New EU Rules For Cross-Border Cash, Gold Bullion Movements

Commodities / Gold and Silver 2017 Dec 19, 2017 - 03:40 PM GMTBy: GoldCore

– War on cash continues and expands to affect non-criminals including gold owners

– War on cash continues and expands to affect non-criminals including gold owners

– New definitions of “cash” to be drawn up by EU to include gold and precious metals

– Claim cash and gold bullion “often used for criminal activities such as money laundering, or terrorist financing”

– Legislation will allow authorities to seize assets from those ‘without a criminal conviction’

– New rules usurp those currently in existence since 2005

The ironically named European Parliament’s Civil Liberties and Economic Affairs committees have backed plans by the European Union to introduce tougher checks and controls on cash entering or leaving the region.

Currently individuals are required to declare cross-border cash sums of €10,000 or more, under the First Cash Control Regulation (CCR) from 2005. A new decision will repeal the CCR and allow authorities to seize cash below the €10,000 threshold should criminal activity be suspected.

According to the European Parliament news website, MEPs have agreed to:

-

– widen the definition of ”cash” to include gold, precious stones and metals, as well as anonymous prepaid electronic cash cards,

– enable the authorities to impound cash below the €10,000 threshold temporarily, if criminal activity is suspected, and

– make it mandatory to disclose “unaccompanied” cash sent by cargo.

“Large sums of cash, be it banknotes or gold bullion are often used for criminal activities such as money laundering, or terrorist financing. With this legislation, we give our authorities the tools they need to improve their fight against those crimes,” Mady Delvaux, MEP.

This decision to tighten controls is not a surprise. On December 21st last year the European Commission announced plans to increase efforts to “tighten cash controls, ease cross border police probes, and speed up asset freezes and confiscation orders”. This is all part of a larger “Security Union” package launched in April 2015.

No conviction needed

Last December Justice commissioner Vera Jourova told reporters that steps were being taken in order to make life more difficult for criminals and terrorists looking to finance activities.

The problem is that whether you’re a criminal or not then you are subject to these new changes. This is particularly worrying when one considers that the ‘loopholes’ being closed currently prevent the authorities from seizing and confiscating if the “criminal is not convicted”. Now law enforcement offices in various states can take one look at you, decide they don’t like you or suspect you and find cause to seize your assets.

Sadly they don’t even have to take a physical look at you in order to seize your assets, even ‘unaccompanied cash’ and precious metals is up for grabs if undisclosed.

Careful with those birthday card gifts and wedding rings

At the moment it is not clear if ‘unaccompanied cash’ includes gold and silver bullion coins and bars but it likely is under the new definition. Given the new legislation comes in two parts, first the inclusion of gold etc in the definition of cash and secondly the seizure of unaccompanied assets, then it would be sensible to assume that gold and silver are under scrutiny.

The definition also includes ‘anonymous prepaid electronic cards’. One has to ask how far this is going to go. I often receive ‘gift vouchers’ in the form of electronic cards, from relatives to be spent in a store of their choosing. Are these now at risk of confiscation?

Furthermore, is the definition just about gold and silver bullion and coins, or also jewellery? Goodness knows how many women cross borders each day with their engagement and wedding rings comfortably sitting above the €10,000 mark.

Typical scare-mongering combined with opacity from the EU

This is typical scare-mongering combined with opacity from the EU. The organisation regularly uses ‘criminal activities’ as the justification for imposing additional controls on society in the drive towards the cashless society.

We have seen this in the EU where many countries have capped the amount that can be legally paid in cash, in order to keep a track of money laundering. Following the Charlie Hebdo attacks France’s Finance Minister Michel Sapin declared war on cash, placing the terrorists’ ability to buy dangerous goods with cash as one of the main reasons for the murders. There is now a €1,000 cap on cash payments, down from €3,000 previously.

Also in the EU, the removal of the €500 note was done under the guise of crime prevention.

Whilst the EU like to act as though they are being transparent in their reasoning for imposing such controls the opacity with which they are able to enforce them is terrifying.

Given that they are now apparently able to seize and temporarily freeze assets without evidence of criminal activity or conviction, we are now all at risk.

The truly frustrating part of all this is that cash is not used for fraud at anywhere near the level we see at the electronic level. Governments love to use cash-based money-laundering as a reason to go cashless but cash-based only laundering is not that big of a deal. In the UK it is common knowledge that it is not as big a problem as cyber money laundering.

The Treasury and Home Office believe that they ‘know about most cash-based money laundering’ but the big problem lies in ‘high-end’ money laundering, such as from bank accounts:

“The size and complexity of the UK financial sector means it is more exposed to criminality than financial sectors in many other countries, including abuse enabled by professional enablers in the legal and accountancy sector.”

It is here that the intelligence agencies see ‘significant gaps’ in their knowledge.

Making you feel like a criminal

The cashless society is very real and pretty terrifying prospect which we explored in some depth last year. One of our key points was how anti-cash legislation ended up affecting the mindset of innocent individuals who were looking to move legitimately held funds:

In Sweden, the bastion of the cashless society, banks have done such a great job in making cash appear so suspicious that:

“In general, the rule of thumb in Scandinavia is: ‘If you have to pay in cash, something is wrong,’” writes Mikael Krogerus for Credit Suisse. Arvidsson explains that “At the offices which do handle banknotes and coins, the customer must explain where the cash comes from, according to the regulations aimed at money laundering and terrorist financing,” The hassle, for the depositor, is enough to make them go cashless.

Surely the risks of holding cash are for you, the individual, to manage. And the risks of criminal activity, if facilitated by cash or even diamonds, is for the police to manage. Why are the two conflated?

Conclusion: Where do we go from here?

The only example I have seen the EU offer up in terms of justifying the control of gold and silver is the following:

National authorities have also seen that certain precious high-value commodities such as gold are now being used to escape the obligation to declare, since gold is not considered ‘cash’ under existing rules. For example, French customs authorities found non-declared cash and gold worth €9.2 million in postal parcels and freight packages during an investigation at Roissy Airport in 2015.

I have seen this cited twice since last year, with no other accompanying examples. A (admittedly quick) Google search found no reports of this. It’s also interesting how the EU’s example fails to offer a breakdown of how much of the €9.2 million was cash and how much was gold.

The sad truth is likely that the EU is seeing increasing numbers of people pulling their assets out of bank accounts and placing them into physical assets. They are doing this because of the increasing threat of both negative interest rates and deposit bail-ins. Both are very real and depressingly legal risks.

As we concluded in our study of the cashless society:

A ban on cash does not remove the issues that the proponents claim it will, instead it exacerbates the issues that already exist and bring them to the forefront of every prudent saver and investors’ mind: liberty, security of assets, protection of wealth against negative interest rates, bail-ins and currency devaluations.

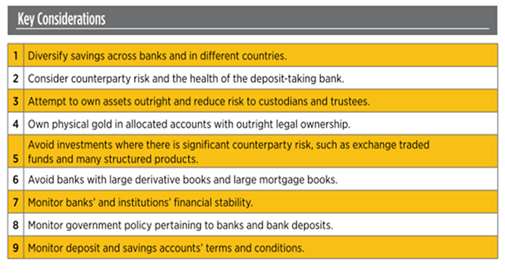

The current drive towards a cashless society shows the importance of being diversified and not having all your savings and assets within the vulnerable financial and banking system.

It underlines the importance of diversification and having direct ownership of some of your wealth – outside the electronic savings and payments systems.

Gold Prices (LBMA AM)

19 Dec: USD 1,263.10, GBP 944.93 & EUR 1,070.10 per ounce

18 Dec: USD 1,258.65, GBP 943.11 & EUR 1,067.71 per ounce

15 Dec: USD 1,257.25, GBP 937.41 & EUR 1,065.52 per ounce

14 Dec: USD 1,255.60, GBP 935.67 & EUR 1,062.49 per ounce

13 Dec: USD 1,241.60, GBP 929.96 & EUR 1,056.97 per ounce

12 Dec: USD 1,243.40, GBP 933.92 & EUR 1,056.27 per ounce

11 Dec: USD 1,251.40, GBP 935.80 & EUR 1,061.19 per ounce

Silver Prices (LBMA)

19 Dec: USD 16.16, GBP 12.08 & EUR 13.68 per ounce

18 Dec: USD 16.09, GBP 12.04 & EUR 13.64 per ounce

15 Dec: USD 15.99, GBP 11.93 & EUR 13.55 per ounce

14 Dec: USD 16.01, GBP 11.92 & EUR 13.54 per ounce

13 Dec: USD 15.71, GBP 11.76 & EUR 13.38 per ounce

12 Dec: USD 15.78, GBP 11.82 & EUR 13.40 per ounce

11 Dec: USD 15.84, GBP 11.84 & EUR 13.43 per ounce

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.