Gold Bull and Bear Markets

Commodities / Gold and Silver 2018 Feb 23, 2018 - 12:17 PM GMTBy: Arkadiusz_Sieron

In the previous part, we thoroughly analyzed the bull and bear trends in the U.S. dollar. But what about gold cycles? Let’s look at the chart below, which shows the long-term behavior of gold prices.

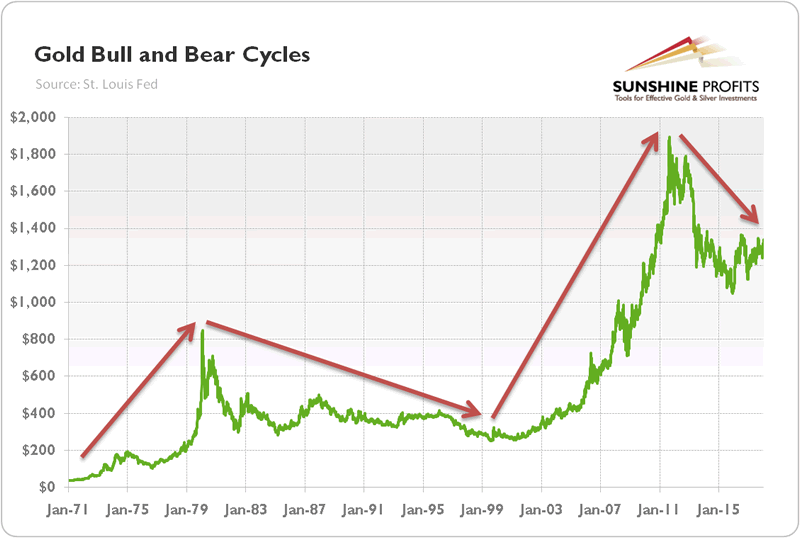

Chart 1: Gold bull and bear cycles (from 1971 to 2018, London P.M. Fix, in $).

As one can see, there were only four cycles compared to six in the U.S. dollar: two gold bull markets and two gold bear markets. The first bull market started symbolically in August 1971, when President Nixon closed the gold window and terminated the gold standard. The collapse of Bretton Woods and the following surge in inflation caused a rally in gold. The bonanza ended in 1980, as the U.S. inflation rate started to decline thanks to the aggressive actions of Paul Volcker, the Fed Chair at the time. As the economy flourished, while the greenback strengthened, the yellow metal entered that bear market. It lasted until 1999/2001, when the dot-com bubble burst. In the 2000s, due to the financial turmoil, rising public debt, and the new wave of terrorism, the confidence in the American economy and its currency dropped, and gold reached its all-time height of $1,895 in 2011. But the economic recovery after the Great Recession has been pushing gold down. Interestingly, a similar (although not identical) pattern – i.e., two bull markets interrupted by a lengthy two decade bear market – can be found in most of the commodities.

Let’s see whether gold will continue its bearish trend or turn it upside. The historical analysis is even more difficult than with the case of the U.S. dollar, as gold experienced only one bear market before the current (recent?) one. All conclusions drawn from such a comparison should thus be taken with a grain of salt.

Having said that, it is worth noting that the previous bear market persisted 228 months and gold prices then plunged 64.44 percent. The bear market which originated in 2011 lasts only 77 months, and the price of gold fell just 29.7 percent (if we assume that the bear market ended in December 2015, it would have survived only 52 months with a 44.31percent decline). Hence, looking at duration and the cumulative percent change during each phase of the cycle (see the table below), we might still be in the gold’s secular bear market (it seems unlikely, but if history repeats exactly, the price of gold will decline to about $660 in 2031), and is now experiencing a technical rally.

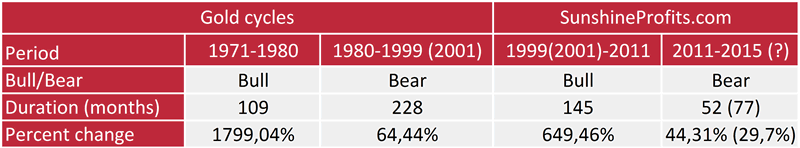

Table 1: Historical gold cycles from 1971 to 2018.

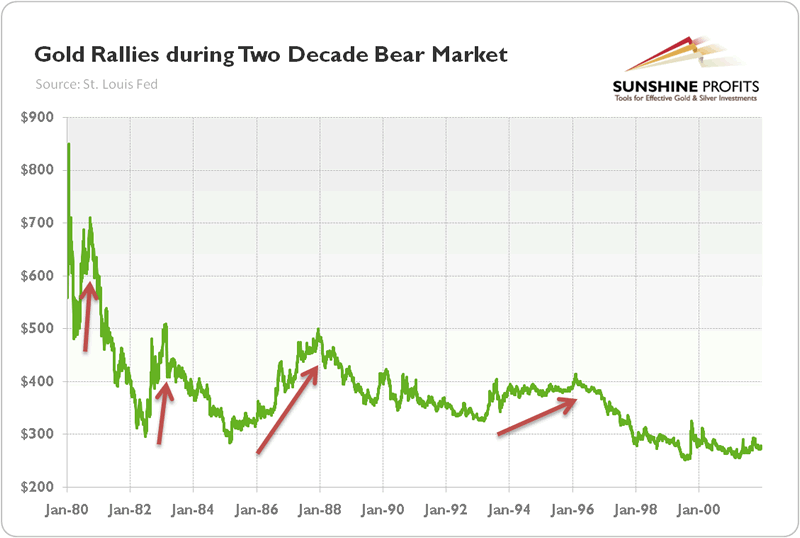

It’s completely possible: during a two decade bear market, gold had four significant rallies (see the chart below). The first was short and occurred between March and September 1980 – the shiny metal gained 47.66 percent then. The second rally happened between June 1982 and February 1983 – gold jumped 71.36 percent during that move. Gold also soared between February 1985 and December 1987, gaining 75.81 percent. Last but not least, gold surged 26.85 percent from March 1993 to February 1996.

Chart 2: Gold rallies during the two decade bear market (from 1980 to 2001, London P.M. Fix, in $).

The last two rebounds lasted about 34-35 months, so the current rally (if it started in December 2015) still has 8-9 months to align with the pattern. And since December 2015 gold jumped about 26 percent, so it has some room for further gains. If historical patterns hold, gold could reach almost $1,600 before continuing its secular downward move.

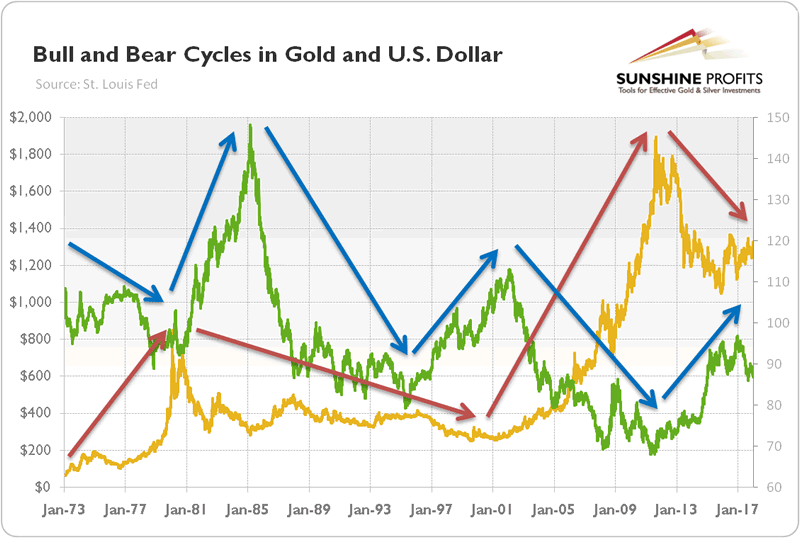

Please note that the above conclusions are generally in line with the analysis of the U.S. dollar cycles. The chart below plots the cycles in both of these assets together. The correlation is not perfect (the first half of the 1990s is a bit tricky), but it is substantial.

Chart 3: Bull and bear cycles in the U.S. dollar (Trade Weighted Index against major currencies) and gold (yellow line, London P.M. Fix, in $) from 1973 to 2018.

The greenback could weaken further in the medium term, but the secular bull market may be not over. It would imply that gold may continue its rally for a while before the day of reckoning will come. What is important is that the tax cuts are not deficit-neutral, so they will widen the fiscal deficit. The increase in the public debt will not only spur some safe-haven for gold acquisition, but it could also raise the dollar supply, contributing to the decline in the U.S. dollar. Since the USD seems to currently be at a decisive point or close to it, we should see either confirmations or invalidations of the above relatively soon.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.