CAT Stock Bouncing after JPM Upgrade How High and How Long Can This CAT Jump?

Companies /

Corporate News

Jan 23, 2018 - 11:01 AM GMT

By: EconMatters

Caterpillar’s (CAT) stock price touched an all-time high of $172.99 on Jan 16 and has drifted lower since. This price action took place after upgrade from JP Morgan a week ago. The stock jumped 2% in the day JPM report came out on Jan. 8.

Shares of Caterpillar have already climbed almost 80% over the past 12 months while the S&P 500 advanced about 20% during the same period. In fact, Caterpillar was one of the top five performing stocks of the Dow Jones Industrial Average (DJIA) in 2017. Caterpillar, along with Boeing, have helped boost DJIA to record highs over the past several months.

From some of the upgrade analysis you can tell how the investing community has lost almost all common sense perspective in this central banks fueled market rally. For example, instead of top or bottom line growth potential, UBS bumped up CAT’s target price by 16% a week before JPM noting the tax bill could provide around $750 million for share buybacks. When has share buyback even become an element in stock recommendation? Does that suggest if Caterpillar decides to invest the extra cash for business, UBS would give it a downgrade?

“10-year Upcycle”

JPM at least came up with a stronger argument. According to JPM, the primary driver of CAT shares “in the coming years” is the Republican tax reform bill. Since then, several other investment houses came out with higher price targets for Caterpillar also citing GOP tax bill as the catalyst.

JPM argues that the global economy as a whole has entered into a "10-year upcycle" in commodities. Production of iron, coal, copper, etc. is rising, and bringing prices along with it. In JPM’s estimate, we're currently entering only year two of this upcycle. That means Caterpillar has nine more years to benefit from the “10-year upcycle”.

Party like It’s 2005

According to JPM, the construction industry could absorb as much as 233,000 annual unit sales of heavy mining equipment, matching peak sales at the top of the last upcycle in 2005.

I’m not sure why investors should get all excited over the possibility of the entire construction industry equipment unit sales back to the 2005 levels? Not to mention it is uncertain how much of the 233,000- unit-sales pie CAT would have?

What’s Really Going on at CAT?

Now let’s take a look at what’s happening at Caterpillar to actually warrant this exuberance.

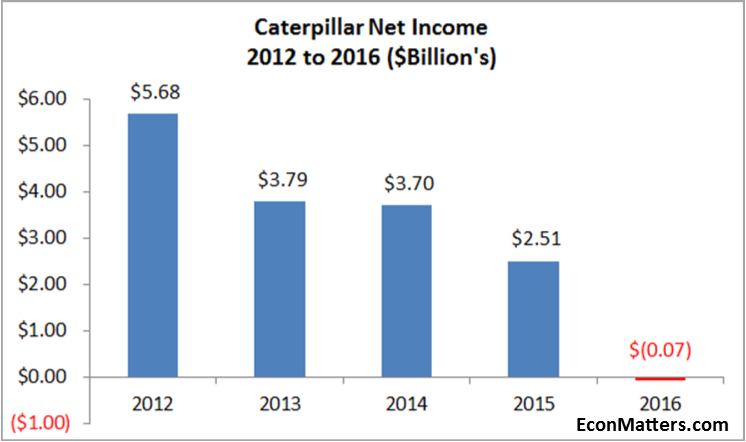

2016 was a five-year low point for Caterpillar. Its sales were falling for four straight years. The company suffered a 36% drop in earnings in fiscal 2016 citing weak end-user demand in most of the industries it serves, including construction, oil and gas, mining and rail.

Caterpillar managed to rebound in 2017. In 3Q 2017, trailing-12-month sales increased 9% from their 2016 trough, and free cash flow grew 63%. It is a moderate improvement considering the easy comp's to the 2016 low’s, but enough to impress investors to think Caterpillar has delivered a successful turnaround.

By the way, I forgot to mention

federal agents raided Caterpillar headquarters last March as part of the government investigation into the company’s alleged tax evasion by shifting corporate profits to a subsidiary in Switzerland.

PE at 112, Really

Caterpillar’s Price Earnings (PE) Ratio has gone from 8.81 in 2006 to currently 114, compared to around 26 for the average of S&P 500. Normally, the PE of industrial manufacturers such as Caterpillar should have a PE in single digits to the mid-20's range.

Remember the core business of Caterpillar is making industrial equipment such as tractors, which is a mature sector. And CAT is not a sexy tech stock with tremendous growth potential justifying a high-flying PE multiple. Even Facebook (FB) only has a PE of 35 which is only 30% of what Caterpillar commands.

More Like 10-year Tightening Cycle

Furthermore, remember we are actually in the beginning of central banks’ tightening cycle. The US Fed helicopter is ahead of the monetary easing curve after the 2008 financial crisis, and again is ahead of the coming global tightening cycle. Expect other central banks to eventually follow suit (it is safe to say within the next 10 years). A business cycle typically lasts about 8-10 years. The current business cycle began from the 2008 financial crash/monetary easing and has already pushed into uncharted territory. I’m not sure how JPM could realistically model the “10-year upcycle” projection given the current lofty valuation on almost all asset classes and the increasingly high risk of war and recession.

Technical and Cash Trading

How could a scandal-ridden tractor-making company become such a darling for investors? Well, that’s just one indication that markets, along with investors, are not behaving normally and rationally.

Zero Hedge reported how central banks like Swiss National Bank (SNB) made $55 Billion last year by purchasing foreign stocks and bonds. This is equivalent to massive hedge funds backed by various governments manipulating the markets for its own agenda. It is like an addictive drug high that everybody is on, but eventually the high will come to a very nasty crash that investors refuse to acknowledge.

In this irrationally crazy market where

a name change incorporating the word “blochchain” could rescue a penny stock from being delisted on Nasdaq, company fundamental analysis and macro event trading have become all but useless traps. The suitable trading style that I believe could survive in this current environment is technical and momentum cash only trades based on solid research.

Who will be left holding the bag? Everybody, after a rude awakening by the sudden burst of this unprecedented bubble that would make 1929 a cake walk.

Disclosure: At the time of this writing, the author and EconMatters do not have position in the aforementioned stocks. Views and opinions are author's own.

By EconMatters

http://www.econmatters.com/

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2018 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Caterpillar’s (CAT) stock price touched an all-time high of $172.99 on Jan 16 and has drifted lower since. This price action took place after upgrade from JP Morgan a week ago. The stock jumped 2% in the day JPM report came out on Jan. 8.

Caterpillar’s (CAT) stock price touched an all-time high of $172.99 on Jan 16 and has drifted lower since. This price action took place after upgrade from JP Morgan a week ago. The stock jumped 2% in the day JPM report came out on Jan. 8.