One Change the Bitcoin Posse Is Unlikely to See

Currencies / Bitcoin Mar 23, 2018 - 09:19 PM GMTBy: Mike_McAra

“Bitcoin will reach the moon,” they said. “$20,000 is only the beginning,” they pressed. The harsh reality of the recent move is that appreciation has been nowhere in sight. Harsh, that is, if you haven’t been positioned properly. Are Bitcoin traders bound to be left with their teeth clenched, watching Bitcoin fluctuate? No. There’s a possibility for some to grow the profits they already have on specific positions and for others to jump in during the next part of the move.

The magnitude of the moves in Bitcoin certainly inspires the imagination. More than that, it also evokes comparisons with past trading and with other assets. One parallel we could draw is between the dot-com bubble and the current price action in Bitcoin. In an article on CNBC, we read:

Bitcoin is behaving a lot like how the Nasdaq did during the dot-com bubble nearly 20 years ago, but the timeline is unfolding much faster, according to research published by Morgan Stanley on Monday.

The Nasdaq in 2000 and modern-day bitcoin both rallied 250 to 280 percent in their most "exuberant" periods ahead of bear markets, Morgan Stanley said in a note to clients.

"Just that the bitcoin rally was around 15 times the speed," Sheena Shah, strategist at Morgan Stanley said.

There are points in this that we don’t agree on, there are also points which might be relevant. First of all, it is generally not very relevant that both Bitcoin and Nasdaq rallied 250-280%. It only matters that both assets went up by a lot. Secondly, comparing Bitcoin to stocks is not ideal. Severe stock market crashes notwithstanding, Bitcoin is still a lot more volatile than the stock market. This is not appreciated enough by the investment public, we believe. This segues into one of the points that might be important. Bitcon is moving at 15 times the Nasdaq’s speed, which is yet another way to address the fact that the currency is a lot wilder than the stock market. What might this mean? That any moves in the market might be a lot more volatile than moves in the stock market. For your safety, keep that in mind.

Does this mean that the Bitcoin market is about to crash to $0? We wouldn’t see this as a certainty. Given the recent frenetic move to $20,000, there certainly still is a lot of downside from the current levels and it might be a wave worth riding but we don’t want you to fall into a rut, so we are constantly on the lookout for signs that the tide is turning. Do we see such signs now?

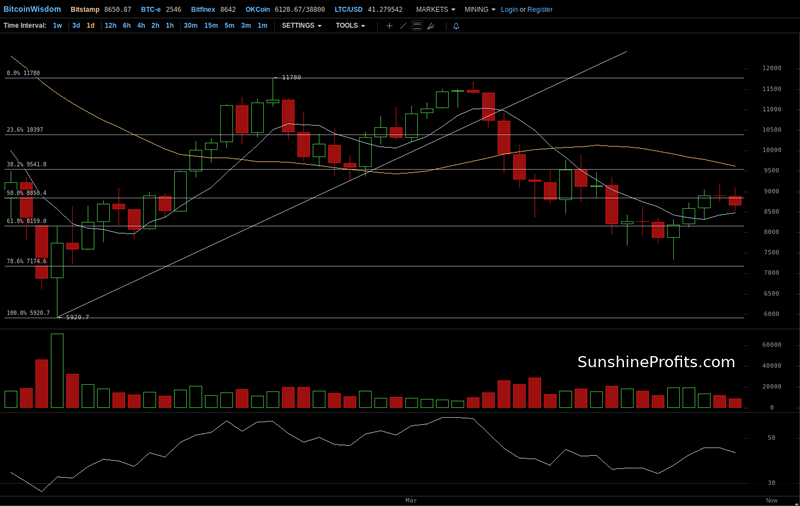

Bitcoin Tests Resistance

For starters, we look at the very short-term BitStamp chart. This is the place where you would see all the obvious stuff regarding the immediate price action. What do we see? That Bitcoin went up to the 50% Fibonacci retracement based on the rebound from the $6,000 low. While the 50% level doesn’t make us too excited itself, the action around it is more interesting. Bitcoin tested this level from the downside, moved above it, stayed above for one day in what might look like a bearish reversal, and is now back below this level. This suggests that the recent move up might have been yet another bullish blip in an otherwise bearish terrain.

The terrain is bearish because we are still well below the 38.2% retracement, below the rising trend line, and quite a lot below it at that, and the volume readings on the up days are very far from spectacular. There is also one other factor which makes the situation increasingly bearish and it is in this factor that we might have seen some change in the last couple of days. The factor we’re referring to is the sequence of lower highs which we have seen since the early January local top. It will be visible on the long-term chart.

Forming a Local Top?

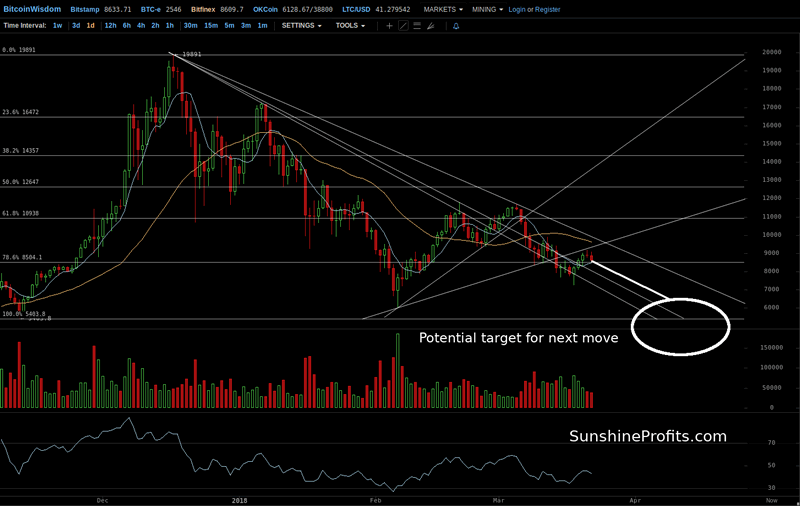

On the long-term Bitfinex chart, we see the mentioned sequence of lower local tops. The sequence started in early January at around $17,000 and hasn’t been convincingly broken yet. This ties in with the short-term situation and the one change we brought up. The change is that in the last couple of days Bitcoin seems to have been forming yet another local top lower than the previous one. This is an extension and reinforcement of the bearish hints from the short-term chart.

Going long-term, we see that Bitcoin is above two out of three possible declining resistance lines. This is not a very bullish indication as the currency is still keeping up with the pace of the decline and we still have an additional trend line serving as resistance. The second mildly bullish indication is the move above the 78.6% retracement – this level is not a very strong one, in our opinion, and the move is not convincing in terms of price.

Having considered that, we have to notice that Bitcoin is still below other retracement levels, not even close to them. Also, the additional rising support lines have both been broken. If you focus on the second one (the flatter one), you will see that Bitcoin has actually tested it in the most recent move to the upside. This suggests that the recent move might not have a lot of momentum to it. The short-term moving average is still below the long-term moving average which at this point is still a bearish hint. The RSI is well above 30 and this points to the possibility that there’s still quite a lot of room for Bitcoin to go down. The most important level at this moment would be the previous local bottom around $6,000. We could see a move there in the next couple of weeks, or even possibly days, and the way Bitcoin would react at $6,000 could strongly hint as to the continuation or invalidation of the trend going forward.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.