Bitcoin Trading Alert: Strong Correction and Possible Rebound

Currencies / Bitcoin Dec 31, 2017 - 03:57 PM GMTBy: Mike_McAra

Crazy week, huh? Bitcoin is firmly in the scope of mainstream media, and the recent very volatile action makes it only a better story. On Bloomberg, we read:

Crazy week, huh? Bitcoin is firmly in the scope of mainstream media, and the recent very volatile action makes it only a better story. On Bloomberg, we read:

Bitcoin resumed its tumble on Thursday after South Korea said it was eyeing options including a potential shutdown of at least some cryptocurrency exchanges to stamp out a frenzy of speculation.

South Korea has been ground zero for a global surge in interest in bitcoin and other digital currencies as prices surged this year, prompting the nation’s prime minister to worry over the impact on Korean youth. While there’s no immediate indication Asia’s No. 4 economy will shutter exchanges that have accounted by some measures for more than a fifth of global trading, the news is a warning as regulators the world over express concerns about private digital currencies.

Bitcoin fell as much as 9 percent to as low as $13,828 in Asia trading, erasing modest gains after the South Korean release, composite Bloomberg pricing shows. The cryptocurrency had retraced some of its losses by 10:13 a.m. in London, trading down 4.5 percent to $14,505. That puts the drop from a record high reached last week at about 26 percent.

While South Korea is an important market and recent stories showed that local traders were willing to pay high premiums for Bitcoin, we don’t generally think that the whole market action is driven by what’s happening in Korea. We rather think that the hectic behavior in Korea is a result of the recent appreciation and is fueling it to a lesser extent than might be presented in media stories.

We would actually expect to see even more stories on Bitcoin in the future. Some of them will follow the “Bitcoin appreciated/depreciated because of X” where it might be really hard to assess whether this is even remotely close to the actual situation in the market. In our opinion, the current market conditions are of extreme emotions and fundamental factors might only influence the market to the extent they shift expectations.

For now, let’s focus on the charts.

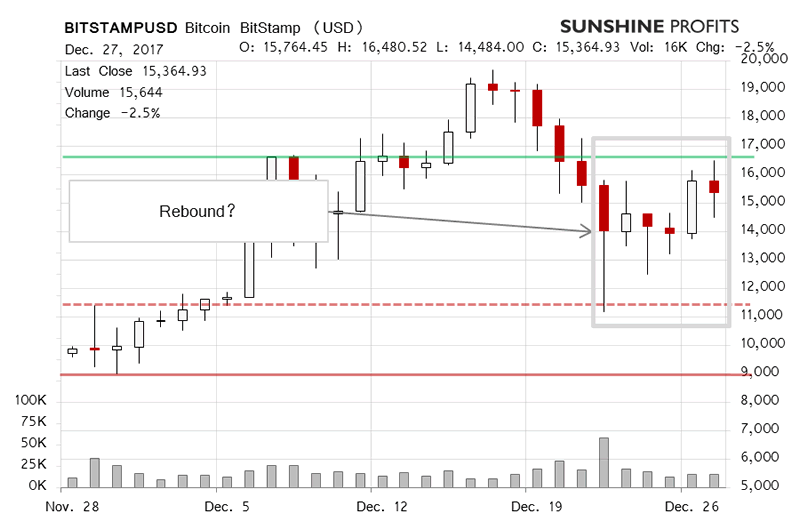

On BitStamp, we saw a very sharp correction and then a possible rebound? What might this mean for the Bitcoin market? In our recent comments, we wrote:

The price action we have seen since then has mostly turned the very short-term outlook around. This means that the perspective for the next couple days seem a lot more bearish than bullish now, mostly based on momentum and the action visibly below the previous all-time high. The volume on which this move has taken place has been relatively strong. This also contributes to the bearish very short-term outlook. But is the situation changed enough to consider hypothetical shorts at the moment?

What we saw in the days following the publication of our last alert was actually strong depreciation. Bitcoin went down to around $11,000 (slightly above this level) and the local bottom was completed on strong volume, to say the least. The fact that such a strong move down was followed by a rebound might suggest a bullish outlook. But is this the case? The move up took Bitcoin to over $16,000 before the currency turned back south, not decisively. Is this all a bullish suggestion?

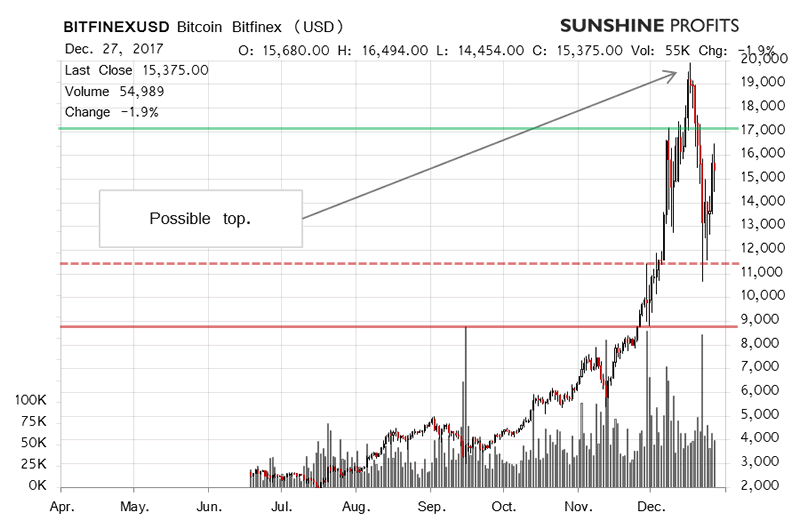

On the long-term Bitfinex chart, we very clearly see the all-time high, the strong move down and a possible rebound. Recall our previous alert:

Is this part of our analysis different now than it was only a couple days ago? Yes, in terms of the very short-term outlook (...). How about in terms of the medium-term outlook? Not necessarily. First of all, it is quite natural for the currency to correct after a period of very strong appreciation. The question is if we’re seeing enough signs that the tide has turned for a longer period of time. At the moment of writing, this doesn’t seem to be the case. If we measure the last rally from the November local bottom, Bitcoin hasn’t even corrected 38.2% of it. This would correspond to Bitcoin at $14,357 – not a stretch from the current price but the currency is not there just yet. Because of the potentially very important nature of the current price action, we would actually prefer to see Bitcoin below this level for a couple of days before considering hypothetical shorts. At the same time, it seems that if the currency is able to rebound from this level, we might have yet another move up on our hands. Currently, our opinion is that a move down seems more probable but the situation is too risky to put on hypothetical speculative positions at the moment.

The next few days played out as a move down and, afterwards, a possible rebound. The action was volatile and consistent with our previous view that the situation had been risky. Now, did the whole move change the outlook? It might have but the implications are uncertain at this time. First of all, the move down from the all-time high corrected around 61.8% of the preceding rally (November-December 2017). The move up tested the 50% Fibonacci retracement and then continued up above the 38.2% retracement before coming back below this level and up to it. All in all, Bitcoin is now right at the 38.2% retracement and this might be the level which signals the next big move. Depending on the exchange, Bitcoin is either above or below this level, so there are no strong implications here. At the moment of writing these words, we view the situation as possibly more bullish than bearish for the short-term but the thing is that this might change even today. If we don’t see a move down in the next couple of days, we might consider hypothetic longs. At the same time, a confirmed move below the 38.2% level might suggest that a more pronounced decline is in the cards. So, even though in the short term the situation is slightly more bullish, the current action is not necessarily bullish for the medium term.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.