Outlook for Crude Oil Prices

Commodities / Crude Oil Jan 10, 2018 - 12:21 PM GMTBy: Donald_W_Dony

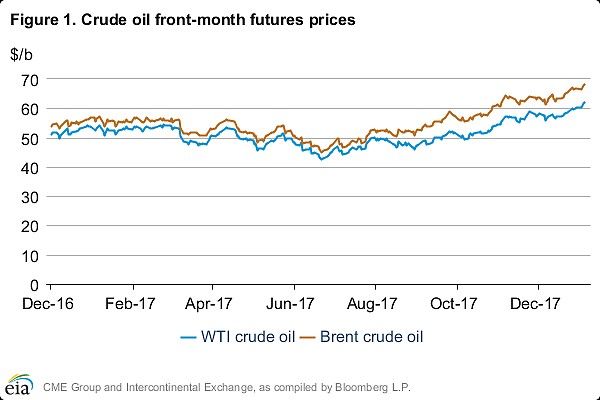

Traders for Light crude oil continue to see higher price levels over the near term. Front-month futures prices reflect their bullish outlook (chart 1).

Traders for Light crude oil continue to see higher price levels over the near term. Front-month futures prices reflect their bullish outlook (chart 1).

The expectation is for $63 to $65 per barrel by late Q1.

The one caveat is that U.S. production appears set to explode later this year.

According to the Energy Information Administration (EIA) nationwide output should average about 10.27 million barrels per day this year and 10.85 million barrels per day in 2019. Both surpassing the old record of 9.6 million set in 1970.

The growth in supply can be contributed to the rapid increase in shale production.

Growth has been mainly situated in the Permian Basin and in Canada's oil sands.

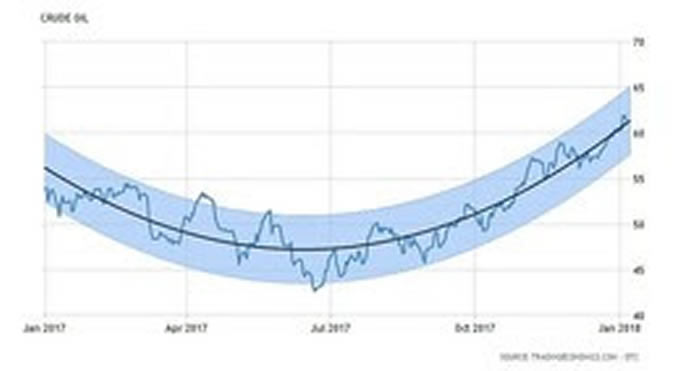

This new flood of production is anticipated to pull the price of WTI down to about $55 to $56 a barrel later this year.

This would suggest a retest of the lower band in the curve model for crude oil (2nd chart).

Bottom Line: Light crude oil price are expected to continue showing price support into late Q1. However, the recent advance is expected to be short-lived and get dampened from overproduction.

We expect Light crude oil prices to remain in the curved projection (chart 2) but to retest the lower levels of $55 to $56 by Q2.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2018 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.