SPX Make a 61.8% Retracement

Stock-Markets / Stock Market 2017 Dec 08, 2017 - 06:24 PM GMT SPX has been challenging the Cycle Top at 4649.38 which is very close to the 61.8% retracement at 2649.68. This may be the final probe with a reversal to follow. From there a panic decline may develop. A 4.3 day decline may take the SPX until Thursday to find a bottom.

SPX has been challenging the Cycle Top at 4649.38 which is very close to the 61.8% retracement at 2649.68. This may be the final probe with a reversal to follow. From there a panic decline may develop. A 4.3 day decline may take the SPX until Thursday to find a bottom.

While even some bears are expecting another push higher, the Model says a nasty decline may be imminent.

ZeroHedge reports, “Despite soaring stock market values and an endless array of postive survey data from various estabishment-based entities, University of Michigan confidence tumbled in November.

Consumer sentiment in the U.S. cooled for a second month. While current conditions managed to improve, expectations for the future slumped...”

NDX nearly made it to the Wave [a] high of 6380.77. This qualifies the correction as an expanded flat or irregular correction, where Wave [b] is the longest wave. Wave [c] may yet rise to the top of [a] before the reversal.

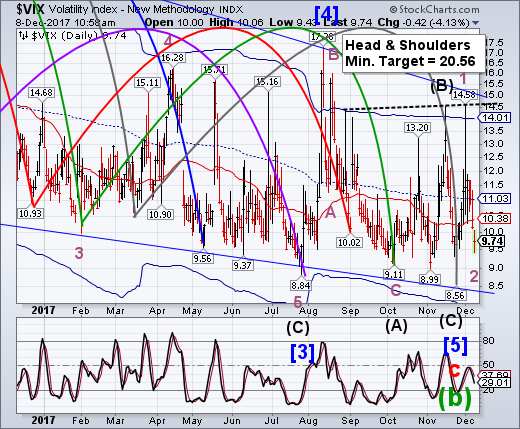

VIX declined to 9.43 this morning, but has recovered somewhat. Wave2s are know to cause some consternation as they may retrace all the way to the bottom of Wave 1. This is not a buy signal, but can be confusing to some.

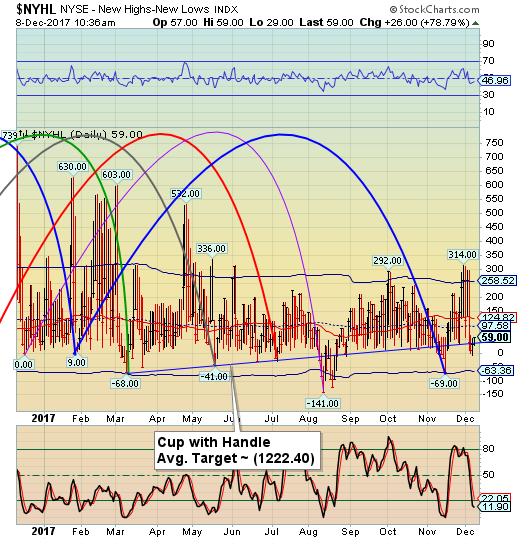

The Hi-Lo index is back above the trendline but the danger signal doesn’t come until it rises above the mid-cycle resistance at 97.56. At this point, the Cycles Model says that we may see stocks beginning to decline again around noon.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.