Why a Corporate Tax Cut Won’t Boost Economic Growth

Economics / Economic Theory Nov 28, 2017 - 05:18 PM GMTBy: John_Mauldin

BY PATRICK WATSON : The House and Senate are considering tax legislation that will add $1.5 trillion to annual deficits over the next 10 years, according to their own numbers.

BY PATRICK WATSON : The House and Senate are considering tax legislation that will add $1.5 trillion to annual deficits over the next 10 years, according to their own numbers.

This is okay, we're told, because the tax cuts will stoke economic growth, delivering added tax revenue that offsets the rate reductions.

Note the bigger point here.

Republicans still say they don’t like deficits—but apparently, this particular plan lets them cut taxes without adding more debt. It’s a miracle.

Is their claim really true? Will the GOP tax plans boost economic growth?

That’s the 1.5-trillion-dollar question.

Theory vs. Reality

The Republican plan’s centerpiece is a reduction in corporate tax rates from a 35% top bracket to only 20%. That would put the US more in line with other countries.

What you seldom hear is that most other developed countries also have value-added tax (VAT), a kind of consumption tax. The US doesn’t. Our tax system will remain different, and not necessarily better, under the new proposal.

Anyway, the theory is that lower tax rates will entice businesses to bring back operations they currently conduct overseas. They will build new factories and hire more US workers. Those workers will spend their higher incomes on consumer goods, and we’ll all be better off.

Unfortunately, that thinking has several flaws.

For one, as we saw in the NFIB Small Business Economic Trends report, business owners say that finding qualified workers is their top challenge right now. Reducing corporate tax rates won’t make new workers magically appear, nor will it improve the skills of those already here.

What increasing labor demand might do is spark that inflation the Federal Reserve has wanted for years. There’s also a good chance it could spiral out of control, forcing the Fed to hike interest rates even faster than planned—which could offset any benefit from the tax cuts.

Fortunately, such added labor demand will appear only if businesses respond to the lower tax rates by expanding US production capacity.

Will they? Let’s ask.

A Corporate Tax Cut Won’t Incentive Businesses to Expand

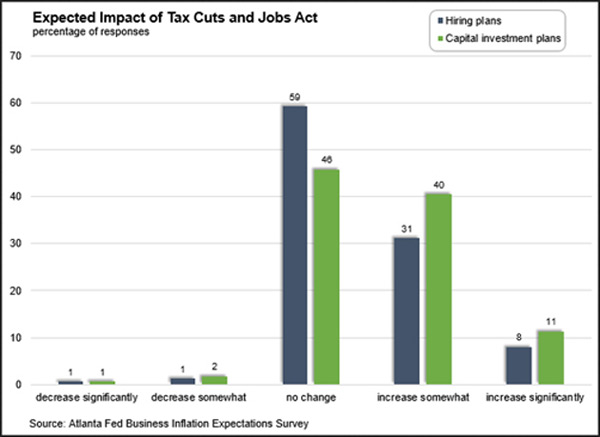

This month, in one of its regular business surveys, the Atlanta Federal Reserve Bank asked executives, “If passed in its current form, what would be the likely impact of the Tax Cuts and Jobs Act on your capital investment and hiring plans?”

Here are the results.

Image: Federal Reserve Bank of Atlanta

Only 8% of the executives surveyed said the bill would make them increase hiring plans “significantly.” Only 11% said they would significantly increase their capital investment plans. A solid majority answered either “no change” or “increase somewhat.”

Other surveys reached similar conclusions.

White House Economic Advisor Gary Cohn had an awkward moment last Tuesday at a Wall Street Journal CEO Council meeting. Sitting on stage to promote the tax cuts, Cohn watched as the moderator asked the roomful of executives whether their companies would expand more if the tax bill passed.

When only a few hands rose, Cohn looked surprised and said, “Why aren’t the other hands up?”

So maybe they were distracted or needed a minute to think. Fair enough. A few hours later, White House Economist Kevin Hassett appeared at the same event and asked the same audience the same question.

He got the same result: only a few raised hands.

Higher Profit Margins Will Land in Executives’ Pockets

None of this should surprise us. Tax rates are only one factor businesses consider when deciding to expand.

The far more important question is whether consumers will buy whatever the new capacity produces.

Think about it this way: if you’re a CEO and you have difficulty selling your products profitably now, why would lower taxes make you produce more? Even a 0% tax rate is no help if you lack customers.

Former Brightcove CEO David Mendels explained how big companies view this in a November 10 LinkedIn post.

A tax cut for corporations will increase their profitability. Why we should believe that this increase in profitability will lead to wage increases when we have already seen that increases in profitability over the last 10 years did not, but rather went to stock buybacks and dividend increases that benefitted the investors?

As a CEO and member of the Board of Directors at a public company, I can tell you that if we had an increase in profitability, we would have been delighted, but it would not lead in and of itself to more hiring or an increase in wages. Again, we would hire more people if we saw growing demand for our products and services. We would raise salaries if that is what it took to hire and retain great people. But if we had a tax cut that led to higher profits absent those factors, we would ‘pocket it’ for our investors.”

By “pocket it,” Mendels means executive bonuses, share buybacks, or higher dividends. That’s what 10 years of Federal Reserve stimulus produced. A corporate tax cut would likely have a similar effect.

All Options Left Are Bad

I don’t think the House and Senate can agree on any significant tax changes. The two chambers have different political incentives they probably can’t reconcile.

So I think we'll be stuck with the current tax system. The economy will limp along like it has been and eventually go into recession. The hope-driven asset bubble will pop, hurting many investors.

If I’m wrong and the GOP plan passes in anything like the current form, we will get higher deficits but little additional growth. The tax cuts will flow to asset owners and shareholders, probably blowing the market bubble even bigger. That will make the inevitable breakdown even more painful.

Clearly, we need a better tax system. Other reform ideas exist. Those ideas apparently aren't attractive to Congress, though. So we’re stuck with either the current broken system or a modified one that will…

- put the government even deeper in debt

- blow the market bubble bigger

- all without helping the economy grow.

Neither scenario is attractive, I know. But those are our choices. You can only pick one.

Or rather, Congress will pick one for you. Let’s hope they choose wisely.

Free Report: The New Asset Class Helping Investors Earn 7% Yields in a 2.5% World

While the Fed may be raising interest rates, the reality is we still live in a low-yield world. This report will show you how to start earning market-beating yields in as little as 30 days... and simultaneously reduce your portfolio’s risk exposure.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.