UK Mortgage fixed Interest rates start to fall

Personal_Finance / Mortgages Mar 26, 2007 - 08:34 AM GMTBy: MoneyFacts

Denise Blake, mortgage analyst at Moneyfacts.co.uk – the money search engine, comments: “Following the shock base rate rise in January, fixed rate mortgages flew off the shelves as consumers rushed to get their hands on existing fixed rate deals before they were pulled. But with base rate remaining unchanged now for the last two months, some level of stability has returned.

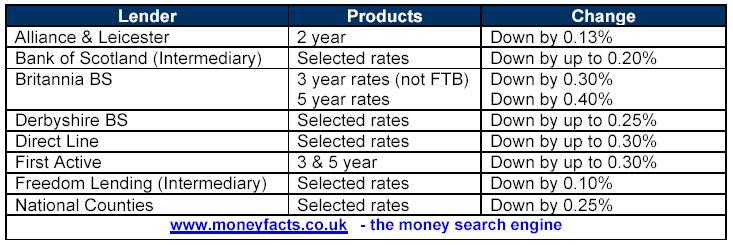

“With swap rates starting to fall back, Moneyfacts.co.uk has seen eight lenders reduce their fixed rate mortgages over the last 10 days, some by as much as 0.40%.

“Figures released yesterday from the Council of Mortgage Lenders showed that 85% of first time buyers and just over 70% of home movers chose a fixed rate mortgage in January, which illustrates the popularity of such deals in the current financial climate.

“With many people balancing their finances on a knife edge, the fear of any further increases to their mortgage payments is driving many towards fixed rate mortgage deals. These new lower rates are therefore great news for anyone who is keen to fix their mortgage but has yet to do so, and especially for those coming off a potentially very low fixed rate and looking for a new deal.

“Unlike this time last year, when fixed and discounted rates were similar, today any borrower looking to fix their mortgage will pay a premium. While low rate fixed deals are available, a competitive fixed rate package will cost around 5.25% compared with the Moneyfacts.co.uk best buy discounted rate of 4.73%. It would take a rate rise in excess of 0.5% before this deal becomes uncompetitive in comparison and generally the upfront fees will be lower too.

“Depending on your expectation of future rates and your personal financial circumstances, there are some great fixed rate and discounted deals on the market. It’s welcome news for some consumers that fixed rates are starting to fall, but with another rate rise still a distinct possibility, it will be interesting to see how long this latest downward trend actually lasts.”

By Michelle Slade,

http://www.Moneyfacts.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.