Bubble Watch: Both the Currency Markets and Bonds Markets See Inflation Coming

Interest-Rates / US Bonds Jan 14, 2018 - 05:48 PM GMTBy: Graham_Summers

If you want to make money investing, you first need to understand the structure of the asset classes in our current financial system,

Everyone likes to go bonkers over stocks, but the reality is that the stock market is in fact one of the smallest and least liquid markets on the planet. All told, US stocks are roughly $26 trillion in market cap.

By way of contrast, the US debt markets (Treasuries, corporate, municipal, local, etc.) is well north of $60 trillion.

And the currency markets (which cannot be accurately measured because every trade involves a currency pair) trades over $5 trillion per day.

Put simply, currencies are the “smartest” money, followed by bonds, and then finally stocks. So when a seismic change takes place, currencies and bonds pick up on it LONG before stocks do.

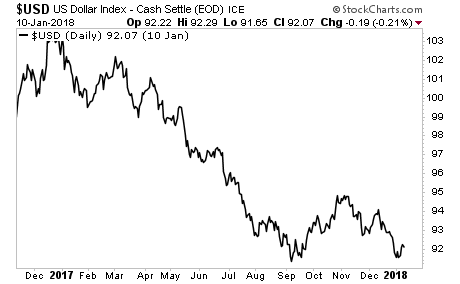

With that in mind consider that the $USD is collapsing, having gone almost straight down for 12 months.

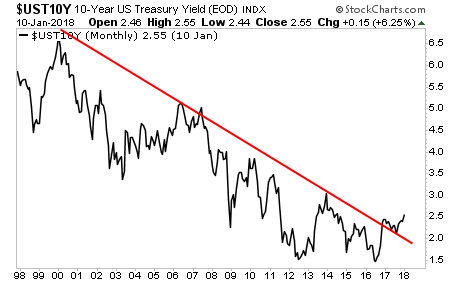

Now consider that the US Treasury bond market, is falling in price, resulting in yields spiking above their 20-year downtrend.

BOTH of these assets are forecasting the same thing: INFLATION.

Inflation forces the $USD DOWN and bond yields UP.

So we’ve got both the “smart” money and the SMARTEST money forecasting the same thing.

And it’s going to blow up the Everything Bubble.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s to come when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.