FAANG Executives Selling Their Stock Is a Warning Signal

Stock-Markets / Stock Market 2017 Jan 03, 2018 - 07:59 AM GMTBy: John_Mauldin

BY JARED DILLIAN : Nobody has a better insight into the future prospects of a company than its top-tier employees.

BY JARED DILLIAN : Nobody has a better insight into the future prospects of a company than its top-tier employees.

Executives will always boast about their businesses, but it’s what they do with their own money that really matters.

I’m talking about insider trading.

Not the illegal kind, but rather planned buys and sells of stock by the company’s insiders—the directors, executives, and founders.

If they are buying their own stock, they’re confident about their company’s prospects. Future potential may not be fully priced in. That’s a good sign for investors.

But when executives hit the sell button, it’s time to be careful. They may believe their company stock is fully valued.

Let’s look at what’s happening with FAANG stocks.

FAANG Executives Are Getting Out

Over the past year, FAANG executives have been selling their stock en masse.

Take a look at these sales.

In September, Facebook announced that CEO Mark Zuckerberg will sell between 35 million and 75 million shares over the next 18 months. At the current share price, that’s between $6.1 billion and $13.1 billion worth of stock, which is one of the biggest insider sales ever.

And that’s on top of the $1 billion worth of stock he’s sold in the last 18 months.

Amazon CEO Jeff Bezos recently sold a million shares in the retailer for $1.1 billion. That adds to the million shares he sold in May this year. The size of Bezos’ sales can’t compare to Zuckerberg’s massive sell-off, but it’s big enough to pay attention.

In August, Apple CEO Tim Cook sold 268,623 shares in Apple, raising $43 million. This follows on the $65 million worth of shares he sold in 2016.

It was a tiny sale in this context, but are you seeing the trend yet?

Of course, there are many legitimate reasons for a company executive to sell shares. But here’s the thing—executives don’t like to cash out on the lows.

Top Tick?

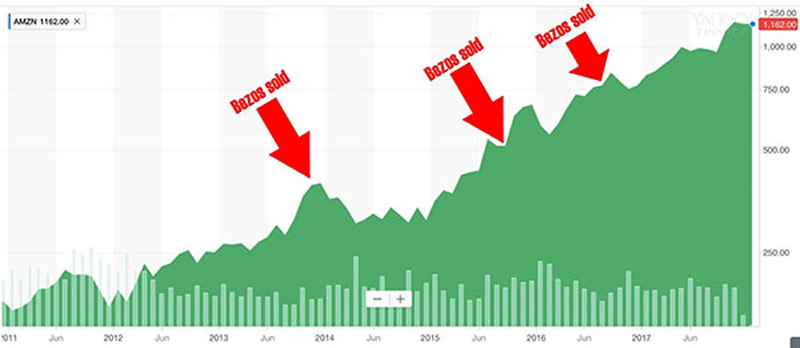

Look what happened with Amazon in the last five years.

Source: Mauldin Economics

In August 2016, CEO Jeff Bezos sold one million shares, raking in over $757 million. While shares moved higher for a few months, they dropped by 12% in October.

The same happened in 2013. In November of that year Bezos sold a million shares, pocketing around $250 million. The stock moved higher for a brief period, before falling almost 30%.

A 35% correction followed his 2015 sale of over a million of sales, too. However, the price didn’t drop to the previous low.

Nevertheless, Bezos appears to know when to sell.

Bezos, Zuckerberg, and Cook aren’t the only executives selling stock at the moment.

This indicates it’s time to be careful.

FAANGs haven’t seen a real correction in almost two years. They’re priced for perfection.

Amazon’s P/E ratio is almost 300. Netflix trades on a ratio of around 185. Facebook looks cheap in comparison on a P/E of “only” 40.

The fact that company insiders such as Zuckerberg, Bezos, and Cook are selling down their holdings only reaffirms to me that we are near the top.

Protect Your Gains

If your portfolio has enjoyed a strong rise this year, consider taking some profits. Right now. Don’t be greedy—rebalance your portfolio.

Look beyond the FAANGs and consider diversifying into international stocks. While the S&P 500 is near its all-time highs, there are many regions across the world that are out of favor.

Europe and the UK are home to several world-class companies that currently trade at attractive valuations.

Consider adding emerging markets exposure. The long-term investment opportunities offered by the world’s developing countries are compelling. China, Taiwan, and India are all growing significantly faster than most developed countries. But decent returns don’t come without risk, so keep a wary eye on trends in those markets.

The good news is that while the US dollar is still strong, today you can buy more for your money.

Another good addition to your recession-proof portfolio would be precious metals. Gold is a “safe haven” asset and can offer protection in times of market volatility.

The vast exchange-traded fund (ETF) universe provides you with access to any of these investments through a simple tracker fund.

Whether your interest is Chinese equities, European dividend stocks, emerging market small caps, or gold, there’s a low-cost ETF available that can get you instant exposure.

Don’t be the investor who regrets not taking profits when the FAANG stocks pull back. Rebalance your portfolio while you still have time.

Free Report: 5 Key ETF Trading Strategies Every Investor Should Know About

From Jared Dillian, former head of ETF trading at Lehman Brothers and renowned contrarian analyst, comes this exclusive special report. If you’re invested in ETFs, or thinking about taking the plunge into the investment vehicle everyone’s talking about, then this report is a clever—and necessary—first step. Get it now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.