SPX Giving Back its Gains

Stock-Markets / Stock Market 2017 Nov 30, 2017 - 06:43 PM GMT SPX went parabolic this morning, nearly undoing my Wave analysis. The current Wave structure is invalidated at 2660.13. That was a close call. By 1:00 pm it was over.

SPX went parabolic this morning, nearly undoing my Wave analysis. The current Wave structure is invalidated at 2660.13. That was a close call. By 1:00 pm it was over.

Equities are at a spike high which makes it hard to go short, especially after this terrific short squeeze.

NDX has made a 64.5% retracement of its decline, which is helpful. A decline beneath Short-term support at 6343.32 may give us an aggressive sell signal.

The VXN is on a clear buy signal, even though it is beneath yesterday’s close. The NASDAQ Hi-Lo Index, however, it still frothy.

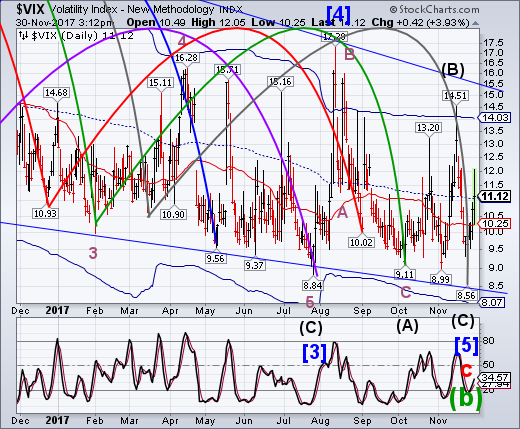

The VIX has been pulsating on both sides of its mid-Cycle support/resistance at 11.05. A close above that level would be a clear, though aggressive, buy signal.

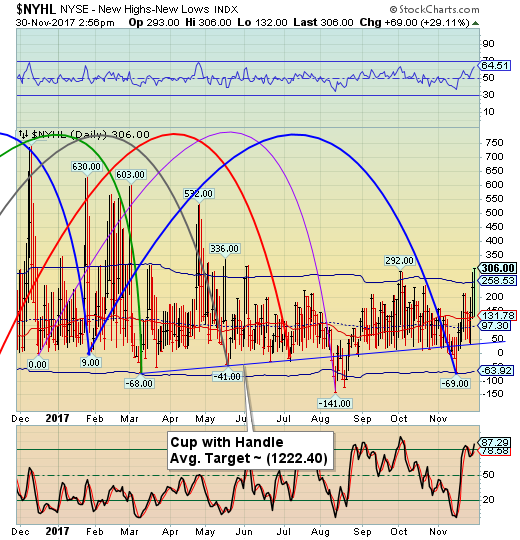

The stick-in-the-mud is the NYSE Hi-Lo Index. This indicator is suggesting a probably rotation into small cap stocks. If true, the spike may be over quickly. In the meantime, this indicator is keeping me from saying “all in” to the shorts.

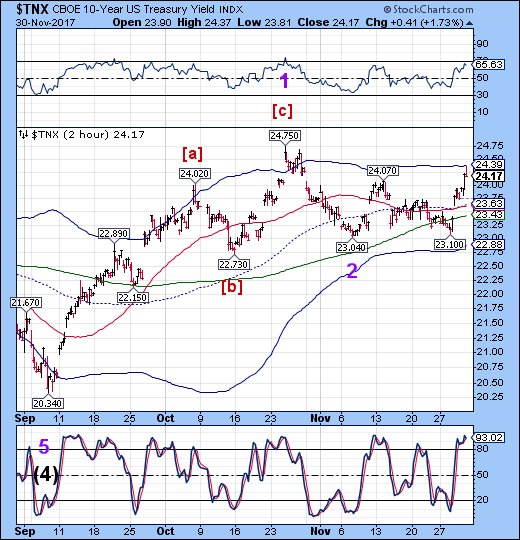

TNX has broken above its prior high and challenged its Cycle Top at 24.39. This reinforces TNX’s buy signal. The Cycles Model suggests strength may last through the weekend. There may be a breakout above the Cycle Top in the making. I am expecting a terrific whipsaw in bonds over the next two weeks.

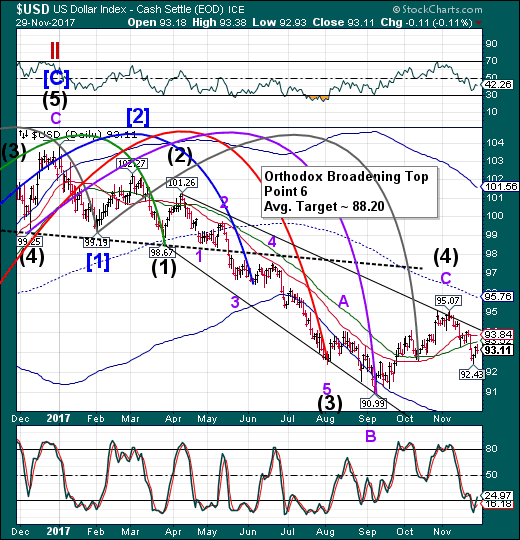

USD appears to be probing lower, but has not yet broken down beneath its prior low. There is a Master Cycle low due the week of December 11, so there is not much reason to rally for a while.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.