Copper Outlook at Critical Juncture and Implications for the Silver Price

Commodities / Copper Jan 02, 2018 - 07:28 AM GMTBy: Metals_Report

Technical analyst Clive Maund delves into the reasons behind copper's recent rise and what that could mean for silver.

Technical analyst Clive Maund delves into the reasons behind copper's recent rise and what that could mean for silver.

We have seen an unusually steady uptrend in copper this month that has resulted in it appreciating by about 10%, which might not sound like much, but makes a big difference if you are a producer with fixed costs. What is remarkable about this uptrend is not only that it came hard on the heels of a high volume smackdown in the early days of the month that at the time looked bearish, but that we have seen 16 days trading days in a row of higher closes as of the close of trading on Thursday, as can be seen on the 3-month chart for copper shown below. After doing some extensive research it has been discovered that the fundamental reason for this day after day seemingly interminable uptrend was that a prominent Chinese buyer, who has an old fashioned way of doing things, was walking over to the London Metals Exchange every day for weeks with his black briefcase in hand and buying roughly the same amount of copper.

But sadly, on Friday, he was run over by a London bus while on his way to the exchange, and was thus unable to buy and the price dipped for the first time in long while.

We will now zoom out to look at copper on its latest 1-year chart. On this chart we can see that, while copper still has not broken down from its steep uptrend in force all this month, it is getting very overbought on its MACD and RSI indicators and is quite a long way ahead of its 200-day moving average, and these factors, taken together with the now extreme COT structure and sentiment indicators that we will look at shortly, suggest a high chance that it will go into reverse here or very soon and react back.

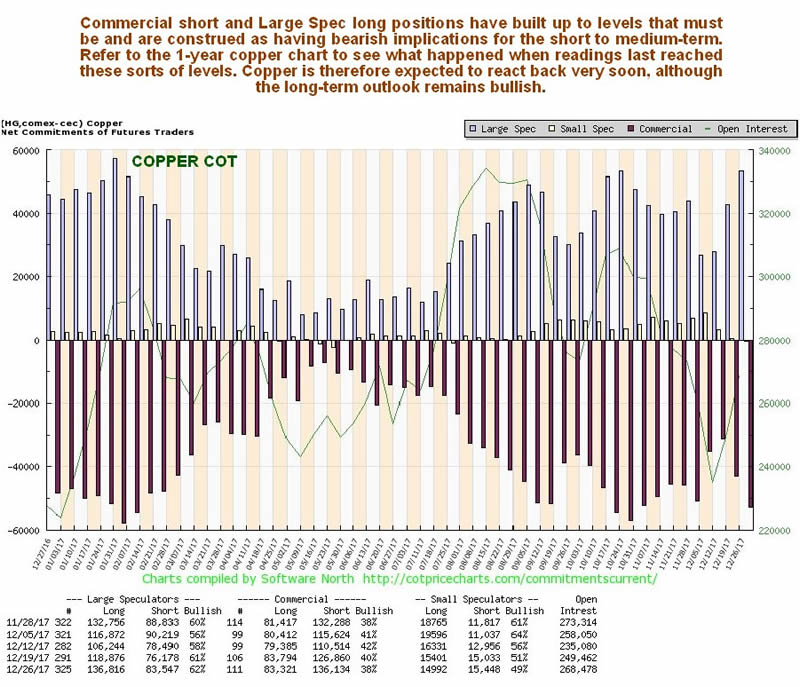

Next we will look at copper's latest COT chart, which, since it also goes back a year, can be directly compared to the 1-year copper chart above. As we can see, Large Spec long positions are very close to their highs of the past year, and when they have reached these sorts of levels in the past, a reaction back by copper reaction has ensued, and a reaction is made more likely given the factors that we have observed on copper's 1-year chart, and the sentiment extremes that now exist that we will look at next.

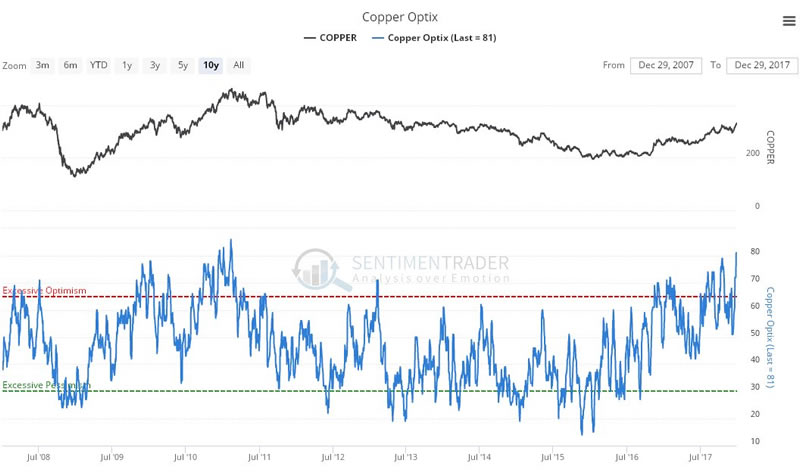

On the latest copper optix, or optimism chart, we can see that bullish sentiment towards copper is at the sort of wild extremes that we have only seen once before in the last 10 years, and that coincided with a major top. This is not to say that it does this time, but it would certainly seem to indicate a high probability that we are at or close to a significant intermediate (medium-term) top.

Chart courtesy of sentimentrader.com

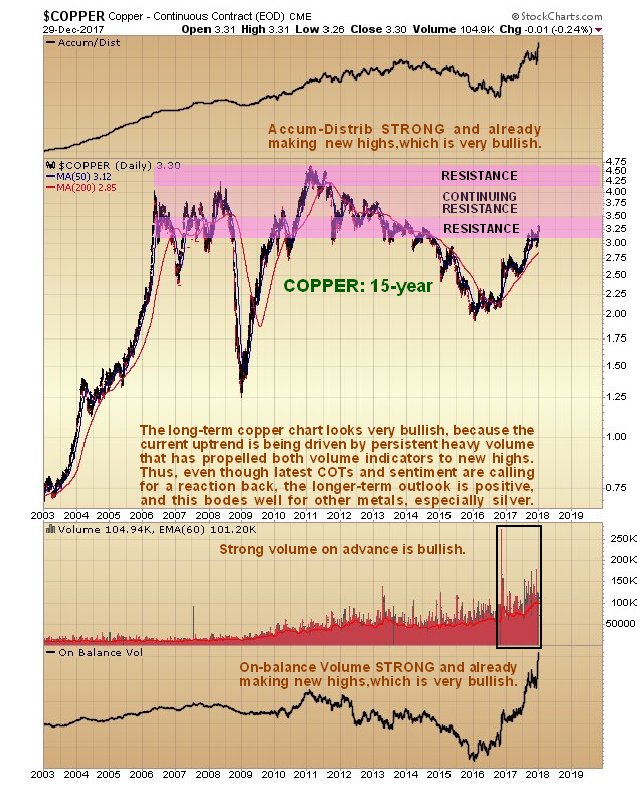

The long-term chart for copper actually looks very bullish, because the bull market that began in October 2016 has been driven by record strong upside volume, which has propelled both volume indicators to clear new highs. What this suggests is that, while the other factors that we have already looked at, allied with the considerable resistance approaching the old peaks that we can delineate on this chart, will probably force a reaction back soon, the longer-term outlook remains favorable, with a high probability that copper will eventually proceed to break out to new all-time highs, i.e., get above even its 2011 peak in the $4.60 area. If that happens its rate of rise can of course be expected to accelerate.

While a detailed look at the copper price technicals may seem like a waste of time to some of you, given all the other subject matter for such analysis, it is important to keep in mind that we are not looking at copper for its own sake, we are looking at it because of its implications for the economy generally, and especially because of its implications for the outlook for the prices of other metals, especially silver. What we are seeing on these copper charts, principally its long-term chart, bodes very well indeed for the future trend of silver prices.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.