Is a Stock Market Tax Bill Surprise Coming?

Stock-Markets / Stock Market 2017 Dec 01, 2017 - 05:39 PM GMT SPX futures declined to 2631.25 in the overnight session, but appears to have recovered the majority of its decline. We may have seen the completion of an a-b-c correction that may probe the upper trendline or go to 2650.00 before reversing back down.

SPX futures declined to 2631.25 in the overnight session, but appears to have recovered the majority of its decline. We may have seen the completion of an a-b-c correction that may probe the upper trendline or go to 2650.00 before reversing back down.

ZeroHedge reports, “Markets were thrown for a loop in the past 24 hours, with the Dow first soaring nearly 400 points on Thursday on expectations that tax reform was a done deal, when drama emerged just after the close when the Senate tax bill came this close to falling apart when the proposed "Trigger" was ruled as invalid, pushing a Thursday tax vote to this morning, and as of this moment the bill appears in limbo with the GOP scrambling to find ways to appease the sudden loud opposition among budget hawks.”

NDX futures declined to 6310.00 before bouncing back. It is currently beneath Short-term resistance at 6343.20. It may push back to the top of Wave a at 6374.19 as it completes Wave c of its correction.

ZeroHedge writes, “What wall of worry?

The S&P 500 Index is heading for its longest streak of monthly gains since 2007, and, as Bloomberg reports, investors are betting there’s more to come.

A sudden jump in trading of bullish options on SPY (the ETF tracking the S&P 500), means there has not been more 'investors' holding S&P 500 Calls relative to Puts since Summer 2016...”

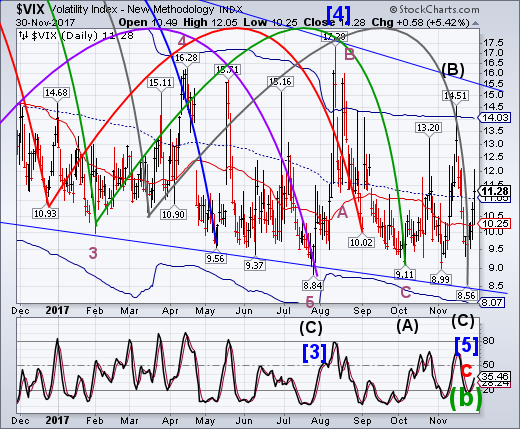

VIX futures spiked to 11.69 this morning, but have settled down to a small gain as I write. The VIX performance has been remarkable as equities have been making new highs. Taken by itself, the VIX is on a buy signal. However, equities appear to have some strength, as shown in the Hi-Lo Index. We will wait for the Hi-Lo to come down for a confirmed sell in the SPX.

Another indicator may be the European overnight money rate, which has suddenly spiked. ZeroHedge observes, “While mainstream media eyes have been focused on wrecked tech stocks and towering trannies, professionals in the world's largest liquidity markets have been shocked at the sudden explosion in one chart... that most everyone is hoping is not 'real'.

With central banks puking money at low or negative rates to anyone who can fog a mirror, the sudden spike in EONIA, or overnight money rates in Europe, which we first highlighted yesterday, is quite a shock in a normally stable market.”

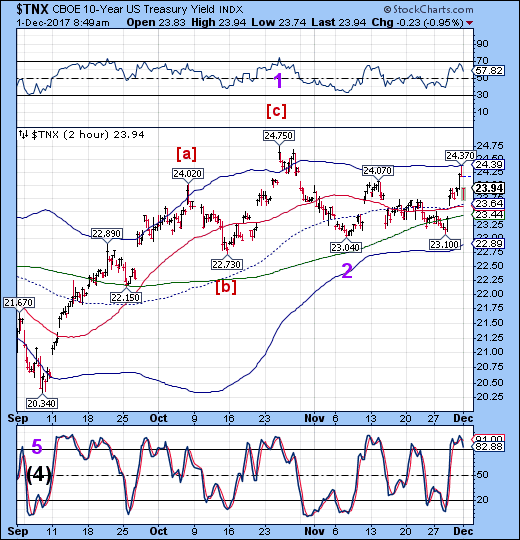

TNX is down this morning, but still above critical supports. We may see some mayhem in the bond market as interest rates are due to rise and fall in a whipsaw fashion. A further rally above 24.75 will confirm this observation.

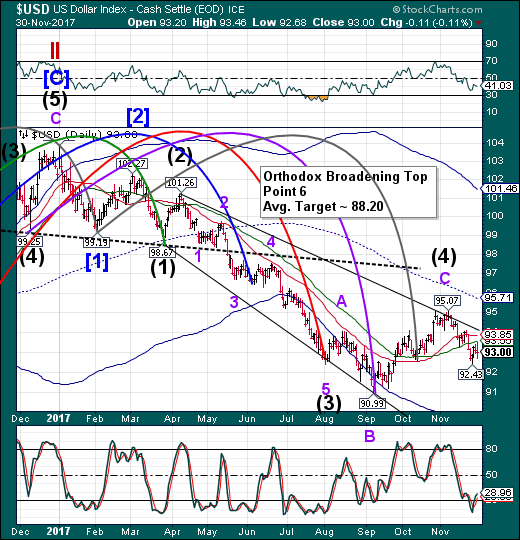

USD futures are drifting higher, but still beneath the 50-day Moving Average at 93.65. It may take another day or so of sideways consolidation until the dam breaks and the decline resumes.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.