Government Shutdown Ends – Markets Ignore Looming Debt and Bond Market Threat

Interest-Rates / US Debt Jan 23, 2018 - 03:36 PM GMTBy: GoldCore

– U.S. Senate pass a temporary spending plan through Feb. 8 to end shutdown

– U.S. Senate pass a temporary spending plan through Feb. 8 to end shutdown

– Markets shrug off both government shutdown and re-opening

– Markets, government and media ignoring worsening US debt position

– Gold responding positively to U.S. dysfunction, rising US Treasury yields & weaker dollar

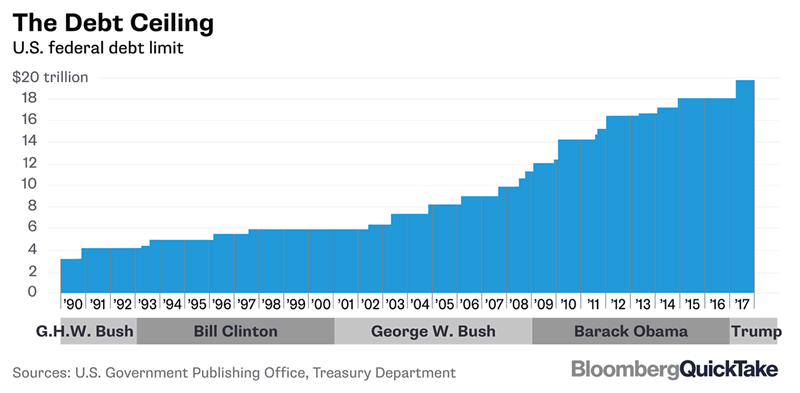

– U.S. government national debt is $20.6 trillion and increasing rapidly

– ‘Bonds, like men, are in a bear market’ – Bill Gross

Editor: Mark O’Byrne

Investors “irrational exuberance” continues after the largely unexpected U.S. government shutdown saw stocks continue on their merry way higher. After the government shut down, U.S. stocks rose and as the U.S. government reopened, U.S stocks rose again.

During the shutdown there had been little reaction from the markets, although gold did tick up on the back of a weaker dollar. The US dollar index struggled to steer clear of a recent three-year low against a basket of currencies and the yield on the 10-year Treasury hit its highest since level since September 2014.

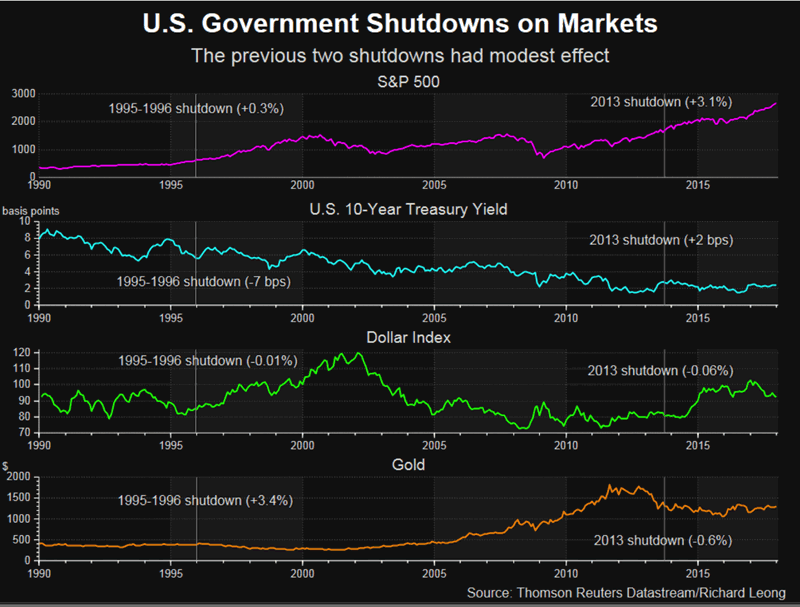

This is not surprising when one considers that in the previous two government shutdowns, markets also remained calm.

This is the twentieth US government shutdown in forty years.

This latest one was priced in long before it happened. Look how (little) markets have reacted to other events which were so expected to tip them over the edge: since Trump’s win – the S&P 500 is up 35% since that fateful day.

The 2013 shutdown? Sure, it initially triggered a sharp fall in the S&P 500 but it more than recovered by the time the shutdown came to an end. In fact, U.S stocks ended 2013 with near 30% gains.

Upon the announcement of the latest shutdown deal U.S. stocks advanced as each of Wall Street’s main indexes touched a record intraday level.

Debt ceiling can be moved but not ignored

Just like the other shutdowns markets were practically yawning at this latest display of dysfunction by the US government.

But this one should have been different. Previously we have not seen a US debt position in such bad shape nor have previous shutdowns happened on the brink of a U.S. bond bear market.

Currently, the U.S. government national debt is $20.6 trillion and increasing rapidly. The Federal Debt Ceiling was extended by Trump in December once again. Despite this increase it will need more borrowing authority to keep operating past April.

For now, the government have merely patched over a big hole which will still be there in February when the short-term deal ends and certainly in April when the cash runs out.

Should the markets begin to connect another possible government shutdown and a default then investors will begin to feel nervous which bodes well for gold.

The last time we saw a debt-ceiling and government showdown risk come together was in 2011. This prompted rating agency Standard & Poor’s to strip the US of its top-notch AAA-rating.

In order to avoid this happening again Congress may raise the debt ceiling before it becomes a binding constraint in the next round of negotiations. Once again kicking the can down the road and storing up much more financial pain for the U.S. in the medium and long term.

What happens if they don’t raise the debt ceiling? The U.S. could default on debt payments and bond yields would surge causing the cost of borrowing to soar as government debt loses its sterling credit rating.

The Bond Bear is circling

Bond yields are, listening to many commentators, nothing to be concerned about. However, some of the smartest money in the bond market is now warning. ‘Bond king’ Bill Gross believes the bond bear market is here and we should all be prepared.

As stated at the beginning, the yield on the 10-year US Treasury was at its highest level in three years, yesterday.

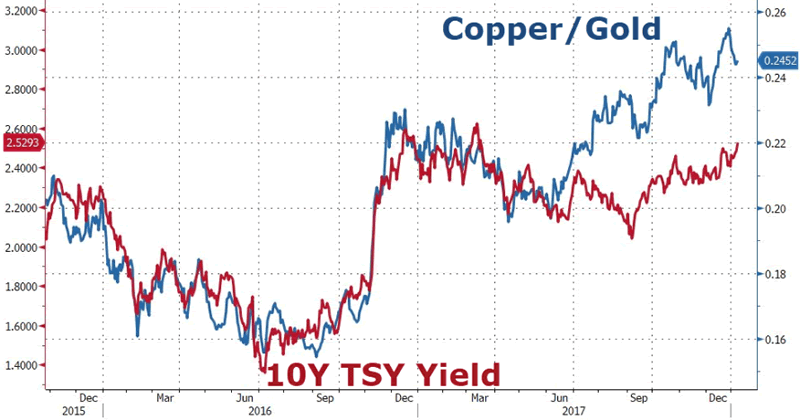

Earlier this month Gross told clients he expected the 10-year yield to rise above 2.75% by the end of this year. Last Friday, the 10-year Treasury yield was up 4 basis points at 2.65%. A bond-bear market would be signalled, according to Gross, when 10-year yields persistently above 2.4%.

These jumps are not particularly significant in the long-term, however for the US economy they could be damaging. The Treasury yield’s move out of a lower long-term range may lure money away from the stock market. It also could mean higher borrowing costs for U.S. companies.

The 10-year itself is important to pay attention to, because it influences so many business and consumer loans, including mortgages.

Generally increased US Treasury yields give investors two signals: the first, that the demand for US Treasuries is falling and secondly that that a higher inflationary environment is just around the corner which would mean higher interest rates and increased stock market volatility.

Bond investor Jeff Gundlach has previously highlighted a breakthrough of 2.63% as the point in which we may see a bond ‘sell-off’. As Zerohedge remind us, Gundlach has been calling out higher bond-yields for a while, as copper has broken out relative to gold:

Bond traders generally may not be so concerned with the US government shutdown affecting yields (for now), what they are concerned with is that the European Central Bank and the Bank of Japan could be more aggressive about ending monetary stimulus than previously assumed.

They are also looking at the impact of Trump’s tax package. As Gross pointed out the US economy could grow at a 5% annualized rate for several quarters as Trump’s tax cuts and resulting deeper budget deficits began to feed into growth and up pressure on inflation.

As MarketWatch summarised:

A 5% growth rate would suggest a 3.60% yield on the 10-year Treasury note in 2018, Gross said, based on his observation that since the financial crisis in 2007-2009, the yield for the benchmark bond sat on average 1.40 percentage points below GDP growth.

Overall a bond bear market is excellent news for gold and we are beginning to see this already with gold over 2% higher year to date and nearly 8% higher since the Fed in mid December.

Gold to thrive on US dysfunction, fiscal uncertainty and Trump

Ultimately, despite a seemingly ‘meh’ response from the market, everything that is happening in the US (and wider global economy) is excellent news for gold.

The precious metal thrives on the uncertainty surrounding high government debt in the short-term and benefits from its long-term damage which leads to more money-printing (the Fed creating dollars and buying Treasuries).

Arguably one of the most interesting things to watch following this shutdown will be any damage to Trump’s reputation. He won the election on the promise of his skills as a deal-maker. This is yet another blow to whatever reputation he had in this regard.

Trump’s lack of ability to make a deal does not bode well for the vital negotiations that will be coming up for both the debt ceiling and the next government shutdown. In all likelihood they will be causing problems in tandem.

If Trump is not able to secure a deal this will be bad news for the U.S. economy and the markets are unlikely to take it so well. However, even if Trump is able to somehow bypass this economic fallout it does not mean that the situation has been solved.

Bond yields are likely to continue rising and the dollar is vulnerable. Smart money investors are slowly losing confidence in the paper assets and fiat currencies that have been pumped and debased – particularly in the last decade.

The arrival of the bond bear market and the complacency of the markets regarding the debt ceiling and still surging U.S. national debt is a signal that gold is ready to resume its bull market.

Gold Prices (LBMA AM)

23 Jan: USD 1,337.10, GBP 959.10 & EUR 1,091.74 per ounce

22 Jan: USD 1,334.15, GBP 959.12 & EUR 1,087.87 per ounce

19 Jan: USD 1,335.80, GBP 960.17 & EUR 1,087.74 per ounce

18 Jan: USD 1,329.75, GBP 961.14 & EUR 1,088.40 per ounce

17 Jan: USD 1,337.35, GBP 969.45 & EUR 1,092.48 per ounce

16 Jan: USD 1,334.95, GBP 970.38 & EUR 1,091.32 per ounce

Silver Prices (LBMA)

23 Jan: USD 16.98, GBP 12.19 & EUR 13.87 per ounce

22 Jan: USD 17.04, GBP 12.25 & EUR 13.90 per ounce

19 Jan: USD 17.04, GBP 12.27 & EUR 13.89 per ounce

18 Jan: USD 17.09, GBP 12.31 & EUR 13.96 per ounce

17 Jan: USD 17.21, GBP 12.49 & EUR 14.10 per ounce

16 Jan: USD 17.10, GBP 12.43 & EUR 13.99 per ounce

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.