Is This The Long-Awaited Gold Break-Out – Or Just Another Paper Market Head Fake?

Commodities / Gold and Silver 2018 Jan 14, 2018 - 05:42 AM GMTBy: John_Rubino

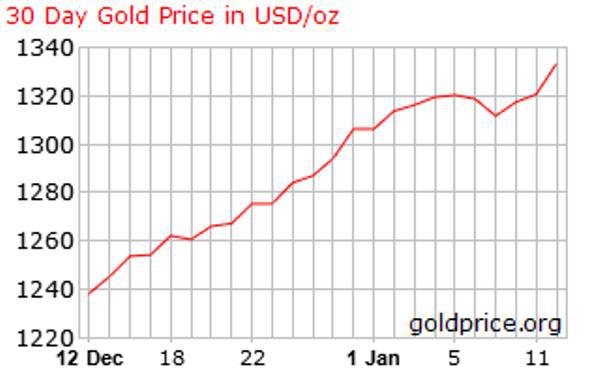

That was fun. Since mid-December gold has behaved like a tech stock, jumping from $1,240/oz to $1,337 and carrying a long list of gold mining stocks along for the ride.

Now everybody’s asking the same question: Is this finally the start of the long-overdue run at gold’s (and silver’s) 2011 record high, or just a case of futures speculators once again panic-buying themselves into an untenable long position, only to be fleeced by the big banks that dominate the paper markets?

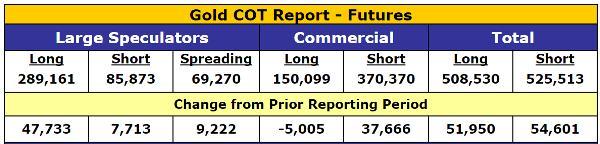

The commitment of traders (COT) report is not encouraging. In the current rally, the speculators (who are, remember, usually wrong at big turning points) have jumped back in with both feet and are now enthusiastically long while the commercials (usually right at big turning points) are once again aggressively short.

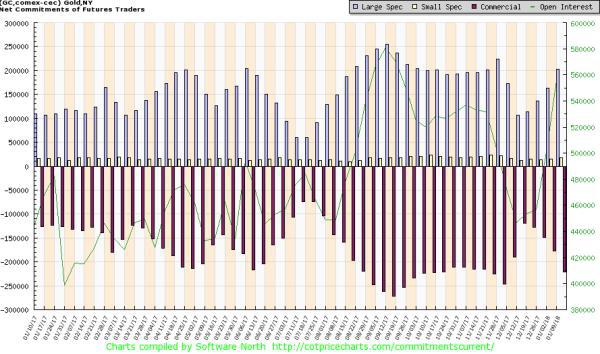

The next chart shows this visually. When the two columns converge, that’s bullish for gold. When they diverge that’s bearish. Favorable conditions of early December have quickly morphed back to bearish.

Looking at just this one indicator, it would be reasonable to assume that gold’s all-too-brief run is about to end. But on the other side of this equation is the certainty that physical demand will eventually swamp these paper games and send gold and silver up in a bitcoin-worthy arc to their intrinsic values of $5,000/oz and $100/oz, respectively.

Therein lies the gold-bug’s dilemma. Precious metals will bounce around aimlessly – until they don’t – but the phase change won’t be obvious until after the fact. With that in mind, here are three possible approaches:

- Avoid this asset class until a sustained uptrend is clearly established. That means waiting for, say, $1,500/oz before jumping in. So you give up a few hundred dollars an ounce in return for avoiding the pointless back-and-forth, but in the end still triple your money. Not bad.

- Keep adding a little at a time. Each month buy a few silver coinsor a few more gold mining shares and tune out the noise (such as this article), safe in the knowledge that eventually the dysfunctional global monetary system will come undone and capital will pour into the relative handful of safe haven assets like gold and silver, making the highs and lows of the before-times completely irrelevant. This is the best way to deal with incomplete knowledge of the future, and is therefore what most people should do.

- Assume that this is it — that the current uptrend will soon go parabolic — and jump into precious metals with both feet. If it works, it’s one of those life-changing bets that everyone wishes they had the guts to make. If not, well, at least the downside is limited at this point.

The longer this goes on, the more attractive the third option becomes.

By John Rubino

Copyright 2018 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.