Gold – Early Stage Of A Secular Bear Market

Commodities / Gold and Silver 2018 Mar 08, 2018 - 05:25 AM GMTLong Term Elliott Wave Analysis

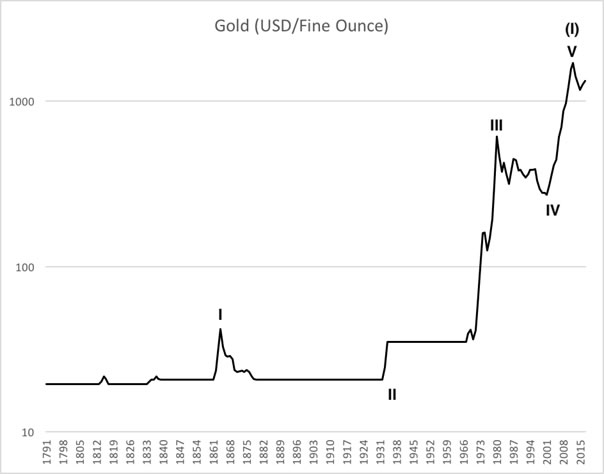

Gold probably shows a complete pattern of supercycle degree into 2011. Its first spike appeared during the US civil war. We interpret that as cycle wave I. The subsequent period shows a correction that lasted for half of a century. It fits the character of a complex sideways correction. It ended roughly at the same time as the US economy started growing from the Great Depression. The subsequent sharp rise took once again half of a century. This was the steepest portion of the recorded gold price progress. Therefore, we are dealing here probably with a third wave. The subsequent fourth wave correction took 20 years and shows a zig-zag pattern with a B-wave triangle. This fits neatly into Elliott’s alternation guidelines regarding a complex second wave. Gold prices took off around the new millennium once again. They came to a stop in 2011. The fifth wave shows roughly equidistant progress to the first wave. We call it complete as long as we do not record a fading 3-wave drop from the top.

Fundamentals

There are little fundamental arguments on why gold should continue to rise. Industrial use is quite slim. Gold is mostly used for electrical connectors and this accounts for less than 10% of new gold production. The vast majority goes into consumption and investment with a share of more than 90%. The investment case is particularly interesting. There is a widespread belief that gold is a great protection against inflation. Well, it isn’t!

Gold produced significant “real losses”, which means inflation-adjusted losses on a very regular basis. The periods 1850-1870, 1890-1920, and 1935-1970 recorded heavy devaluation for gold in real terms. Each of this periods experienced a drop of more than 50% in the value of gold in real terms! That’s still nothing compared to the 1980-1999 period. Gold devalued by roughly 80% in real terms during this period. Hence, gold is not a reliable protection against inflation at all.

Conclusion

There is a widespread misperception that gold protects value during inflationary periods. An analysis of historic data reveals different facts. Moreover, the technical picture hints to a terminal pattern of a large scale. It is likely that we entered a secular bear market for gold in 2011. It will mark the biggest devaluation seen if our analysis proves correct!

About The Author

Our background lies in economics and trading. We have been trained at reputable universities and worked as proprietary traders as well as portfolio managers throughout the past couple of decades. We started exploring the field of behavioral economics due to self-interest in the late 90’s.

Our goal is to contribute outstanding technical analysis and forecasting. We focus on the most liquid assets that are subject to worldwide public attention.

Please visit us for more information:

http://www.scienceinvesting.com/

© 2018 Science Investing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.