Crude Oil Price Bears - Stay the Course

Commodities / Crude Oil Apr 04, 2018 - 12:27 PM GMTBy: Nadia_Simmons

What a day! The beginning of the new quarter, the new month and the new week was undoubtedly the triumph of oil bears. Thanks to their attack crude oil lost almost 3% in one day, which was the biggest decline since weeks. What impact did this drop have on the short-term outlook? Where are the nearest supports? For these and other questions you will find answers in today's alert.

What a day! The beginning of the new quarter, the new month and the new week was undoubtedly the triumph of oil bears. Thanks to their attack crude oil lost almost 3% in one day, which was the biggest decline since weeks. What impact did this drop have on the short-term outlook? Where are the nearest supports? For these and other questions you will find answers in today's alert.

Technical Analysis of Crude Oil

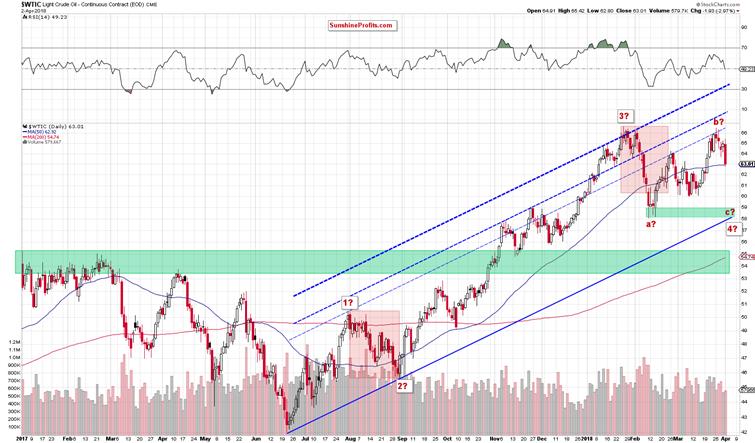

Let's take a look at the charts (charts courtesy of http://stockcharts.com).

In our Thursday’s alert, we wrote that black gold slipped under $65 and the CCI joined the Stochastic Oscillator by generating a sell signal. Additionally, (…) recent declines materialized on increasing volume, which suggests that currency bears didn’t say the last word and further deterioration is still ahead of us.

Looking at the daily chart, we see that the situation developed in line with the above scenario and we didn’t have to wait long to see oil bears’ determined attack during yesterday’s session.

Thanks to Monday’s price action, light crude moved sharply lower, breaking below last week’s lows and slipped to the 50-day moving average. Although we can see some rebound from here, the sell signals generated by the indicators remain in the cards, supporting oil bears and lower prices – just like the volume, which increased during yesterday’s decline.

How low could light crude go in the coming days?

In our opinion, if light crude drops under the blue moving average, we’ll see (at least) a test of the support area created by the March lows and the barrier of $60. However, when we take into account the zigzag pattern seen on the above chart, the next downside target for oil bears will be the green support zone based on the February lows and the lower border of the medium-term blue rising trend channel around $58.20 (if you want to know more about the above-mentioned big zigzag and Elliott wave theory, we encourage you to read our Oil Trading Alert posted on March 27, 2018).

The pro-bearish scenario is also reinforced by the long- and medium-term picture of black gold about which we wrote in our last commentary.

Crude Oil from Broader Perspective

Let’s start this section with the medium-term chart.

The first thing that catches the eye on the weekly cart is an invalidation of the earlier tiny breakout above he upper border of the blue consolidation. This is a negative development, which suggests further deterioration and a test of the lower line of the formation in the coming week(s).

When we zoom out our picture, we’ll see one re bearish factor, which could be use in the coming week. What do we mean?

Another unsuccessful attempt to break above the major resistance – the 200-month moving average, which continues to keep gains in check since the beginning of the year. Additionally, the sell signal generated by the Stochastic Oscillator remains in play, supporting oil bears and lower prices of black gold in the coming month.

Summing up, crude oil extended losses, invalidating the earlier breakout above the upper border of the blue consolidation (seen on the medium-term chart) and failed to break above the major resistance – the 200-month moving average (marked on the long-term chart) for the third time in a row. These bearish developments increase the probability of further declines and a test of the green support zone in the coming week.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Oil Trading Alerts as well as Gold & Silver Trading Alerts. Sign up now.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski

Founder, Editor-in-chief

Sunshine Profits: Gold & Silver, Forex, Bitcoin, Crude Oil & Stocks

Stay updated: sign up for our free mailing list today

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.