Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts to Continue?

Commodities / Gold and Silver 2017 Dec 12, 2017 - 04:43 PM GMTBy: GoldCore

– Gold and silver COT suggests bottoming and price rally coming

– Gold and silver COT suggests bottoming and price rally coming

– Speculators cut way back on long positions and added to short bets

– Commercials/banks significantly reduced short positions

– Commercial net short position saw biggest one-week decline in COMEX history

– ‘Big 4’ commercial traders decreased their short positions by 28,800 contracts

– Seasonally, January is generally a good month to own gold (see table)

– “If history is still reliable, January will be a great month to own precious metals”

Have you found the gold price in the last few months to be particularly boring? Well, fear not as it looks like it might all be about to take a turn upwards. Last Friday’s Commitment of Traders (COT) report signaled we are close to bottoming and suggest that both gold and silver should have a positive January and Q1, 2018.

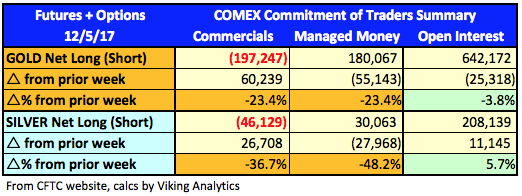

As John Rubino wrote in his latest note, ‘gold futures traders have finally started behaving “normally.”’ This simply means that speculators are finally beginning to cut back on long bets whilst commercials and large bullion banks, the “smart money” and the “inside money” have reduced their shorts dramatically.

This was seen in gold and also in silver, the industrial, technological precious metal. Historically when commercial and speculator positions are brought into balance then this has proven to be bullish for the precious metals.

Previously peaks in net commercial short interest have often happened alongside sell-offs, subsequently valleys in commercial short interest have almost always coincided with nearby rises in price. This could be a positive indicator for the next few months in both gold and silver prices.

Silver: short 181 days of world silver production

According to Ed Steer:

“In silver, the Commercial net short position cratered by an eye-watering 26,721 contracts, or 133.6 million troy ounces of paper silver. That is, without doubt, the biggest one-week decline in COMEX history. They arrived at that number by adding 9,701 long contracts, plus they reduced their short position by an incredible 17,020 contracts — and the sum of those two numbers is the change for the reporting week…the Big 4 traders reduced their short position by about 6,400 contracts — and the ‘5 through 8’ large traders reduced their short position by around 4,700 contracts… the 36-odd small Commercial traders other than the Big 8, added approximately 15,600 contracts to their long position.”

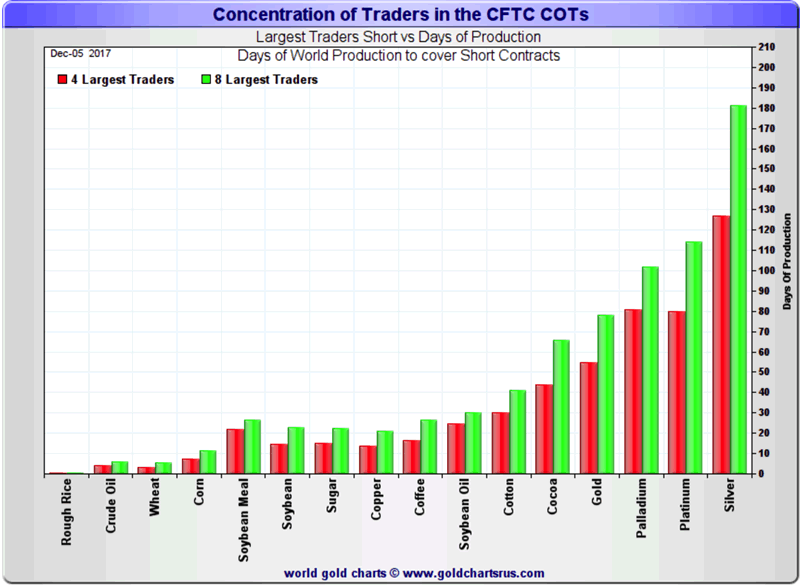

As you can see from the chart at the top, the Big 8 commercial trader are now net short 439.8 million troy ounces of paper silver. This is equal to 181 days of world silver production or about 439.8 million troy ounces of paper silver held short by the Big 8.

“The two largest silver shorts on Planet Earth—JP Morgan and Canada’s Scotiabank—are short about 92 days of world silver production between the two of them—and that 92 days represents about 72 percent of the length of the red bar in silver in the above chart… about three quarters of it.”

Interestingly these dramatic changes in both short and long positions did not bring with them any dramatic changes in price. This is clearly something to look out for in the coming weeks. For many analysts, this latest COT report suggest we are looking at a bottom in silver as such changes in futures positions ordinarily coincide with a low in gold and silver prices and a good time to buy.

Gold: short 78 days of world gold production

As reported by Ed Steer:

“The commercial net short position crashed by 56,651 contracts, or 5.65 million troy ounces of paper gold. They arrived at that number by adding 15,678 long contracts, plus they decreased their short position by an incredible 40,973 contracts — and the sum of those two numbers is the change for the reporting week.Ted said that the ‘Big 4’ traders decreased their short position by a whopping 28,800 contracts, or thereabouts — and the big ‘5 through 8’ large traders decreased their short position by around 16,900 contracts…the 47-odd small commercial traders other than the Big 8, added 11,000 contract to their long position.”

The big chart at the top show the Big 8 are short nearly 80 days of production.

“In gold, the Big 4 are short 55 days of world gold production, which is down 10 days from what they were short last week — and the ‘5 through 8’ are short another 23 days of world production, which is down 6 days from what they were short the prior week, for a total of 78 days of world gold production held short by the Big 8 — which is down 16 days from the 94 days they were short in last week’s report. These are monster weekly changes. Based on these numbers, the Big 4 in gold hold about 70 percent of the total short position held by the Big 8…which is up 1 percentage point from last week’s COT Report.”

New Year’s resolution: buy gold and silver

Some caution should be exercised when looking at COT reports. When released the data is three days old, published on a Friday with Tuesday’s trading data. However this does not mean that some signal can be taken from them.

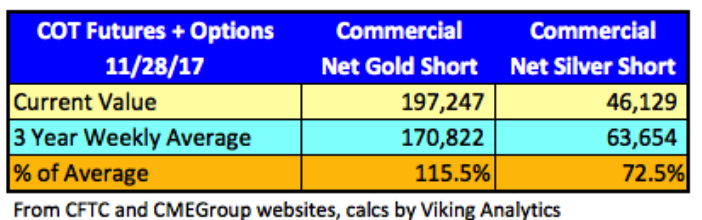

Seasonally, January is generally a good month to own precious metals, particularly gold. On average the gold price rises over 3% in the month and generally continues to rise into February.

This latest COT report is unlikely to be a one-off and should be embraced by those looking to allocate funds to own gold and silver.

As John Rubino concluded in his own coverage:

The numbers we’re seeing here are as of Tuesday the 5th, and the final three days of last week were a bloodbath for precious metals, so it’s highly likely that the next COT numbers – due out on Friday the 15th – will show absolute panic among speculators, leading to an even bigger swing in the right direction.

If history is still reliable, January will be a great month to own precious metals and mining stocks.

Investors and savers should keep their heads over the next few months and take solace from the fact that whilst the ‘Big’ players are gambling with paper they can in fact benefit by buying physical, allocated and segregated gold and silver.

We leave you with some wise words from John Hathaway who wrote on how the phenomenon of the paper precious metals market would come to benefit those holding the real thing:

“An acute shortage of readily marketable physical gold is developing that we believe will deepen in years to come. This possibility seems to be unrecognized by those who are short the gold market through paper contracts. The relentless dumping of synthetic or paper gold contracts since 2011 by speculators in Western financial markets has caused the shortage. The steady selling has driven down the price of physical gold, hobbled the gold-mining industry, and drained the stores of gold held in the vaults of Western financial centers …”

Veteran gold market analyst and CFA, Hathaway concludes that:

“Much of what passes for financial wealth is in our opinion imprisoned in a matrix from which there is no easy exit. The return migration of capital to real assets promises to be disruptive. The misdirection of capital could well cause losses for many but opportunity for a few. The list of opportunities is short, limited in capacity, possibly complex, and difficult to access. Among the possible opportunities, gold is accessible and straightforward. Gold has a history of responding inversely to the direction of confidence.

Gold Prices (LBMA AM)

12 Dec: USD 1,243.40, GBP 933.92 & EUR 1,056.27 per ounce

11 Dec: USD 1,251.40, GBP 935.80 & EUR 1,061.19 per ounce

08 Dec: USD 1,245.85, GBP 924.42 & EUR 1,061.09 per ounce

07 Dec: USD 1,256.80, GBP 937.57 & EUR 1,066.77 per ounce

06 Dec: USD 1,268.55, GBP 948.37 & EUR 1,072.31 per ounce

05 Dec: USD 1,275.90, GBP 950.29 & EUR 1,075.71 per ounce

04 Dec: USD 1,279.10, GBP 952.67 & EUR 1,079.43 per ounce

Silver Prices (LBMA)

12 Dec: USD 15.78, GBP 11.82 & EUR 13.40 per ounce

11 Dec: USD 15.84, GBP 11.84 & EUR 13.43 per ounce

08 Dec: USD 15.83, GBP 11.76 & EUR 13.48 per ounce

07 Dec: USD 15.91, GBP 11.94 & EUR 13.49 per ounce

06 Dec: USD 16.12, GBP 12.06 & EUR 13.64 per ounce

05 Dec: USD 16.29, GBP 12.14 & EUR 13.72 per ounce

04 Dec: USD 16.33, GBP 12.09 & EUR 13.77 per ounce

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.