A few words on the Gold Sector

Commodities / Gold and Silver 2018 Jan 24, 2018 - 03:38 PM GMTBy: Gary_Tanashian

As the long-term interest rate Amigo continues upward, the anti-USD ‘inflation trade’ continues onward and more and more gold bug writers emerge from the woodwork, it is time for a little antidote to the inevitable pitches and hype to come.

As the long-term interest rate Amigo continues upward, the anti-USD ‘inflation trade’ continues onward and more and more gold bug writers emerge from the woodwork, it is time for a little antidote to the inevitable pitches and hype to come.

Everything is playing to script and with this little pullback to a higher low in the miners being resolved in the favored direction, the writer bugs are going to further their bullish message and try to get more reader bugs to follow their guidance. But absolutely nothing has changed.

We caught the seasonal rally amid much disgust by writer and reader bugs, and it has simply not yet concluded. Nothing more to read into it than that. While I think 2018 is likely to see the confirmation of a new bull market, a selling opportunity is probably upcoming amid gold bug bravado and pomp (oms) because the fundamentals are not yet in order.

Everybody’s gonna be touting inflation when yields hit their limiters (again, ref. Amigo #1), and run away inflation is not the proper lock & load fundamental backdrop. The miners can go a long way as inflationist bugs tout gold, silver, oil, copper and resources of all kinds. But the other stuff is cyclical and the best case for gold mining is counter-cyclical.

Anyway, here is some droning from NFTRH 483 (1.21.18)…

Gold has obviously been bullish vs. both the US dollar and long-term Treasury bonds and each of those conditions is indicative of an ‘inflation trade’. Please see the weekly Gold-Eagle article to be linked at nftrh.com later today for more on the sector and why I think its rally is nearing its end, if it is not already complete.

While said ‘inflation trade’ is ongoing as part of the risk ‘on’ macro party, the gold sector is an also ran. If you’d like self-reinforcing gold bug feel good sentiments you can find them aplenty out there now, and that is part of the problem. The bugs are on the tout.

I won’t play that game. The fact that the gold herd is getting more bullish now only reaffirms that profit taking is a good idea, with the question being did the rally end last week or is it going to take a final leg up per the still-intact uptrend?

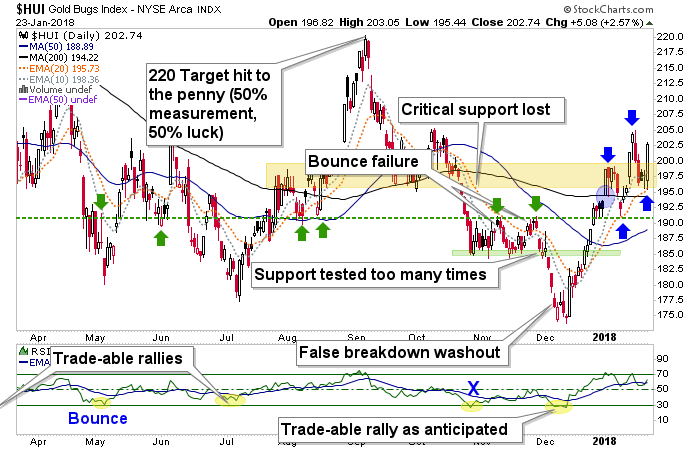

So as noted in Thursday’s update, HUI remains on its uptrend from December and thus far holds a higher low. Another leg up (or 5th wave) could be the best yet and really cement gold bugs into a full bull view. A loss of the SMA 200 and the January low brings on a stern warning that the rally ended at the 1st target of 205 (ultimate target near <omitted>).

<inserting an updated, and more detailed chart (than the one in NFTRH 483), which tells the story of the index since we caught the top at 220, got frustrated w/ a couple of failed bounce attempts, caught the sentiment washout and seasonal bottom in December and began managing the ongoing rally and its intact series of higher highs and higher lows>

Right or wrong, I am not going to mince words because I’ve seen the cheerleaders become most vocal at exactly the wrong time too many times over the years and I’ve sometimes regretted being delicate, in hindsight.

Among good, sharp analysts the sector is also populated by charlatans, pitch men, people who desperately want you to be bullish because they know that emotion sells (there’s no fever like gold fever) and finally, non-analysts pretending to be analysts. I believe that many regular people who want to be bullish on gold feel in their hearts the reasons why; they abhor dishonesty and they respect integrity. But that is what the gold cult “community” uses as currency. It sells good (vs. evil). But these are the financial markets and there is nothing inherently good about them. They are what they are.

I see no reason to change the play now. The fundamentals have not improved appreciably as the ‘inflation trade’ moves forward. The seasonal factor is now mature and the pompoms are no longer afraid (or embarrassed) to tout gold. I think 2018 will be good for gold, but a selling opportunity may well come first. And this would be it.

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.