China/Asia Economic Implosion on the Horizon?

Economics / China Economy Mar 28, 2018 - 06:20 AM GMTBy: Chris_Vermeulen

Recent news of the US enacting $60 billion in economic tariffs on China as well as reactionary tactics from China have everyone spooked. The US stock markets and global markets tanked last week as this news hit the wires. At www.TheTechnicalTraders.com, we have been warning of a massive upside move in precious metals as well as global market concerns for the past 12+ months. Our recent research shows just how fragile the global markets are to external factors as well as strengths in the US and other established economies.

Recent news of the US enacting $60 billion in economic tariffs on China as well as reactionary tactics from China have everyone spooked. The US stock markets and global markets tanked last week as this news hit the wires. At www.TheTechnicalTraders.com, we have been warning of a massive upside move in precious metals as well as global market concerns for the past 12+ months. Our recent research shows just how fragile the global markets are to external factors as well as strengths in the US and other established economies.

This multi-part special report will delve into the immediate and future risks that are associated with the fundamental and economic likelihoods of credit market contractions and economic rotations within the China, India, South East Asia markets in relation to recent news events. We hope to clearly illustrate the opportunities and risks that will likely play out over the next 12 to 48+ months for investors and traders. Let’s start by trying to keep it simple with some very clear examples of what has transpired over the past 4 to 5 years and how we believe things will change in the near future.

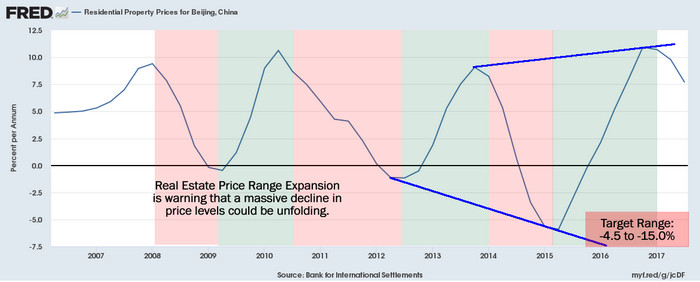

This chart of property price cycles (advancing price cycles vs. declining price cycles; highlighted for your convenience) in Beijing, China, clearly illustrates the expansion and contraction cycles experienced in the capital city/region of China. One can clearly see the expansion of the peaks vs. troughs as these price cycles have played out over the past 10 years.

What we find interesting about this chart is that the upper boundary appears to reside within the +8.5% or slightly greater expansion range, while the price contraction cycles continue to explore deeper and broader downside boundaries over this same range.

This leads one to consider the possibility that Real Estate prices and cycles in China may be much more speculative in nature than we may have considered in the past. It also points to the concept that the Global Credit Crisis (2008 through 2010) may have created a consumer mentality that wealth can be created by speculating on real property throughout these cycles.

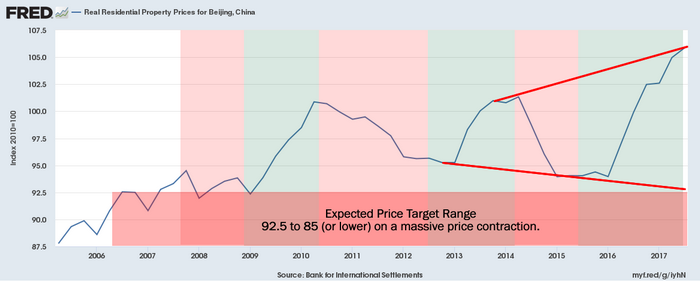

Additionally, we see some correlation to the real price valuations of Beijing property in the following chart. Any analyst can clearly see that prior to 2008, the rotational price levels were much narrower than after 2008 (roughly 2~3% in range vs. 7 to 15% in range). This volatility in pricing is one key factor that is leading us to our conclusion that the current downward price cycle (see the above chart) may lead to a substantially lower downside price target range in Beijing (and other areas of the world). Our analysis leads us to believe this early stage price rotation is an excellent opportunity for investors and traders to prepare for and begin to execute trades to attempt to profit from these events.

Recently, we posted an article regarding the massive increase in pre-foreclosures in most US metros. Our intent was to illustrate just how dynamically this price cycle is changing and to highlight the potential for investors to be prepared for a move. Our current research into the potential for a China/Asia market implosion is based on the assumption that the past years of easy money, quantitative easing, support for property markets across the globe and massive support for an expansion cycle are nearing an end event. If our analysis is correct, this end event cycle will present incredible opportunities for smart investors by attempting to capitalize on early and middle stage market events.

This current data, as shown above, clearly illustrates this price cycle event is very early in the rotational process and this presents a huge opportunity for investors. Our research team at Technical Traders Ltd. has been actively following these trends and global market indicators for years.

We specialize in developing advanced price modeling systems that assist us in determining what may happen in the future and we attempt to capitalize on these moves with our subscribers. These members receive advanced warnings of these types of setups and we alert them to critical trade setups in real-time – as they happen. We urge you to visit our website to learn more about our services and products and we hope you find our research informative and relevant to current market events. If you want to be ahead of the markets with our continued research and content, please consider becoming a valued member of our Wealth Building Newsletter.

With 53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Chris Vermeulen

Technical Traders Ltd.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.