Inflation Target, Taylor Rule and Gold

Commodities / Gold and Silver 2017 Nov 28, 2017 - 05:30 PM GMTBy: Arkadiusz_Sieron

The central banks’ inability to achieve their inflation targets led some analysts to argue for modifying these targets. Are they inappropriate in a modern, globalized economy? Should central banks change them? Or should they conduct a more rule-based policy, as John Taylor argues? How would such moves affect the gold market?

The central banks’ inability to achieve their inflation targets led some analysts to argue for modifying these targets. Are they inappropriate in a modern, globalized economy? Should central banks change them? Or should they conduct a more rule-based policy, as John Taylor argues? How would such moves affect the gold market?

As a reminder, the Fed (as well as other major central banks) targets 2-percent inflation. It may seem to be strange, as such a level is far away from the price stability (which, taken literally, means neither inflation nor deflation), which the central banks should are obliged to ensure. However, deflation is a central banks’ worst nightmare, so they want to have some buffer in case of negative demand shock. With the inflation target at zero, the margin of error would be very limited. But central banks have been missing their targets for years – should they change them?

In the October 2016 edition of the Market Overview, we discussed the idea of raising inflation targets. It would push the zero-bound problem away and increase central banks’ room for action. But how would the central banks achieve, let’s say,4-percent inflation, if they cannot generate the mere 2-percent rise in prices?

So should central banks perhaps lower inflation targets, confirming their inability to meet the 2-percent targets in the modern, global economy? It is a tempting vision, as lower inflation targets would imply faster normalization of monetary policy. But there are some problems with that as well. First of all, lower inflation targets would decrease the interest rates (due to softer inflation premium demanded by investors), limiting the room to maneuver of central banks and exacerbating the zero-bound constraint even further.

Moreover, modifying parameters for ad-hoc needs could reduce central banks’ credibility and the confidence in the whole financial sector, as interest rates that are too low hinder financial intermediation (banks are less willing to lend money). It could spur some safe-haven demand for gold, but lowering the inflation target could actually strengthen investors’ faith in central banks (it would be easier for them to achieve lower targets), hurting gold bulls. And lower inflation rate corresponds to higher real interest rates, which could be bearish for the gold market.

Hence, we see the change in the level of inflation targets as unlikely. It does not mean that we support the current central banks’ obsession with the goal of raising their national inflation rates to about 2 percent, even if the low inflation does not result now from negative demand shock and does not risk a deflationary spiral. If anything, it results from the supply-side factors - such as changes in energy prices, or global value chains – and the decline in the velocity of money due to the debt burden and high uncertainty in the economy. But central banks believe that there are good theoretical and empirical reasons why they should target inflation rate which is not too low and not too high, just about 2 percent. Thus, the change is not impossible, but very unlikely, at least until the next crisis hits the global economy.

We argue that adopting a more rule-based approach by the Fed is actually more probable, especially given the high odds of John Taylor being nominated to the Fed’s Board of Governors. He is an opponent of granting policymakers broad discretion, arguing that monetary policymakers should stick to clear rules, such as the Taylor Rule. We will discuss Taylor’s model in more detail in the future edition of the Market Overview. Here, we would like to point out that rules-based policymaking would increase the transparency and predictability of central banks. It goes without saying that lower uncertainty would be negative for the safe-haven assets, such as gold.

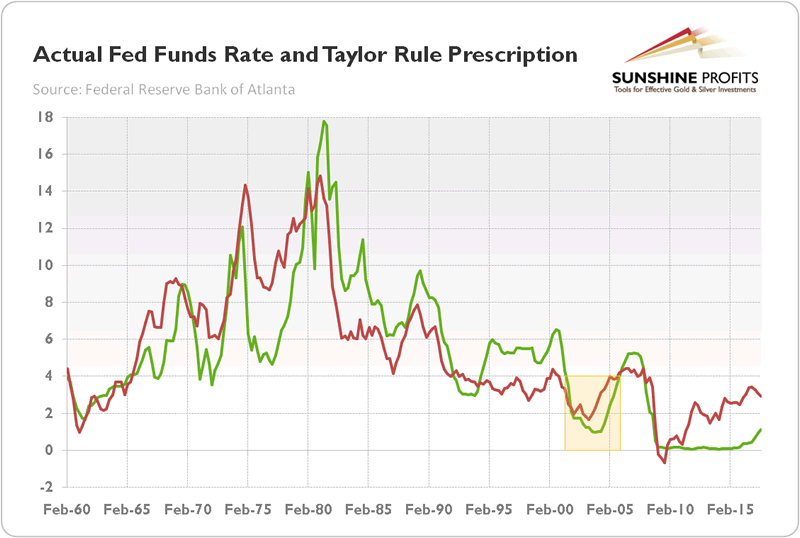

Moreover, as one can see in the chart below, introducing a sound rule-based approach would increase the economic stability – in the past, discretionary Fed held interest rates too low for too long, causing asset bubbles. Remember the financial crisis which burst forth in 2008 and plunged the whole world into a great recession? The chart below shows that if the central bank followed the Taylor rule in the 2000s, the interest rates would have been higher, which would have prevented or at least limited the irrational exuberance which resulted in the housing crisis.

Chart 1: Actual Federal Funds Rate (green line) and Taylor Rule prescription (red line) from 1960 to 2017.

Again, more hawkish central banks, higher interest rates and reduced financial imbalances resulting from adopting a Taylor-like monetary rule would be fundamentally negative for the yellow metal, which shines during the period of ultra-low interest rates (such as ZIRP) and financial crises.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.