Bitcoin’s $10,000 "Line in the Sand"

Currencies / Bitcoin Jan 31, 2018 - 04:08 PM GMTBy: EWI

The cryptocurrency's trends continue to be fueled by investor psychology

On January 23, Bitcoin fell below $10,000. That's the second time in recent days that prices dipped below this psychologically important threshold. The headlines picked up on the drama:

"Bitcoin tumbles below $10,000 and is now down 25% on the year..." (CNBC, Jan 23)

That same article also observed:

"No specific driver was immediately apparent behind Tuesday's decline..."

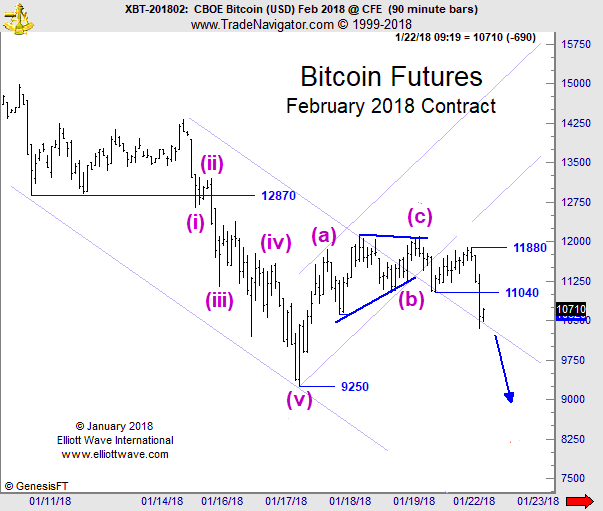

The day before the drop, our Cryptocurrency Pro Service posted this chart and a bearish forecast (partial Elliott wave labels shown):

Bottom Line: Multiple [Elliott] wave counts warn XBT is headed lower.

(Last Price 10710): The decline below 11,040 signals that the recent correction is likely complete. There are two ways to count it. Wave iv might have ended... or we can count [a still-unfolding wave iv triangle]... Both [wave counts] warn the risk is to the downside...

Early the next day, Bitcoin fell to $9,910. Here's what the price action has looked like since (partial Elliott wave labels shown):

Keep in mind that sideways market moves are almost always corrective. Meaning that, most likely, Bitcoin's "wave iv" our January 22 analysis mentioned above is still developing -- as an Elliott wave pattern called a "contracting triangle."

If you know Elliott, you know exactly what this wave labeling implies.

[FREE REPORT] Bitcoin: The Greatest Bubble of All TimeAs you read the news that Bitcoin dropped "below $10,000 with $36 billion of value wiped off in a day..." (CNBC, Jan. 17), you're probably asking, "What's next for Bitcoin and other cryptos?" Our new, free report gives you some much-needed answers. |

This article was syndicated by Elliott Wave International and was originally published under the headline Bitcoin’s $10,000 "Line in the Sand". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.