Upside Risk for Gold in 2018

Commodities / Gold and Silver 2018 Jan 19, 2018 - 02:44 PM GMTBy: Arkadiusz_Sieron

Black swans are very surprising and rare events. As they are beyond the realm of normal expectations, it is impossible to predict them. However, analysts do not care about such details and they outdo each other in forecasts. Our favorite is the list of ten outrageous predictions published by the Saxo Bank. The risk events include: the loss of Fed’s independence for the U.S. Treasury, the plunge in Bitcoin prices as government strike back, the abandonment of the yield curve control by the Bank of Japan, or the harsh division between the old and new EU members.

Black swans are very surprising and rare events. As they are beyond the realm of normal expectations, it is impossible to predict them. However, analysts do not care about such details and they outdo each other in forecasts. Our favorite is the list of ten outrageous predictions published by the Saxo Bank. The risk events include: the loss of Fed’s independence for the U.S. Treasury, the plunge in Bitcoin prices as government strike back, the abandonment of the yield curve control by the Bank of Japan, or the harsh division between the old and new EU members.

What do we think about such risks? Well, as Janet Yellen put it at her last scheduled press conference as the Fed Chair, “I can always give you a list of potential troubles.” This is why it is always good idea to have some precious metals in the investment portfolio, as gold is like insurance against tail risks. And it is good to be open to many scenarios. However, we see such predictions as interesting thought experiments, but unlikely to realize (although who knows the fate of Bitcoin?).

But there are more plausible risks, which could materialize in 2018, supporting or even boosting the price of gold. The most important are as follows: the U.S. political risk, the correction in the U.S. stock market, and significant uptick in inflation. Let’s analyze them now.

First, political uncertainty is likely to rise next year. We do not mean the threat of conflict with the North Korea or the unknown Brexit process – markets proved to be resilient to these geopolitical risks. We mean here the potential breakthrough in the Mueller investigation into alleged interference by Russia in the latest U.S. presidential election. Another issue is that Democrats may win in the U.S. midterm elections. In both cases, the position of the Republicans would be weakened, which could worsen the prospects of implementing Trump’s pro-growth agenda. As a result, the investor sentiments towards the U.S. stock market should turn more negative, making safe-haven assets such as gold more reasonable investments. However, neither Trump’s blunders nor the accusations of cooperation with the Russians have made gold soar so far. The tax bill has already been passed – and midterm elections will not take place until November – until then the Congress has some time to adopt an infrastructure spending program, which, by the way, may find bipartisan support.

So what about the stock market crash? Well, the correction definitely may occur, as corrections should normally happen from time to time. But the crash is another kettle of fish. It is true that valuations are high. But it does not necessarily mean that equities are overvalued or that they will drop in 2018, especially with the current environment of low interest rates, low inflation, accelerating global growth and rising earnings. With a still cautious Fed and its gradual tightening cycle, the rally in the stock market may continue. Having said this, investors should beware of investing in equities, as the stock prices have already been bid up based on future business expansions. With historically low volatility and compressed risk premiums, some external shocks may trigger a correction, although market sentiment does not support the view of an overbought market and upcoming market crash.

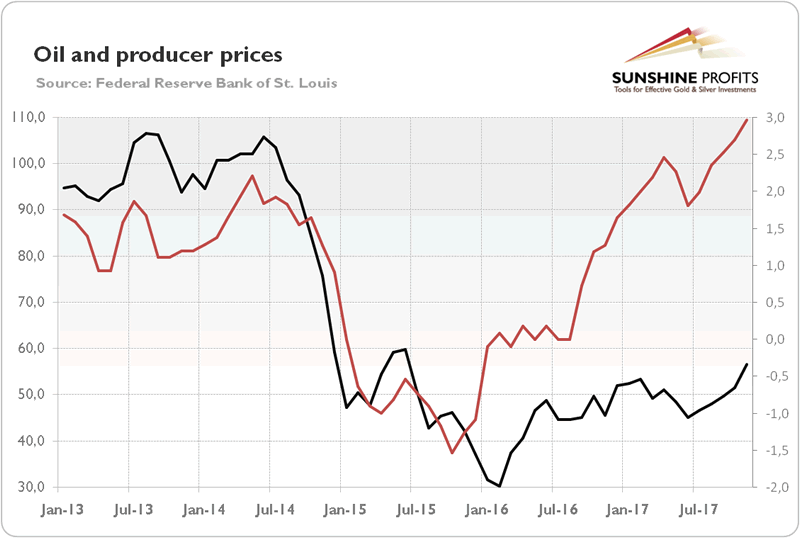

And finally let’s examine the possibility of a significant rise in inflation. On the one hand, inflationary pressure should increase somewhat in 2018, due to the tightening labor market, rebound in oil prices and producer prices (see the chart below).

Chart 1: Producer prices (Producer Price Index by Commodity for Final Demand, red line, right axis, % change y-o-y) and crude oil prices (WTI, black line, left axis) over the last five years.

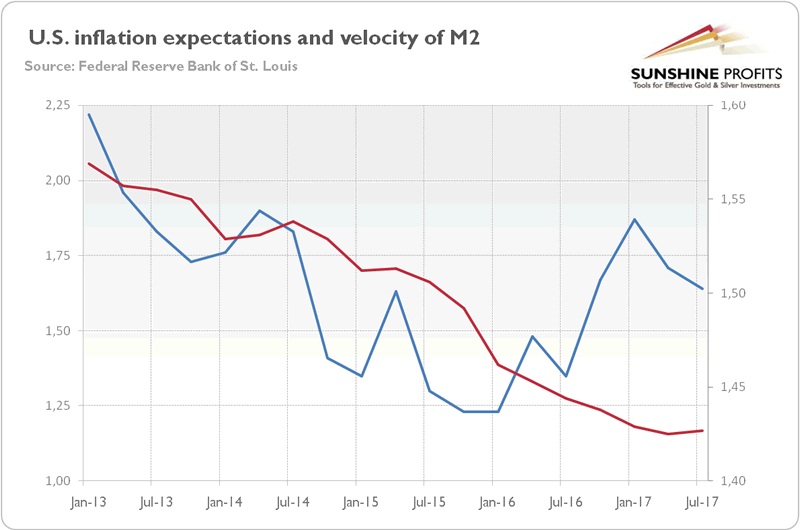

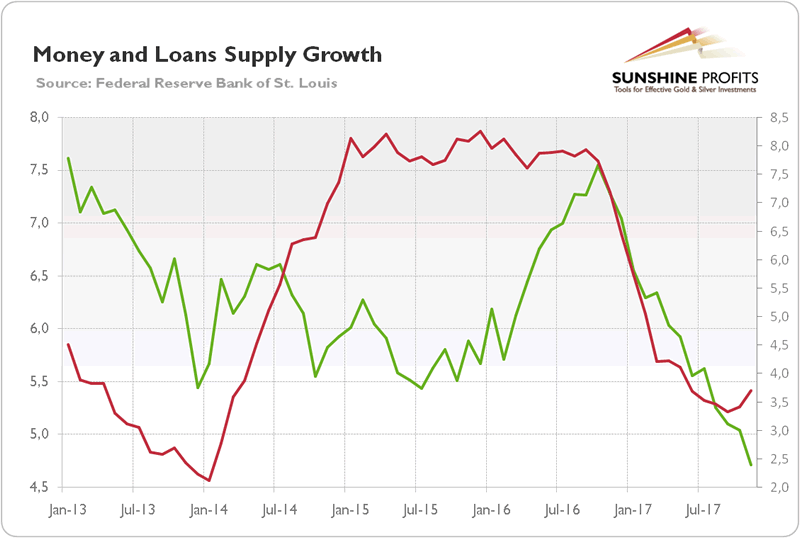

On the other hand, inflationary expectations do not signal a significant jump in inflation, as one can see in the next chart. And it’s not surprising, given the downward trend in money velocity, money supply, and credit growth, as the charts below show.

Chart 2: Inflationary expectations (5-year breakeven inflation rate, blue line, left axis) and velocity of M2 money supply (red line, right axis) over the last five years.

Chart 3: Money supply growth (M2, % change y-o-y) and the bank loan growth (% change y-o-y) over the last five years.

Hence, although there might be a pickup in inflation in 2018, the rise is likely to be only moderate. It is bad news for the gold market, as the yellow metal is perceived as inflation hedge. It is not always true, but high inflation helps to keep real interest rates low. Without significantly accelerating inflation, real interest rates have more room to rise, which would be negative for the bullion.

Last but not least, investors should remember that there are not only upside risks, but also downside risks for the gold market, such as the sudden surge in the real interest rates or harsh appreciation of the U.S. dollar. Naturally, they are not imminent from the fundamental point of view, but the Eurozone economy remains vulnerable (think about non-performing loans in some southern banks or the crisis over the Catalonia) – if another crisis burst in the Eurozone, the EUR/USD will decline, dragging gold prices down.

Summing up, there are some upside risks for the gold market, which could materialize in 2018. We do not consider them as likely, but the next year is far from being certain. We expect the boom to continue, but stock valuations are at preposterous levels and the risks are rising. And there is actually one more potentially bullish factor for the yellow metal. If the bear market in the greenback continues, the price of gold may rise, or remain in a sideways trend, at least. Will that happen? We will analyze it in the next part of this edition of the Market Overview.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.