US Hiring Intentions Lowest In 17 Years: Manpower

Economics / US Economy Sep 09, 2008 - 02:56 AM GMTBy: Mike_Shedlock

MarketWatch, citing data from Manpower, is reporting Glum outlook on jobs .

MarketWatch, citing data from Manpower, is reporting Glum outlook on jobs .

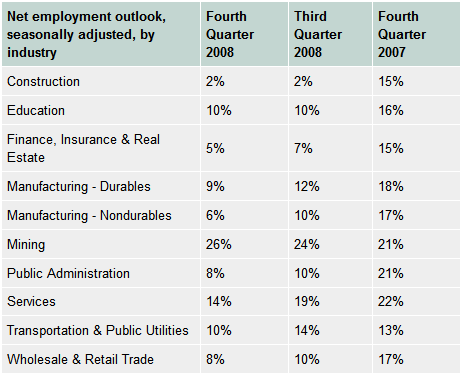

Unless you work in the oil, gas or related mining industries, the job market is unlikely to look brighter in the fourth quarter, and even retailers are glum about hiring for the upcoming holiday season, according to the latest Manpower Employment Outlook Survey.

The Milwaukee firm's quarterly survey of hiring plans found that a net 9% of firms expect to hire in the fourth quarter, down from 12% in the previous quarter, and 18% for the fourth quarter a year ago. This fourth quarter outlook is the tenth consecutive quarter of declining employer sentiment in the survey -- the longest such retreat in more than 20 years.

Manpower's seasonally adjusted net-employment numbers, based on a survey of 14,000 U.S. companies, measure the percentage of firms planning to hire minus those intending layoffs. Manpower doesn't measure the number of jobs. The survey's margin of error is 0.8%.

Among retailers, even the upcoming holiday season doesn't seem to offer much hope: Just 8% of employers in wholesale and retail trade expect to hire in the upcoming fourth quarter, the lowest figure for that sector in 17 years, said Jonas Prising, president of Manpower North America. That category includes department stores, gas stations, restaurants, discount retailers, computer stores and wholesalers, among others.

The industry's "hiring intentions are the lowest we've seen in the last 17 years. That tells you something about what they feel about end-of-year shopping sprees," Prising said. The sector "hasn't been this pessimistic for a long time."

Retailers aren't alone in their pessimism. Overall, this is the tenth consecutive quarter of declines in employers' hiring plans, the longest such retreat since 1986, Prising said.

Unemployment Target Revised

In August 2008 Jobs Declined 8th Consecutive Month, Unemployment Hit 6.1%

In December 2007 with unemployment hovering at 4.8%, I called for 6% unemployment by the end of the year as well as a miserable jobs report every month in 2008. However, I see I may have been way too optimistic. If those manpower estimates are correct, we might see 7% by the end of the year.

So just to prove to everyone what a continuous optimist I am, I will revise my guess to 6.6%-6.8% based on this data.

Should that happen, it is going to be a miserable Christmas season for retailers. Look for headlines like worst Christmas season in 20 years.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.