Global Trade War Fears See Precious Metals Gain And Stocks Fall

Commodities / Gold and Silver 2018 Mar 23, 2018 - 02:24 PM GMTBy: GoldCore

– Market turmoil as trade war concerns deepen and Trump appoints war hawk Bolton

– Market turmoil as trade war concerns deepen and Trump appoints war hawk Bolton

– Oil, gold and silver jump as ‘Russia China Hawk’ Bolton appointed

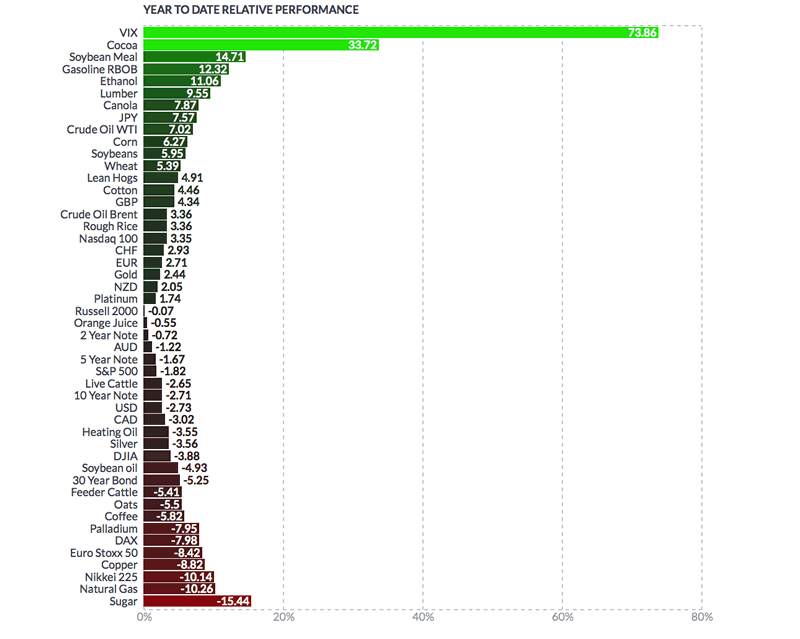

– Oil up 4%, gold up 2.2% and silver up 1.6% this week (see table)

– Stocks down sharply – Nikkei down 4.5%, S&P 4.3% & Nasdaq 5.5%

– Bolton scares jittery markets already shell-shocked by US’ tariffs against China

– Currency wars and trade wars tend to proceed actual wars

– Gold now outperforming stocks year to date (see table)

Editor: Mark O’Byrne

1 Week Relative Performance (Finviz.com)

Gold and silver have gained another 1% today as market turmoil deepens on concerns about global trade wars and actual war after the appointment of uber hawk John Bolton as national security adviser.

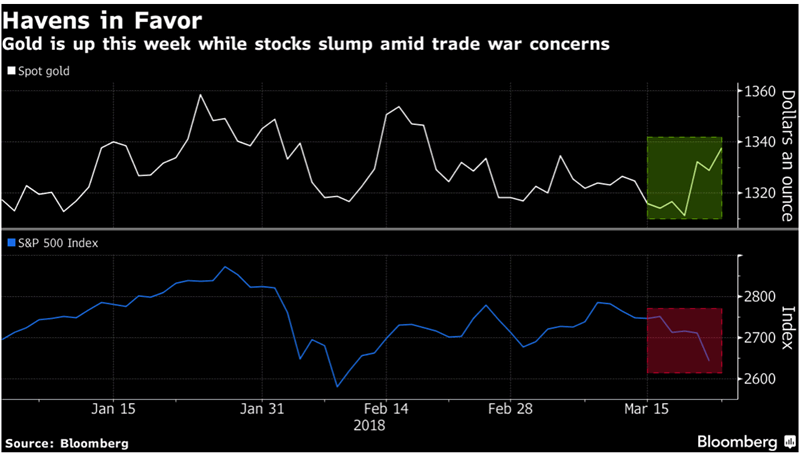

In response to increasing economic and geo-political risks, key stock market indices have fallen sharply this week as investors again diversify into the safe havens of gold and silver. At the time of writing the Nikkei is down by 4.5%, the S&P by 4.3% and Nasdaq 5.5%. Gold and silver have climbed by over 2.2% and 1.4% respectively this week (see table above).

Gold is now outperforming stocks year to date (see table below). Year to date, gold is 2.5% higher while stocks have now turned negative and some are down very significantly for the year. The S&P is down 2%, the DJIA 4%, EuroStoxx 8.4% and the Nikkei 10% year to date (see table below).

Gold is again acting as a good hedge – exactly when investors need a hedge. We are in an environment of increasing and heightened uncertainty – conditions in which safe havens thrive

America is on a path to war. Currently it’s a trade war, predominantly with China, but collateral damage is already showing itself. China has responded with its own tariffs whilst EU leaders are today meeting and trade is at the top of their agenda.

The appointment of war hawk Bolton has also confirmed Trump’s instinct to be aggressive in what are currently simmering geopolitical tensions – namely with Russia, Iran, North Korea and the “Elephant in the room,” America’s hegemonic rival China.

The appointment of “chicken hawk” Bolton has delivered further blows to both political establishments and fragile markets which were already nervous following tariff announcements.

As history clearly shows trade wars, currency wars and economic and geo-political sabre-rattling frequently lead to actual wars. Markets do not tend to like such conditions and they frequently result in sharp market corrections (especially in stock markets), in bear markets in stocks and indeed in financial crashes.

Finviz.com

Trade War breaks out

Yesterday President Trump instructed Trade Representative Robert Lighthizer to place tariffs of $50 billion on Chinese imports. Beijing said they would fight any such move “to the end” and announced tariffs of $3 billion.

The restrained reaction from China suggests that there are likely to be further counter-reactions on the way. As we have found with the PRC’s dealings with the Trump administration, they like to take their time.

In the early hours of this morning Beijing called on the United States to “pull back from the brink”. In a statement the Chinese commerce ministry said:

“China doesn’t hope to be in a trade war, but is not afraid of engaging in one.”

At present there is a temporary stay-of-execution for the European Union and other nations in regard to the tariffs, making the focus on China perfectly clear. The lingering threat that controls could be implemented in a matter of months has alarmed leaders. Those in the EU have pushed trade talks to the top of their agenda, for today’s meeting.

According to Reuters, ‘The European Commission has proposed that, if tariffs are imposed, the bloc should challenge them at the World Trade Organization, consider measures to prevent metal flooding into Europe and impose import duties on U.S. products to “rebalance” EU-U.S. trade.’

Make America great again? Make it even poorer…

Trade wars are always dangerous and often pre-empt real wars. How this will play out will depend very much on what form tariffs end up taking. It’s most likely that it will be America that suffers the most, with a huge uptick in both producer and consumer prices.

The danger of this trade war is that markets really are unprepared for it. The other factor in the US this week was the Federal Reserve meeting. Markets have been prepared for its outcome for months. Whilst the tone might have been slightly more hawkish than expected, it was certainly not a major shock.

In contrast a trade war such as the one which appears to be coming is far from priced into complacent markets – especially U.S. stock markets which remain near all time highs.

Right now markets have little idea how these trade announcements will hit the US and global economy. The only thing for sure is that equity markets will likely bear much of the initial brunt. How long it will take for the Federal Reserve to respond is anyone’s guess, but it is likely to mess with with their carefully timetabled tightening of monetary policy.

Trade agreements came into their own following the Second World War, leaders saw them as a way to maintain peace between nations. The idea that if everyone had vested interests then they would be less likely to engage in damaging behaviour.

Tariffs are very often the bully’s response. They are preferred over months of renegotiation over multilateral rules. The presence of tariffs and controls significantly raise the risk of escalation of conflict as they break down the separation between commerce and national security.

This is where Trump may well be playing the long game. The appointment of war hawk Bolton suggests that the US President is well aware of where his provocations may get him. But, how will this play out with the electorate when they realise the dire economic and human consequences?

Bolton’s appointment is at odds with the electorate and Trump’s promises

Much of Trump’s election was on the back of promising to take down China and no longer engage in ‘pointless’ wars such as Iraq. The irony of the last 24 hours is that both of these announcements will end up doing damage to not only the US but also to Trump’s popularity.

Bolton’s appointment is very much at odds with the electorate. During the election campaign Trump told voters:

We’ve spent $4 trillion trying to topple various people that, frankly, if they were there and if we could have spent that $4 trillion in the United States to fix our roads, our bridges, and all of the other problems—our airports and all the other problems we have—we would have been a lot better off, I can tell you that right now. We have done a tremendous disservice not only to the Middle East—we’ve done a tremendous disservice to humanity. The people that have been killed, the people that have been wiped away—and for what?

It’s not like we had victory.

It’s a mess. The Middle East is totally destabilized, a total and complete mess. I wish we had the $4 trillion or $5 trillion. I wish it were spent right here in the United States on schools, hospitals, roads, airports, and everything else that are all falling apart!

During the same period of Trump’s campaign, the now new Security Adviser John Bolton was telling anyone who would listen that ‘the decision to overthrow Saddam was correct. I think decisions made after that decision were wrong, although I think the worst decision made after that was the 2011 decision to withdraw U.S. and coalition forces. The people who say, ‘Oh, things would have been much better if you didn’t overthrow Saddam,’ miss the point’

Bolton is extremely dangerous to the global situation. He will be a position of enormous influence. His previous declarations that there should be U.S. military action to prevent Saddam Hussein, Ayatollah Khamenei, Kim Jong Un from amassing weapons of mass destruction, are music to Trump’s ears.

As the Atlantic reminds us of a recent Bolton interview on Fox News:

“Question: How do you know that the North Korean regime is lying? Answer: Their lips are moving,” he said on Fox News shortly after news broke that Trump and Kim Jong Un had agreed to participate in direct talks on “denuclearization” by May. The North Koreans aren’t going to voluntarily abandon their goal of obtaining nuclear-tipped long-range missiles, he argued. “They want to buy time: three months, six months, 12 months—whatever it is they need to get across the finish line. What Trump did … is foreshorten that period” by organizing a meeting that can quickly expose North Korea insincerity about relinquishing its nuclear program anytime soon. (“I may leave fast or we may sit down and make the greatest deal for the world,” Trump himself recently predicted.) “Rather than having the low-level negotiations rising to the mid-level negotiations rising to the high-level negotiations, finally rising to a summit meeting—that’ll be two years from now, they’ll have deliverable nuclear weapons,” Bolton explained. “That we cannot allow.”

As Trump correctly points out, wars cost the economy huge amounts of money with little obvious upside. Yet, as we have seen in the last year he has been keen to poke the bear that had previously been left dozing – see Iran, Russia and North Korea for a start. We know that Trump likes to make impulsive decisions and is inclined to listen to the loudest voice in the room. Right now, Bolton suits this approach.

Trump thinks the electorate wants America to show its strength. He believes the country will be happily distracted from domestic policy issues by going to war. However, wars cost money, drive up inflation and ultimately pay little attention to the needs of the marketplace or the real economy.

Geo-political risks will support precious metals

At the beginning of the week, market chatter was in regard to the upcoming central bank meetings, namely in the UK and US.

These now seem a distant memory. However the underlying economic situation should not be forgotten when considering the future of gold and silver prices. Ultimately central bank announcements have very little direct impact on the price of precious metals. It is the fallout from their decisions that most impact prices.

Both gold and silver ticked up following the Fed’s decision to increase rates. Now, policy makers have to contend with nervous markets concerned about the economic damage to the US as a result of Trump’s latest decisions. This is just an extra cherry on top of what was already a dangerously piled high ice-cream Sundae of very significant financial and economic risks.

Gold has performed very well, not only since Trump’s election, but also since the start of the year. The foundations of this are the debasement of currency and theft through inflation and low to negative interest rates. Another fundamental support for precious metals is the uncertainty that comes with global leaders such as Trump and potentially Xi Jinping deciding they don’t have time for diplomacy or hard-fought deals.

Keep calm and diversify into gold

For all of Trump’s peacocking around Russia, China, Iran and North Korea there has been (in comparison) very little officially done. As Luxembourg’s Xavier Bettel reminded us:

“Even in America laws are passed by signature, not by tweet.”

That is to say Trump can go ahead declaring his delight at declaring a trade war or appointing a war monger but the laws that have to accompany his intended outcomes must be approved of by a huge number of lawmakers.

There is a very good chance that both sides of the house will not see the apparent benefits of going to (trade/currency) war with China and the rest of Asia. Or, wish to engage in violent war with North Korea, Iran or more powerful Russia and China.

However, Trump has proven to be a force unto himself. One who is clearly disinterested in a contradictory opinion, no matter how experienced.

The dismissal of key aides who had felt differently about decisions regarding the likes of Russia, China and Iran is as good an indication as any that President Trump fully intends to act upon his plan to ‘Make America Great Again’, no matter the financial or human cost.

Editors Note: There is little we as individuals or companies can do to influence or change the actions of our “great leaders.” What we do control and what we can do is protect our wealth from their actions by a few simple steps.

Reduce leverage and debt, re-balance portfolios and diversify. Prudent asset allocation and real diversification involves owning gold. The safest way to hedge these risks is to own allocated and segregated physical gold and silver coins and or bars.

Precious metals held in this way have shown themselves to reduce the risk in an investment portfolio during stock market downturns, periods of uncertainty and wars (of any kind).

We appear to be in the calm before the storm. This provides an opportunity to get investment and pension portfolios in order before the financial, economic and geo-political situation deteriorates further.

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

23 Mar: USD 1,342.35, GBP 952.80 & EUR 1,088.65 per ounce

22 Mar: USD 1,328.85, GBP 939.36 & EUR 1,078.10 per ounce

21 Mar: USD 1,316.35, GBP 935.53 & EUR 1,071.64 per ounce

20 Mar: USD 1,312.75, GBP 935.60 & EUR 1,066.22 per ounce

19 Mar: USD 1,311.70, GBP 934.59 & EUR 1,066.41 per ounce

16 Mar: USD 1,320.05, GBP 945.42 & EUR 1,071.09 per ounce

15 Mar: USD 1,323.35, GBP 949.24 & EUR 1,070.72 per ounce

Silver Prices (LBMA)

23 Mar: USD 16.53, GBP 11.70 & EUR 13.39 per ounce

22 Mar: USD 16.52, GBP 11.64 & EUR 13.41 per ounce

21 Mar: USD 16.25, GBP 11.56 & EUR 13.23 per ounce

20 Mar: USD 16.25, GBP 11.60 & EUR 13.22 per ounce

19 Mar: USD 16.29, GBP 11.59 & EUR 13.24 per ounce

16 Mar: USD 16.48, GBP 11.79 & EUR 13.36 per ounce

15 Mar: USD 16.52, GBP 11.86 & EUR 13.37 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.