A Former Wall Street Veteran: Good Traders Are Born, Not Trained

Interest-Rates / Learn to Trade Dec 12, 2017 - 05:07 PM GMTBy: John_Mauldin

BY JARED DILLIAN : Some people are better with money than others. Is it nature or nurture?

BY JARED DILLIAN : Some people are better with money than others. Is it nature or nurture?

What I mean is: Can investing be taught, or does it come naturally?

I’m going to make a very controversial statement. Financial acumen is almost entirely nature. You are born with it.

You were born with your tolerance for risk. It is in your DNA. I would not be surprised if 23andMe found a gene for it someday.

Let me explain.

There Are Mushes in Every Walk of Life

Everyone has heard of “the mush.” This is a person who is wrong about everything.

This person bought the highs in Internet stocks in 2000, bought the highs of homebuilders in 2006, bought the highs in gold in 2011, and perhaps is buying the highs in bitcoin now. (I wrote about investing in times likes these in my exclusive free report, Investing in the Age of the Everything Bubble, which you can download here)

Funny thing about them—they are present in every walk of life, including Chicago MBAs and derivatives traders.

Just because you have the credentials, doesn’t mean you are good with money. I have seen my share of traders who are wrong all the time. They do manage to stick around. Wall Street can be a lot more forgiving than you think.

Given that mushes come from all over the place, the only conclusion I can draw is that financial ability is not a learned trait.

Financial Literacy Doesn’t Help

I am a big proponent of teaching financial literacy in schools. But you have to be realistic—even with all the education in the world, lots of people are going to be bad with money.

They will be the ones to buy the timeshares. There is nothing you can do about it.

“Bad with money” seems to imply the tolerance of a higher level of financial risk. There is plenty of that going around these days. Millennials are too scared to invest in the 6-vol S&P 500 but will readily fork over their cash for 150-vol bitcoin. And for sure, there are some people who just need a volatility fix—all these leveraged ETFs exist for a reason.

But there is also such a thing as taking too little financial risk. If you missed out on this whole food fight, shame on you. The peak of financial conservatism is money under the mattress. Some people go there.

Financial literacy should be about:

- Teaching how the banking system works

- Teaching how mortgages work

- Teaching how car loans and credit cards work

- Teaching the basics of how financial markets work

- Etc.

Financial literacy should not be about:

- Giving people a healthy appetite for risk

Traders are born, not made.

Most People Are Better Off with Cash in the Bank

I spent part of my career on Wall Street. The one lesson I took from working on a trading desk was just how unsuitable most financial instruments are for average folks.

The financial markets are for big boys. For everyone else, there is cash in the bank.

I’m going to say something so far out of consensus, someone will punch me in the teeth. Cash in the bank is not the worst thing in the world. Yes, it pays no interest. But for a lot of people, making 0% is superior to losing 10%.

It’s not just the mush—lots of people make suboptimal financial decisions.

When you see the 1, 3, and 5-year returns of the Vanguard 500 Index Fund, do you know how many people actually achieve those returns? Very few. Because they buy on the highs and sell on the lows.

The number of investors who hold a fund in good times and bad, dollar-cost averaging on the way down as well as on the way up, is very small. For a lot of people, cash sitting in the bank is good.

But that’s a difficult discussion to have, because people want to have their money “working for them.” They think that if it’s in the bank, it’s not “working for them.” This may be true, but most of these people should be a lot more pessimistic about what their returns will be.

Unrealistic Expectations Are Across the Board

The last few years have not made people pessimistic.

They think they can get 20% a year out of the stock market, but that is peanuts compared to what they might get out of bitcoin, which is up about 1000% in the last year. This has given people very unrealistic expectations.

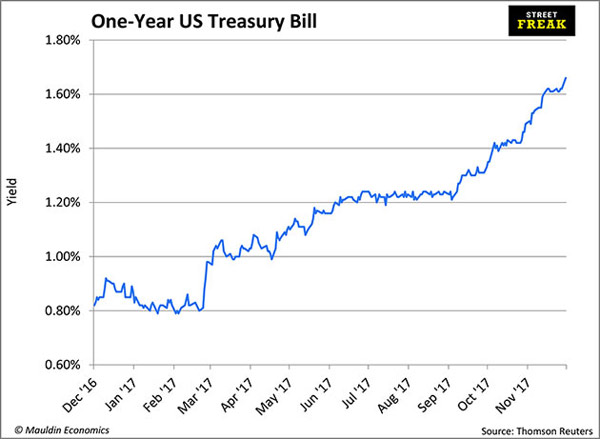

You know what I am excited about? I am super excited about 1.66% on one-year T-bills.

Almost 2% for taking no risk at all. That number keeps going up, as the Fed is almost certainly going to hike next week and is poised to hike a bunch of times next year.

At the top of the dot-com bubble you could have had 6.5% in a money market mutual fund. Nobody was interested.

Nobody, except for the folks who were born with it.

Grab Jared Dillian’s Exclusive Special Report, Investing in the Age of the Everything Bubble

As a Wall Street veteran and former Lehman Brothers head of ETF trading, Jared Dillian has traded through two bear markets.

Now, he’s staking his reputation on a call that a downturn is coming. And soon.

In this special report, you will learn how to properly position your portfolio for the coming bloodbath. Claim your FREE copy now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.