Gold Prices Rise To $1,326/oz as China U.S. Treasury Buying Report Creates Volatility

Commodities / Gold and Silver 2018 Jan 11, 2018 - 01:25 PM GMTBy: GoldCore

– Gold prices rise to $1,326/oz on concerns China may slow U.S. Treasury buying

– Gold prices rise to $1,326/oz on concerns China may slow U.S. Treasury buying

– Equities fell sharply on the report as did Treasurys and the U.S. dollar

– Chinese officials think U.S. debt is becoming less attractive compared to other assets

– Trade tensions could provide a reason to slow down or halt U.S. debt purchases

– U.S. dollar vulnerable as China remains biggest buyer of U.S. sovereign debt

– Currency wars to return as China rejects U.S. hegemony in Asia

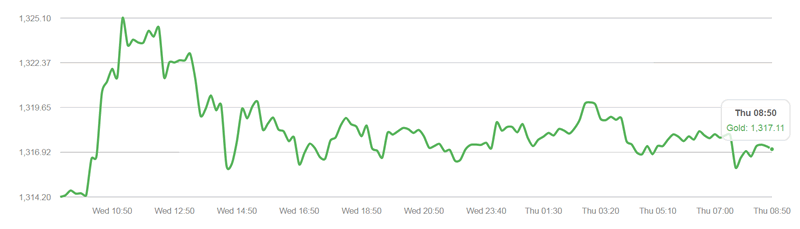

Gold prices in US dollar (GoldCore)

Gold prices rose yesterday, reaching their highest level in four months as the dollar fell just after a report that Chinese officials had encouraged slowing or halting purchases of U.S. Treasury securities.

The greenback fell against all major currencies and especially gold after the report.

Spot gold prices rose 1.2% from session lows of $1,310/oz to session highs of $1,326.56/oz prior to falling back and closing in New York at $1,317.40/oz where it remains in late morning trading in London.

U.S. Treasury yields jumped to 10-month highs following a Bloomberg report that Chinese officials have recommended China gradually sell or halt their buying of U.S. debt.

China is likely to stop buying U.S. Treasurys, the question is when, and when it happens it will have major repercussions for U.S. monetary policy. It will greatly hamper the Federal Reserve in reducing its bloated balance sheet and may force the Fed to begin QE again which would be very positive for gold.

Chinese relations with the U.S. remain frayed and Trump’s aggressive economic and military policies are likely to see a monetary response from China. As China-U.S. relations deteriorate, so too will currency wars return as China rejects U.S. hegemony in Asia.

The dollar and financial and monetary dominance of the U.S. is increasingly at risk. And as monetary and economic tensions between the struggling superpower and the emerging superpower deepen – a gold-backed yuan becomes more likely.

If China were to partially back its yuan with gold it would require a gold price of $64,000 per ounce, 50 times gold bullion’s price today, according to research from respected Bloomberg Intelligence (see below).

Gold Prices (LBMA AM)

11 Jan: USD 1,319.85, GBP 978.14 & EUR 1,104.45 per ounce

10 Jan: USD 1,321.65, GBP 976.96 & EUR 1,103.31 per ounce

08 Jan: USD 1,314.95, GBP 972.01 & EUR 1,102.19 per ounce

08 Jan: USD 1,318.80, GBP 974.33 & EUR 1,099.09 per ounce

05 Jan: USD 1,317.90, GBP 973.40 & EUR 1,094.25 per ounce

04 Jan: USD 1,313.70, GBP 969.77 & EUR 1,090.24 per ounce

03 Jan: USD 1,314.60, GBP 968.20 & EUR 1,092.96 per ounce

Silver Prices (LBMA)

11 Jan: USD 17.01, GBP 12.64 & EUR 14.24 per ounce

10 Jan: USD 17.13, GBP 12.64 & EUR 14.27 per ounce

09 Jan: USD 17.05, GBP 12.60 & EUR 14.30 per ounce

08 Jan: USD 17.17, GBP 12.68 & EUR 14.33 per ounce

05 Jan: USD 17.15, GBP 12.66 & EUR 14.24 per ounce

04 Jan: USD 17.13, GBP 12.64 & EUR 14.20 per ounce

03 Jan: USD 17.12, GBP 12.63 & EUR 14.25 per ounce

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.