA following a downgrade of European banks by Kepler Cheuvreux.”

The VIX futures are considerably higher this morning, confirming Thursday’s buy signal. Uncertainty about the Tax Bill is certainly a factor dictating the markets, since the anticipation of higher prices were predicated on the expectation of lower corporate taxes, thus higher profits.

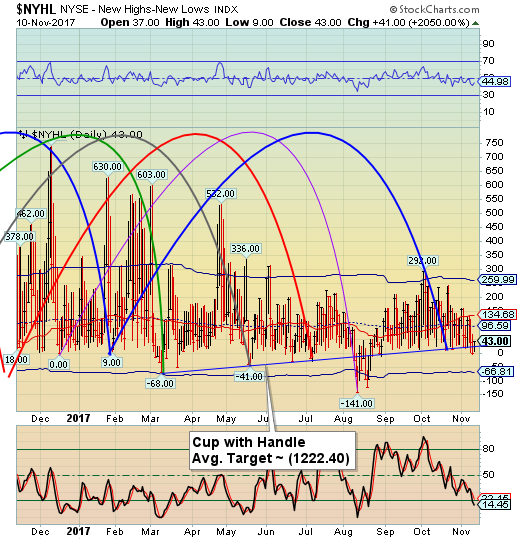

The NYSE Hi-Lo closed at 2.00 on Thursday and at the lower end of its consolidation range on Friday. It remains on a sell signal and is likely to probe new lows in the next few days.

NDX futures are also down, but have a way to go to violate any supports. The first support to break is the Short-term support at 6235.52. For this occasion, we are using the SPX signals, but the NASDAQ Hi-Lo closed at 22.00 on Friday after hitting -24.00 on Thursday. The VXN also closed above its 50-day Moving Average for two days in a row.

One stark reminder that Super Cycle Wave (c) may have begun is the unfilled gaps in all the indices that were left last week. That is a hallmark of a Wave C decline, which is considered one of the most destructive waves in the series.

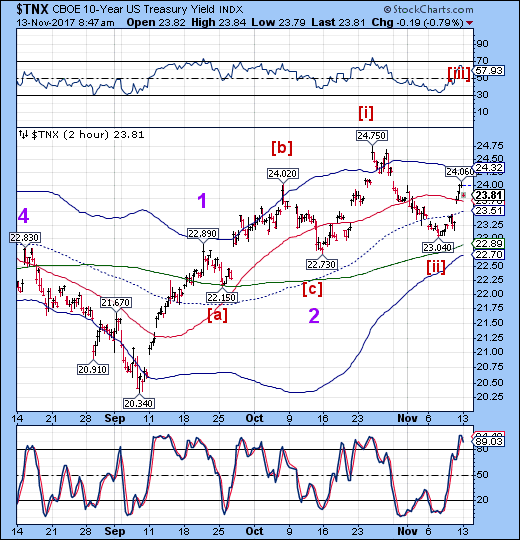

TNX futures are pulling back, but may bounce at Short-term support at 23.70. Thus far the pattern supports TNX going higher, so the retracement is meant to temporarily relieve the overbought condition. On the other hand, prices may remain overbought in a Wave [iii] scenario.

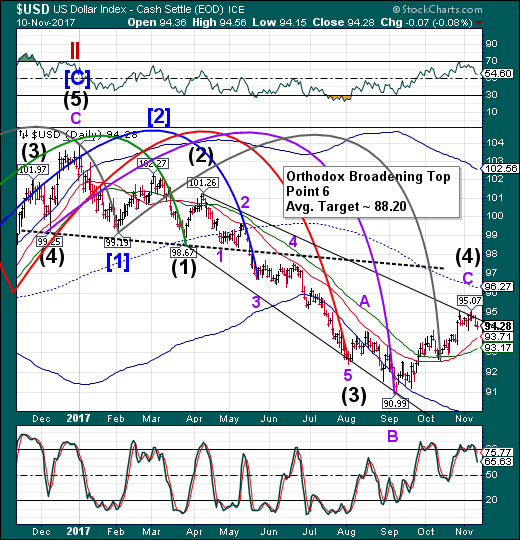

USD futures are coming down from a weekend high of 94.55. A decline beneath Short-term support at 93.71 puts it back on a sell signal.

USD/JPY is down this morning. This may be signaling a deterioration in market liquidity. A break of critical supports may set off a deluge of selling.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.