Bitcoin Doesn’t Exist – 2

Currencies / Bitcoin Dec 07, 2017 - 09:08 AM GMTBy: Raul_I_Meijer

Chapter 1 of this five-part series by Dr. D is here: Bitcoin Doesn’t Exist – 1

Chapter 1 of this five-part series by Dr. D is here: Bitcoin Doesn’t Exist – 1

Chapter 3 will follow shortly.

Dr. D: You have to understand what exchanges are and are not. An exchange is a central point where owners post collateral and thereby join and trade on the exchange. The exchange backs the trades with their solvency and reputation, but it’s not a barter system, and it’s not free: the exchange has to make money too. Look at the Comex, which reaches back to the early history of commodities exchange which was founded to match buyers of say, wheat, like General Mills, with producers, the farmers. But why not just have the farmer drive to the local silo and sell there? Two reasons: one, unlike manufacturing, harvests are lumpy. To have everyone buy or sell at one time of the year would cripple the demand for money in that season. This may be why market crashes happen historically at harvest when the demand for money (i.e. Deflation) was highest. Secondly, however, suppose the weather turned bad: all farmers would be ruined simultaneously.

Suppose the weather then recovered: the previous low prices are erased and any who delayed selling would be rich. This sort of random, uncontrolled, uninsurable event is no way to run an economy, so they added a small group of speculators into the middle. You could sell wheat today for delivery in June, and the buyer would lock in a price. This had the effect of moderating prices, insuring both buyers AND sellers, at the small cost of paying the traders and speculators for their time, basically providing insurance. But the exchange is neither buyer, seller, nor speculator. They only keep the doors open to trade and vet the participants. What’s not immediately apparent is these Contracts of Wheat are only wheat promises, not wheat itself. Although amounts vary, almost all commodities trade contracts in excess of what is actually delivered, and what may exist on earth. I mean the wheat they’re selling, millions of tons, haven’t even been planted yet. So they are synthetic wheat, fantasy wheat that the exchange is selling.

A Bitcoin exchange is the same thing. You post your Bitcoin to the exchange, and trade it within the exchange with other customers like you. But none of the Bitcoin you trade on the exchange is yours, just like none of the wheat traded is actual wheat moving on trucks between silos. They are Bitcoin vouchers, Bitcoin PROMISES, not actual Bitcoin. So? So although prices are being set on the exchanges – slightly different prices in each one – none of the transfers are recorded on the actual Bitcoin Ledger. So how do you think exchanges stay open? Like Brokers and Banks, they take in the Bitcoin at say 100 units, but claim within themselves to have 104.

Why? Like any other fractional reserve system, they know that at any given moment 104 users will not demand delivery. This is their “float” and their profit, which they need to have, and this works well as far as it goes. However, it leads to the problem at Mt. Gox, and indeed Bear Sterns, Lehman and DeutscheBank: a sudden lack of confidence will always lead to a collapse, leaving a number of claims unfulfilled. That’s the bank run you know so well from Mary Poppins’ “Fidelity Fiduciary Bank”. It is suspected to be particularly bad in the case of Mt. Gox, which was unregulated. How unregulated? Well, not only were there zero laws concerning Bitcoin, but MTGOX actually stands for “Magic The Gathering Online eXchange”; that is, they were traders of comic books and Pokemon cards, not a brokerage. Prepare accordingly.

The important thing here is that an exchange is not Bitcoin. On an exchange, you own a claim on Bitcoin, through the legal entity of the exchange, subject only to jurisdiction and bankruptcy law. You do not own Bitcoin. But maybe Mt.Gox didn’t inflate their holdings but was indeed hacked? Yes, as an exchange, they can be hacked. Now you only need infiltrate one central point to gain access to millions of coins and although their security is far better, it’s now worth a hacker’s time. Arguably, most coins are held on an exchange, which is one reason for the incredibly skewed numbers regarding Bitcoin concentration. Just remember, if you don’t hold it, you don’t own it. In a hack, your coins are gone.

If the exchange is lying or gets in trouble, your coins are gone. If someone is embezzling, your coins are gone. If the Government stops the exchange, your coins are gone. If the economy cracks, the exchange will be cash-strapped and your coins are frozen and/or gone. None of these are true if YOU own your coins in a true peer-to-peer manner, but few do. But this is also true of paper dollars, gold bars, safe deposit boxes, and everything else of value. This accounts for some of the variety of opinions on the safety of Bitcoin. So if Polinex or Coinbase gets “hacked” it doesn’t mean “Bitcoin” was hacked any more than if the Comex or MF Global fails, that corn or Yen were “hacked”. The exchange is not Bitcoin: it’s the exchange. There are exchange risks and Bitcoin risks. Being a ledger Bitcoin is wide open and public. How would you hack it? You already have it. And so does everybody else.

So we’ve covered the main aspects of Bitcoin and why it is eligible to be money. Classically, money has these things:

1. Durable- the medium of exchange must not weather, rot, fall apart, or become unusable.

2. Portable- relative to its size, it must be easily movable and hold a large amount of value.

3. Divisible- it should be relatively easy to divide with all parts identical.

4. Intrinsically Valuable- should be valuable in itself and its value should be independent of any other object. Essentially, the item must be rare.

5. Money is a “Unit of Account”, that is, people measure other things, time and value, using the units of value to THINK about the world, and thus is an part of psychology. Strangely that makes this both the weakest and strongest aspect of:

6. “The Network Effect”. Its social and monetary inertia. That is, it’s money to you because you believe other people will accept it in exchange.

The Score:

1. Bitcoin is durable and anti-fragile. As long as there is an Internet – or even without one – it can continue to exist without decay, written on a clay tablet with a stylus.

2. Bitcoin is more portable than anything on earth. A single number — which can be memorized – can transport $160B across a border with only your mind, or across the world on the Internet. Its portability is not subject to any inspection or confiscation, unlike silver, gold, or diamonds.

3. Bitcoin is not infinitely divisible, but neither is gold or silver, which have a discrete number of atoms. At the moment the smallest Bitcoin denomination or “Satoshi” is 0.00000001 Bitcoin or about a millionth of a penny. That’s pretty small, but with a software change it can become smaller. In that way, Bitcoin, subject only to math is MORE divisible than silver or gold, and far easier. As numbers all Bitcoin are exactly the same.

4. Bitcoin has intrinsic value. Actually, the problem is NOTHING has “intrinsic” value. Things have value only because they are useful to yourself personally or because someone else wants them. Water is valuable on a desert island and gold is worthless. In fact, gold has few uses and is fundamentally a rock we dig up from one hole to bury in another, yet we say it has “intrinsic” value – which is good as Number 4 said it had to be unrelated to any other object, i.e. useless. Bitcoin and Gold are certainly useless. Like gold, Bitcoin may not have “Intrinsic value” but it DOES have intrinsic cost, that is, the cost in time and energy it took to mine it. Like gold, Bitcoin has a cost to mine measurable in BTU’s. As nothing has value outside of human action, you can’t say the electric cost in dollars is a price-floor, but suggests a floor, and that would be equally true of gold, silver, copper, etc. In fact, Bitcoin is more rare than Rhodium: we mine rare metals at 2%/year while the number of Bitcoins stops at 22 Million. Strangely, due to math, computer digits are made harder to get and have than real things.

5. Bitcoin is a unit of account. As a psychological effect, it’s difficult to quantify. Which comes first, the use of a thing, or its pricing? Neither, they grow together as one replaces another, side-by-side. This happened when gold replaced iron or salt or when bank notes replaced physical gold, or even when the U.S. moved from Pounds and Pence to Dollars and Cents. At first it was adopted by a few, but managed to get a critical mass, accepted, and eventually adopted by the population and entirely forgotten. At the moment Bitcoin enthusiasts do in fact mentally price things in Bitcoins, especially on exchanges where cross-crypto prices are marked vs BTC. Some never use their home currency at all, living entirely according to crypto-prices until home conversion at the moment of sale, or as hundreds or thousands of businesses are now accepting cryptocurrencies, even beyond. For them it is a unit of account the way Fahrenheit is a unit within the United States.

6. Bitcoin has the network effect. That is, it is widely accepted and publicly considered money. It’s in the news, has a wide following worldwide, and exchanges are signing up 40,000 new users a month. It’s accepted by thousands of vendors and can be used for purchases at Microsoft, Tesla, PayPal, Overstock, or with some work, Amazon. It’s translatable through point-of-sale vendor Square, and from many debit card providers such as Shift. At this point it is already very close to being money, i.e. a commonly accepted good. Note that without special arrangements none of these vendors will accept silver coins, nor price products in them. I expect if Mark Dice offered a candy bar, a silver bar, or a Bitcoin barcode, more people would pick the Bitcoin. In that way Bitcoin is more money than gold and silver are. You could say the same thing about Canadian Dollars or Thai Bhat: they’re respected currencies, but not accepted by everyone, everywhere. For that matter, neither are U.S. dollars.

Note what is not on the list: money is not a unit created or regulated by a central authority, although governments would like us to think so. In fact, no central authority is necessary or even desirable. For centuries the lack of monetary authority was historic fact, back with medieval markets through to private banks, until 1913, 1933, 1971, and the modern evolution into today’s near-total digital fiat. Besides the technical challenge, eliminating their overhead, oversight, control and corruption is the point of Bitcoin. And right now the government’s response to Bitcoin is a strange mixture of antipathy, ignorance, oppression, and opportunity. At $160 Billion it hardly merits the interest of a nation with a $500 Billion trade deficit, and that’s spread worldwide.

This leads into one of the spurious claims on Bitcoin: that it’s a refuge for drug smugglers and illegal activities. I assure you mathematically, that is not true. According to the U.N. the world drug trade is $435B, 4 times the total, and strictly theoretical value of Bitcoin, coins locked, lost, and all. Besides if you owned $160B coins, who would you transfer them to? You’re the only user. $435B/year can only be trafficked by major banks like as HSBC, who have paid public fines because money flows that large can’t be hidden. This is so well-known the U.N. suggested the drug-money flows may be one reason global banks were solvent in ‘08. Even $160B misrepresents Bitcoin because it had a 10-fold increase this year alone. So imagine $16B total market cap. That’s half the size of the yearly budget of Los Angeles, one city. Even that overstates it, because through most of its life it’s been around $250, so imagine a $4B market cap, the budget of West Virginia.

So you’re a drug dealer in illicit trades and you sell to your customers because all your buyers have Bitcoin accounts? Your pushers have street terminals? This doesn’t make sense. And remember as much as the price of Bitcoin has risen 40-fold, the number of participants has too. Even now, even with Coinbase, even with Dell and Overstock, even with BTC $10,000 almost no one has Bitcoin, even in N.Y.C. or S.F.. So who are these supposed illegal people with illegal activities that couldn’t fit any significant value?

That’s not to say illegal activities don’t happen, but it’s the other half of the spurious argument to say people don’t do illegal acts using cash, personal influence, offshore havens, international banks like Wells Fargo, or lately, Amazon Gift Cards and Tide Detergent. As long as there is crime, mediums of value will be used to pay for it. But comparing Bitcoin with a $16B market cap to the existing banking system which the U.N. openly declares is being supported by the transfer of illicit drug funds is insanity.

Let’s look at it another way: would you rather: a) transfer drugs using cash or secret bank records that can be erased or altered later or b) an public worldwide record of every transaction, where if one DEA bust could get your codes, they could be tracked backwards some distance through the buy chain? I thought so. Bitcoin is the LEAST best choice for illegal activities, and at the personal level where we’re being accused, it’s even worse than cash.

We showed that Bitcoin can be money, but we already have a monetary and financial system. What you’re talking about is building another system next to the existing one, and doubling the costs and confusions. That’s great as a mental exercise but why would anyone do that?

In a word: 2008.

It’s probably not an accident Bitcoin arrived immediately after the Global Financial Crisis. The technology to make it possible existed even on IRC chat boards, but human attention wasn’t focused on solving a new problem using computer software until the GFC captured the public imagination, and hackers started to say, “This stinks. This system is garbage. How do we fix this?” And with no loyalty to the past, but strictly on a present basis, built the best mousetrap. How do we know it’s a better mousetrap? Easy. If it isn’t noticeably better than the existing system, no one will bother and it will remain an interesting novelty stored in some basements, like Confederate Dollars and Chuck-e-Cheez tokens. To have any chance of succeeding, it has to work better, good enough to overcome the last most critical aspect money has: Inertia.

So given that Bitcoin is unfamiliar, less accepted, harder to use, costs real money to keep online, why does it keep gaining traction, and rising in price with increasing speed? No one would build a Bitcoin. Ever. No one would ever use a Bitcoin. Ever. It’s too much work and too much nuisance. Like any product, they would only use Bitcoin because it solves expensive problems confronting us each day. The only chance Bitcoin would have is if our present system failed us, and fails more every day. They, our present system-keepers, are the ones who are giving Bitcoin exponentially more value. They are the ones who could stop Bitcoin and shut it down by fixing the present, easy, familiar system. But they won’t.

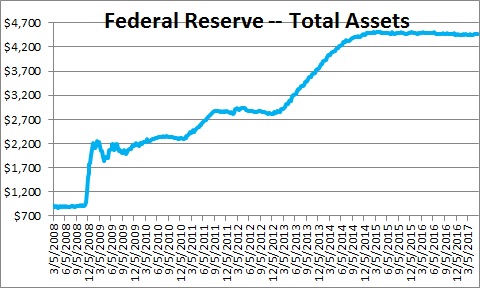

Where has our present system gone wrong? The criticisms of the existing monetary system are short but glaring. First, everyone is disturbed by the constant increase in quantity. And this is more than an offhand accusation. In 2007 the Fed had $750B in assets. In 2017 they have $4.7 Trillion, a 7-fold increase. Where did that money come from? Nowhere. They printed it up, digitally.

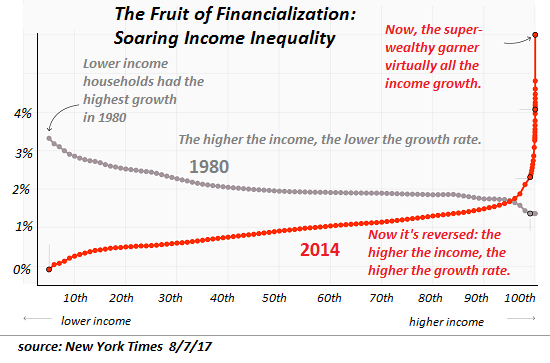

The TARP audit ultimately showed $23 trillion created. Nor was the distribution the same. Who received the money the Fed printed? Bondholders, Large Corporations, Hedge Funds and the like. Pa’s Diner? Not so much. So unlike Bitcoin, there not only was a sudden, secret, unapproved, unexpected, unaccountable increase in quantity, but little to no chance for the population to also “mine” some of these new “coins”. Which leads to this:

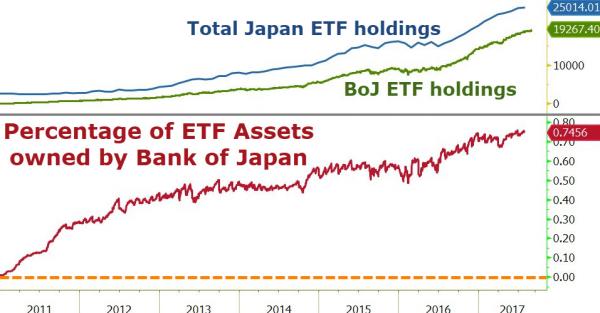

Near-perfect income disparity, with near-perfect distribution of new “coins” to those with access to the “development team”, and zero or even negative returns for those without inside access. Does this seem like a winning model you could sell to the public? Nor is this unique to the U.S.; Japan had long ago put such methods to use, and by 2017 the Bank of Japan owns a mind-bending 75% of Japanese ETFs:

So this unelected, unaccountable bank, which creates its coin from nothing without limit or restraint, now owns 75% of the actual hard labor, assets, indeed, the entire wealth HISTORY of Japan? It took from the Edo Period in 1603 through Japan-takes-the-world 1980s until 2017 to create the wealth of Japan, and Kuroda only 6 years to buy it all? What madness is this?

Nor is Europe better. Mario Draghi has now printed so much money, he has run out of bonds to buy. This is in a Eurozone with a debt measuring Trillions, with $10 Trillion of that yielding negative rates. That’s a direct transfer from all savers to all debtors, and still the economy is sinking fast. Aside from how via these bonds, the ECB came to own all the houses, businesses, and governments of Europe in a few short years, does this sound like a business model you want to participate in?

So the volume of issuance is bad, and unfairness of who the coins are issued to is as bad as humanly possible, giving incredible advantages to issuers to transfer all wealth to themselves, either new or existing.

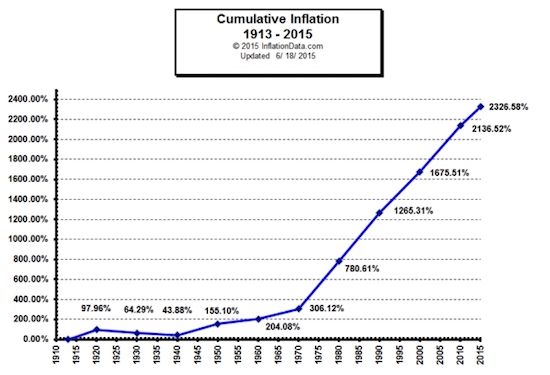

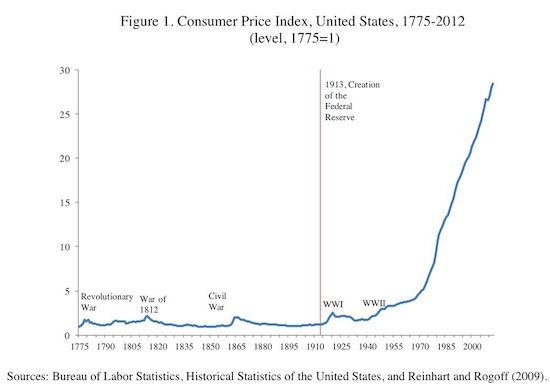

But if the currency is functional day-to-day, surely the issuance can be overlooked. Is it? Inflation is devilishly hard to measure, but here’s a chart of commodities:

CPI:

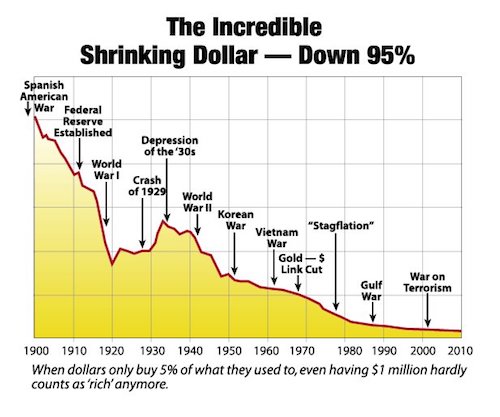

The US Dollar:

or vs Gold (/silver):

Does that look stable to you? And not that Bitcoin is stable, but at least Bitcoin goes UP at the same rate these charts are going DOWN. One store coupon declines in value at 4% a year, or may even start negative, while the other gives steady gains to loyal customers. Which business model would you prefer?

But that’s not all.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2017 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.