Gold, Silver Predictions 2018

Commodities / Gold and Silver 2018 Jan 02, 2018 - 07:21 AM GMTA major shift in sentiment will drive prices in the new year

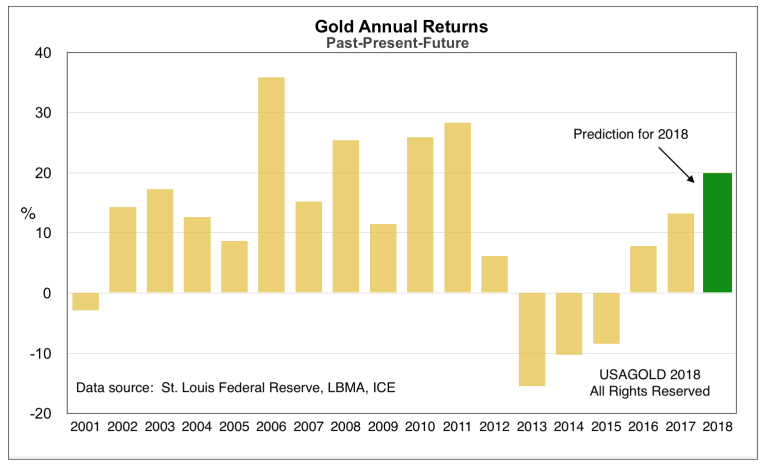

With such a solid end to 2017, it prompts the question what we might expect of gold in 2018. The most immediate question is whether or not it will pick up where it left off 2017 and continue its climb into the New Year, or fizzle and spend the year going sideways or worse, down. I have refrained from the perennial turn of the year prediction sweepstakes for a number years, but I will venture out on the limb this year to say a price in the mid-$1500s looks achievable in 2018.

Coming off two successive positive years, gold seems to be building toward something. Fizzling or dropping seem unlikely given 2017’s surprise performance and the general state of global equity markets – most of which seem to be overpriced, over-loved and over the top. 2017 will be recorded as a transition year for gold; 2018, in my opinion, will go down as the year gold reasserted itself as a primal force in the global financial marketplace.

I base that opinion not so much on the fundamentals or a technical reading of the charts – or anything overly scientific for that matter, but rather on a gut feeling that comes with being in the gold business for 45 years. When all is said and done for 2018, after all the factors have been weighed and measured, I see sentiment – a thing that cannot be measured or weighed – emerging as the principal determinant for gold in 2018.

Investment capital is forever rummaging around for an opportunity and smart money will always find what is undervalued. That in a nutshell is what gold has going for it as we enter the new year. In 2017, we saw the first signs of a sentiment-driven, smart money migration to gold – a vanguard led by professional investors who govern institutional trading desks and manage multi-billion dollar hedge funds. In 2018, cash-flush private investors, absent the past year, will join with professional money in the pursuit of gold both in physical and paper forms. That should be enough, in my view, to generate a 20% improvement from December's closing number and put the price in the $1550-$1560 range.

As for silver, I would not be surprised to see it trading over $22 at some point during the course of the new year – the equivalent of a 30% price increase. It has a history of outperforming gold on both the upside and the downside, and this time around is unlikely to be an exception. Silver will also continue to benefit from its new role as a safe-haven asset and junior partner to gold in the asset preservation business.

January, 2018 Edition

“The Gold Owner’s Guide to 2018”

We invite you to sign-up for FREE immediate access

+ e-mail notification on future publication dates.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.