UK Base Interest Rate Rise Aftermath Sees Mortgage Competition Slow

Interest-Rates / UK Interest Rates Jan 08, 2018 - 02:23 PM GMTBy: MoneyFacts

Moneyfacts UK Mortgage Trends Treasury Report data (not yet published) reveals a sharp slowdown in mortgage competition, just two short months after the Bank of England increased the base rate.

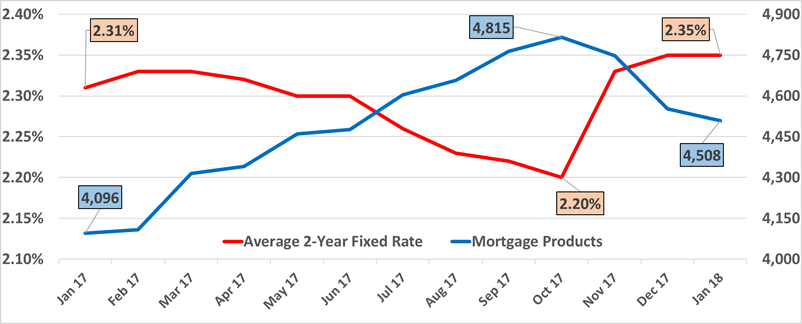

Comparison of Average Two-Year Fixed Rate and Mortgage Products

Charlotte Nelson, Finance Expert at Moneyfacts, said:

“The latest Moneyfacts UK Mortgage Trends Treasury Report shows a steady decline in product numbers since October 2017, when availability reached 4,815 – the highest number of deals since March 2008. However, the effects of the base rate rise, which had been seen as a sure thing, have caused the number of deals to fall by 307 products in just three months.

“On top of this, both the average two-year fixed rate and two-year tracker rate have remained static for the first time on Moneyfacts’ records, now standing at 2.35% and 2.02% respectively. This, coupled with the drop in product availability, clearly signals that competition among providers is starting to slow.

“This could be explained by the seasonality of these figures; however, with 4,500 individual product changes in the month of December alone, providers are clearly happy to update their range in what looks to be a slower month. This suggests that perhaps they are choosing to focus less on their rates, whereas in the past lenders were very rate-driven.

“Back in October 2017, the average two-year fixed rate had fallen to a record low, standing at 2.20%. However, the fact that averages have risen since then suggests that rates may have already reached their minimum, particularly given the base rate rise, which will make it increasingly difficult for providers to maintain rates at record low levels.

“The reduction in availability has been most keenly felt at the higher loan-to-values (LTVs), with 74 products being withdrawn from the 90% and 95% LTV markets since November, not to mention four providers exiting the 95% LTV sector in just two months. This suggests that lenders are simply unsure of how to price these products after the base rate rise.

“Providers may be choosing to wait for the dust to settle from the rate rise in November, to see how the land lies. However, borrowers should not despair as rates are still historically low and a good deal can still be had, but they have to be savvy and shop around to ensure the most cost-effective option is maintained.”

www.moneyfacts.co.uk - The Money Search Engine

Moneyfacts.co.uk is the UK's leading independent provider of personal finance information. For the last 20 years, Moneyfacts' information has been the key driver behind many personal finance decisions, from the Treasury to the high street.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.