US Treasury Yields Inflating?

Interest-Rates / US Bonds Feb 01, 2018 - 10:42 AM GMTBy: Submissions

Fundamentals

Fundamentals

The Herd is running into one direction. It is from bonds into stocks. The latest BAML Fund Manager report showed an intresting picture. Extreme flows have been recorded over the past couple of months relative to the past 12 years. That came on top of the fact that flows were at elevated levels throughout the past 14 months already.

The investment reasoning behind that gets confirmed by economic fundamentals. The US economy is expanding, retail sales have risen to all-time highs, unemployment is at a multidecade low, and new home sales look as good as they have never looked for the past 10 years.

Moreover well known Names from the fixed income arena have called a bond bear market as started! Jeffrey Gundlach and Bill Gross for example see the rally as ended in 2016.

Meanwhile, the Daily Sentiment Index for US Treasuries has been free falling. It has reached at a figure of 14% extreme territory among bond bulls. This means that the entire market is expecting higher rates. What can possibly go wrong?

Markets do not take on the path of a straight line. There are certainly pullbacks! More importantly, there are business cycles. Nobel Laureate Robert J. Shiller published an artricle in the New York Times this week. His key takaway is that the current business cycle has been lifted on consumer confidence. Moreover he identifies confidence levels as elevated and due for a shift at some point. He concludes that the shift in sentiment will have negative consequences for the economy. It should be noted at this point that Shiller is not known for being married to a permanently bearish point of view.

Business cycles are nothing new obviously. It is not a question if the current cycle ends but rather when it ends. A business cycle turn will certainly not imply higher rates! Rates are likely to be low during economic downturns. We therefore see the stage being built for a contratian investment setup.

Technicals

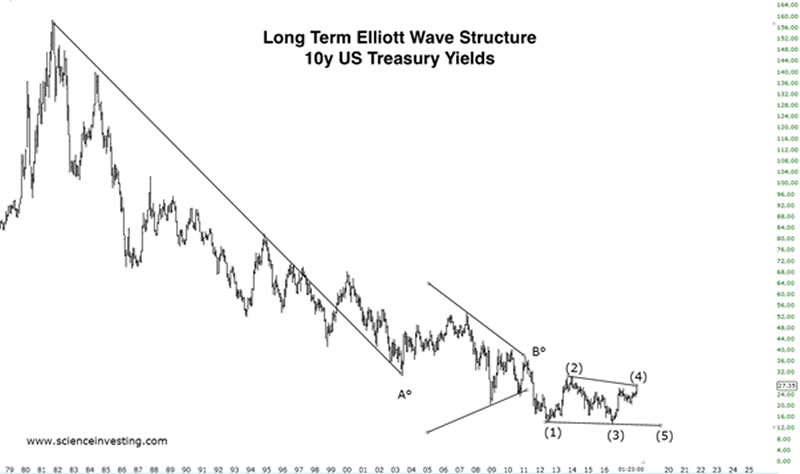

The 10y treasury yield in the US looks like a 3 wave trend down since the 80’s. Our view is that the interest rate downside trend is about to finish in the next few years. It may be the case that the 10y treasury yields are forming a contracting diagonal. This is typical for a terminal structure ahead of a trend change.

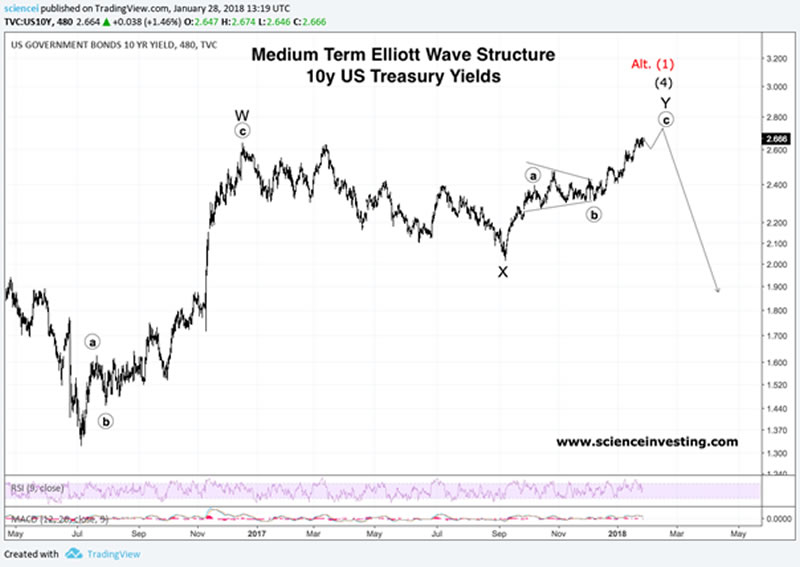

The medium term 10y elliott wave structure is ambiguous. It can be counted as a double zig-zag or as an impulse to the upside. One version is medium term bullish (with long term implications) and the other version is bearish. The bullish version is against our case here. Nevertheless, we put it in front of us in order to be reminded that we may be wrong! However, both versions imply a reversal coming within the next few weeks.

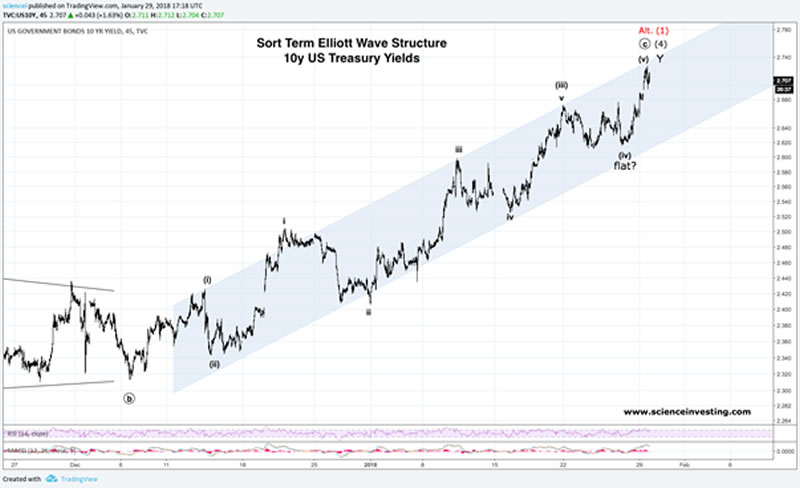

Ultimately the reversal will bring more light into the question if we are dealing with a correction or the final elliott wave of a secular bull market! It is still too early to call a reversal from the short term charts however. Subminuette wave (iii) may well extend further into higher yields. We need to see confirming action to call a significant trend reversal in 10y US treasury rates. First strong evidence comes as an impulsive break of the pale blue trend channel as well as minuette wave (iv). This kind of market action may kick of a market path that would truly catch the vast majority of market participants by surprise. The investment setup looks promising - with or without a new multidecade low in yields!

About The Author

Our background lies in economics and trading. We have been trained at reputable universities and worked as proprietary traders as well as portfolio managers throughout the past couple of decades. We started exploring the field of behavioral economics due to self-interest in the late 90’s.

Our goal is to contribute outstanding technical analysis and forecasting. We focus on the most liquid assets that are subject to worldwide public attention.

Please visit us for more information:

www.scienceinvesting.com

© 2018 Science Investing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.