Stock Market Minor Top

Stock-Markets / Stock Market 2017 Nov 26, 2017 - 07:43 PM GMTBy: Andre_Gratian

Current Position of the Market

SPX: Long-term trend – The bull market is continuing with no sign of a major top in sight.

SPX: Long-term trend – The bull market is continuing with no sign of a major top in sight.

Intermediate trend – Soon coming to an end – 2 wks?

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com

At Minor Top

Market Overview

This should be one of the last minor tops before the arrival of a much more serious correction, most likely the most serious one since the 1810 low in the SPX. From a time standpoint: a little more time is required. Price-wise: a few more points as well. More specific information regarding the date and the top projection has already been made available to subscribers (including trial subscribers).

In the last letter, I pointed out that we just had the largest correction since August, but needed to confirm that it was over. That confirmation came when we went up on Monday instead of re-testing the 2567 low one more time, and Thanksgiving week brought about a new all-time high for the SPX. It is anticipated that there is more to go, but not immediately. If Friday was not the top of the move from 2557, Monday should be. There is a minor cycle bottoming over the next week which will give us a few days of consolidation/correction before we resume the intermediate move which started nearly two years ago, at 1810. More important cycles bottoming in January/February will place a limitation on how far the next upward push can extend over the near-term.

Chart Analysis (These charts and subsequent ones courtesy of QCharts)

SPX daily chart:

The next minor cycle is due in 3-4 days, and Friday’s action was rather tepid, but since it was only a shortened session, we’ll give the index the benefit of the doubt and allow for another potential few points on the upside before the cyclic rhythm starts to pull prices down. Whether we start retracing right away or a little later in the day, Monday looks like a good day for a cycle peak – unless it was Friday.

Since a .382 retracement of the move from 2557 would bring the index back to about 2585, and that level corresponds to good support, that would be a good point for the minor correction to end -- this is assuming that we start retracing right away! At 2585, the index would also benefit from support at the green trend line.

There is no good reason why we should go much higher before correcting, and the oscillators, which lost their upside momentum on Friday, seem to bear this out. The structure from 2557 also appears complete.

SPX hourly chart:

The last uptrend finished with a somewhat unorthodox ending diagonal triangle, since wave-e did not make a new high. It was also unorthodox in the sense that it did not retrace all the way down to the beginning of the formation, as diagonals are prone to do. The pattern that we are currently completing also has the appearance of an EDT, but since the waves are not overlapping, it is probably an impulse wave which may have completed 5 waves up on Friday and may already have begun to correct. We should have some indication of this as soon as 6:00 pm ET Sunday when Globex trading is reported.

Supporting this view is the fact that the oscillators all show negative divergence and the SRSI has even started to roll over. Confirmation will come as soon as the index makes a new hourly low and closes below the green trend line (different from the one mentioned on the daily chart). As you can see, upside progression is limited by another trend line directly above Friday’s price which has already provided resistance on numerous previous occasions.

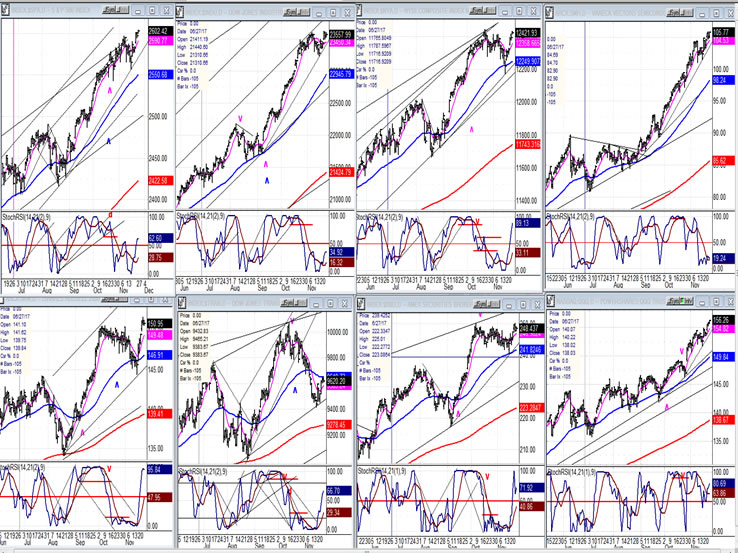

An overview of some important indexes (daily charts)

Some diversity is clearly showing in the indexes posted below. The biggest change of behavior is in IWM (bottom left) which has gone from warning of a pending correction to initiating a strong rally in which it was only joined in making a distinct new high by SPX (above) and the two tech representatives on the right. The middle indices showed a little more reluctance at participating, with TRAN (second from left, bottom) reverted to its historic role as the harbinger of a more protracted correction coming in the near future.

UUP (dollar ETF)

UUP had its moment of glory, but it only proved to be an oversold rally. It was not able to overcome its main downtrend line and has declined to the support provided by the last short-term low. While it could be ready to firm up, its likely future path will be one of more correction after a short rally.

GDX (Gold miners ETF)

As forecast last week, GDX rallied to the top of its slanted corrective pattern where it met some resistance and was pushed back. It may still hover in this area for a little longer but, as you can see, important cycle lows lie directly ahead that should determine the index’s trend for the next couple of weeks.

USO (United States Oil Fund)

A weekly chart of USO better portrays the significant basing action of the past two years which preceded the nmove out of its major corrective channel. In spite of the resistance which lies directly overhead, the P&F chart projects an immediate move to about 13, followed by a longer term target to 18-20 which could even be revised higher, eventually.

Summary

SPX appears to have completed its initial rally phase from the 2557 correction low, and is now ready to consolidate/correct for a few days, after which it should resume its final climb to an intermediate top.

Andre

For a FREE 4-week trial, send an email to anvi1962@cableone.net, or go to www.marketurningpoints.com and click on "subscribe". There, you will also find subscription options, payment plans, weekly newsletters, and general information. By clicking on "Free Newsletter" you can get a preview of the latest newsletter which is normally posted on Sunday afternoon (unless it happens to be a 3-day weekend, in which case it could be posted on Monday).

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.