Uncle Sam Issuing $300 Billion In New Debt This Week Alone

Interest-Rates / US Debt Mar 29, 2018 - 09:55 PM GMTBy: GoldCore

– US needs to borrow almost $300 billion this week alone

– US needs to borrow almost $300 billion this week alone

– This is the largest debt issuance since 2008 financial crisis

– Trump threatens trade war with its biggest creditor – China

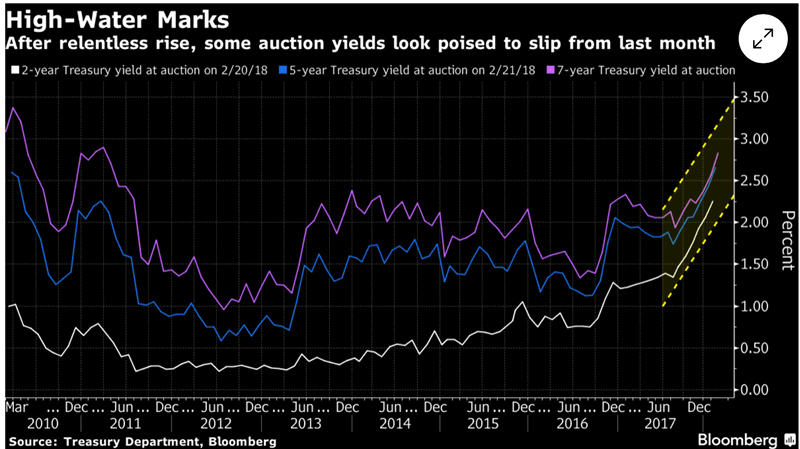

– Bond auctions have seen weak demand due to large supply and trade war concerns

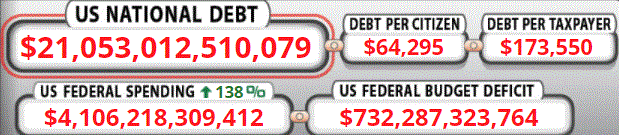

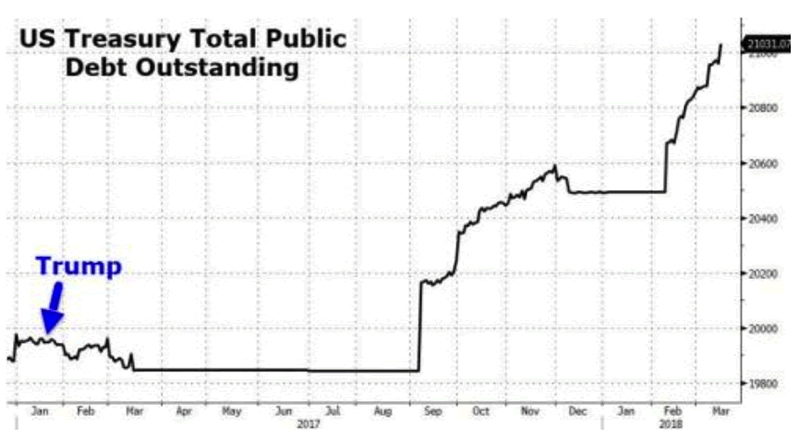

– $20 trillion mark reached in early September 2017; $1 trillion added in just 6 months

– US total national debt level now exceeds $21.05 trillion and is accelerating higher

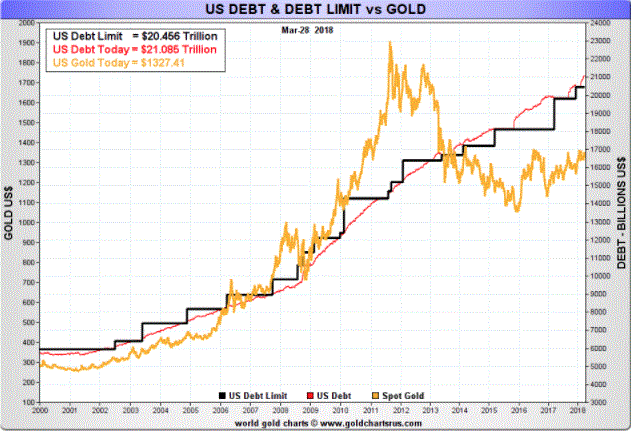

– U.S. debt and dollar crisis coming which will propel gold higher (see chart)

Source: USDebtClock.org

This week the US has gone cap in hand to the bond markets to sell nearly $300 billion of US debt while at the same time threatening a trade war with its largest creditor China. This is despite it being the largest debt issuance since the 2008 financial crisis.

Trump has added $1 trillion in new debt in just over six months. This trillion dollar increase has only happened once before – at the height of the 2009 global financial crisis.

To give a sense of perspective of how huge $300bn issuance in one week is, it is the total amount of US debt when JFK was President. The U.S. national debt appears to be increasing parabolically and yet much of the media remains silent on the real risks this poses to the dollar, financial markets and the U.S. and global economy.

Source: Goldchartsrus.com

The U.S. government is in need of another $300 billion this week due to Trump’s grand tax and spend policies. The recent cut in taxes means there is reduced federal revenue and therefore the government must borrow more in order to make ends meet. The money will be used to refinance the current maturing debts and to finance new.

The sale will include $109 billion of coupon-bearing paper (debt featuring a maturity of more than a year) and $185 billion of bills.

Will Trump’s creditor China be interested?

Asking the market for $300bn when you’re picking a fight with some of the world’s biggest economic powers is bad timing to say the least. This is particularly the case when one of those economic powers is China, by far the largest holder of Treasuries.

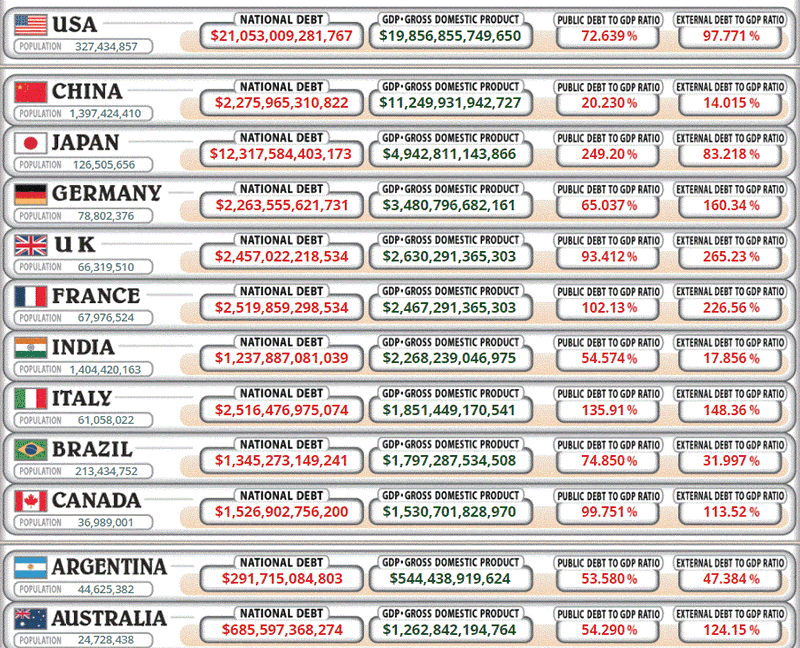

Currently around 46% of US debt is owned by foreign entities, China’s holding accounts to $1.18 trillion of this. In light of Trump’s recent trade tariff placed on the Asian superpower, markets are unsure if US debt’s biggest fan will be coming to the debt waterhole for more.

When trade tariffs and wars were first mentioned China said it would respond to any measures by fighting a trade war ‘to the end’. China’s ambassador to the United States told Bloomberg ‘we are looking at all options’ when asked if the country would scale back purchases of US debt.

This isn’t news that China may be losing interest in propping up the US economy. In early January Bloomberg reported that, ‘Senior government officials in Beijing reviewing the nation’s foreign-exchange holdings have recommended slowing or halting purchases of U.S. Treasuries.’

Given how heavily invested China is in just one class of US debt, it would not be surprising for the country to consider rebalancing their portfolio. Strategically now might be considered a wise time to do so.

Even if China doesn’t make an active decision to slow down its US debt purchases, it might be inevitable. Should the US be successful in reducing its trade deficit with the country then China will automatically have fewer dollars with which to purchase US Treasuries. Trump’s promises to ‘Make America Great Again’ may well lead to bond market panic and rising borrowing costs.

This sounds as though China holds the US by its private parts when it comes to debt. In many ways it does, but it could prove to be a zero sum game. It would not work in China’s interests to decide to suddenly sell US debt in large tranches as it would reduce the value of China’s dollar denominated assets.

More likely is that they greatly reduce purchases of U.S. debt and stop buying and instead buy the debt of sovereigns with a more sustainable debt profile such as Switzerland, Singapore, Norway and other creditor nations. They may also favour the debt and assets of nations that they have good trade, economic and foreign policy relations such as Russia.

Gold will become even more attractive to China and the People’s Bank of China (PBOC) and the Chinese accumulation of gold is likely to accelerate.

Is the market saturated with US debt?

Demand for US debt has certainly been lacklustre this week. A large part of this may be due to timing. The recent sabre-rattling from Trump in regard to trade war talk will have certainly put a dampener on demand.

However, the average-demand auctions have seen the 10-year yield curve flatten to a seven week low. Since February, the 10-year Treasury note yield has traveled in a tight trading range of 2.80% to 2.90%.

Treasury rates have been supported this year by concerns of the gap between US revenue and spending. The issuance of new debt this week will not be a one off, last week President Trump signed a $1.3 trillion spending bill that will increase spending requirements at a time when federal revenues are falling.

Bond buyers will likely demand a much higher interest rate to compensate for the increased sovereign risk in the U.S. and the country’s lack of desire and ability to rein in its debt-fuelled decisions.

The Committee for a Responsible Federal Budget (a fiscal watchdog group) warned yesterday the interest payments on US debt alone may quadruple to $1.05 billion by 2028 if current policies are not discontinued.

In February the country ran its biggest deficit in six years, of $215 billion. By as early as next year the annual budget deficit will exceed $1 trillion, according to the Committee for a Responsible Federal Budget.

The issuance of new debt will likely see inflation rise, which may hamper the Federal Reserve’s stated plans to step away from its carefully crafted timeline and force them to revert increase interest rates at a faster pace than scheduled.

Source: Zero Hedge

Will this give the US a false sense of hope?

The danger with successful auctions (no matter where or how strong the demand was) is that it gives the seller the confidence that this is a good way to raise funding.

The US, like many western economies, has become a debt addict. It is completely unaware as to how it can grow and maintain its super power status without an economic model that is based on debt. It assumes it must grow by spending and consumption, rather than saving and production – two very different models.

In the words of Sovereign Man Simon Black, ‘Countries whose economic models are based on debt and consumption will suffer’.

When the US does suffer it will not be a contained event, the whole world will feel the pinch as we are so intertwined and dependent on the U.S., their policies and the dollar.

Trump has bankrupted many of his companies over the years and he appears to be accelerating the slow motion bankruptcy of the U.S. At the very least, he is set to create a U.S. debt and a dollar crisis which will again propel gold higher.

This risk underlines the importance of owning physical gold to protect against geo-political risks, stock and bond market bubbles and the continuing devaluation of the dollar and all fiat currencies.

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

29 Mar: USD 1,323.90, GBP 941.69 & EUR 1,075.80 per ounce

28 Mar: USD 1,341.05, GBP 946.24 & EUR 1,082.23 per ounce

27 Mar: USD 1,350.65, GBP 954.64 & EUR 1,087.41 per ounce

26 Mar: USD 1,348.40, GBP 949.27 & EUR 1,086.95 per ounce

23 Mar: USD 1,342.35, GBP 952.80 & EUR 1,088.65 per ounce

22 Mar: USD 1,328.85, GBP 939.36 & EUR 1,078.10 per ounce

21 Mar: USD 1,316.35, GBP 935.53 & EUR 1,071.64 per ounce

Silver Prices (LBMA)

29 Mar: USD 16.28, GBP 11.58 & EUR 13.21 per ounce

28 Mar: USD 16.46, GBP 11.63 & EUR 13.28 per ounce

27 Mar: USD 16.64, GBP 11.79 & EUR 13.41 per ounce

26 Mar: USD 16.61, GBP 11.67 & EUR 13.39 per ounce

23 Mar: USD 16.53, GBP 11.70 & EUR 13.39 per ounce

22 Mar: USD 16.52, GBP 11.64 & EUR 13.41 per ounce

21 Mar: USD 16.25, GBP 11.56 & EUR 13.23 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.