Inflation Trade, in Progress Since Gold Kicked it Off

Commodities / Gold and Silver 2018 Jun 15, 2018 - 07:12 PM GMTBy: Gary_Tanashian

I am sure you remember the lead up to Q1 2016. The US economy and stock market were transitioning from a Goldilocks environment and narrowly avoiding a bear market while the rest of the world was still battling deflation. Precious metals and commodities were in the dumper and try though US and global central banks might, they seemed to fail to woo the inflation genie out of its bottle at every turn.

I am sure you remember the lead up to Q1 2016. The US economy and stock market were transitioning from a Goldilocks environment and narrowly avoiding a bear market while the rest of the world was still battling deflation. Precious metals and commodities were in the dumper and try though US and global central banks might, they seemed to fail to woo the inflation genie out of its bottle at every turn.

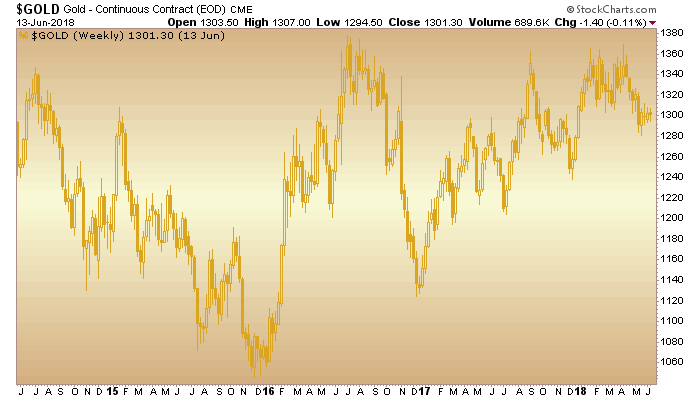

Then came December of 2015 when gold and silver made bottoms followed by the gold miners in January of 2016. Then by the time February had come and gone the whole raft of other inflatables (commodities and stocks) had bottomed and begun to set sail.

As I listened to Mr. Powell speak about inflation yesterday my mind wandered back to Q1 2016 as I thought about the Fed trying to manage inflation at or around 2%. I also thought about how inflation tends to lift boats, not sink them. At least that is what it does in its earlier stages, in its manageable stages.

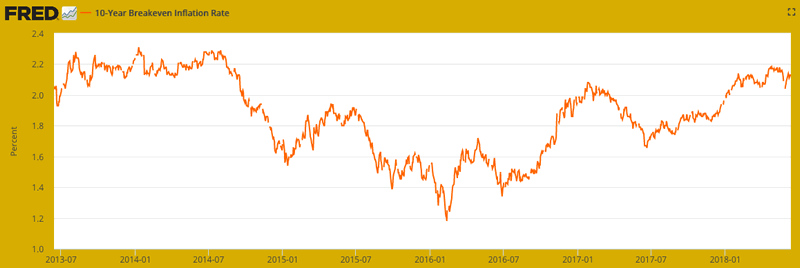

The balls out post-crisis inflation begun by Ben Bernanke was a massive market input and I suspect we have not yet seen its full effects – other than in US stock prices thus far. So dialing back to Q1 2016 let’s look at a few pictures, beginning with the Fed’s 10 year breakeven inflation rate, which bottomed… you guessed it, in Q1 2016. That means that ‘deflation expectations’ topped at that time.

A month or so earlier gold had made its low, amid deflation’s last gasp. I often talk about how gold is not about inflation and that deserves a qualification. Gold is not only or even primarily about inflation, especially when the economy is doing well against an inflationary backdrop and interest rate dynamics are not favorable. That is the case today, but gold led the whole show and it is marking time now (in its laborious post-2016 uptrend) perhaps for when the inflation starts to cut into the economy’s bones.

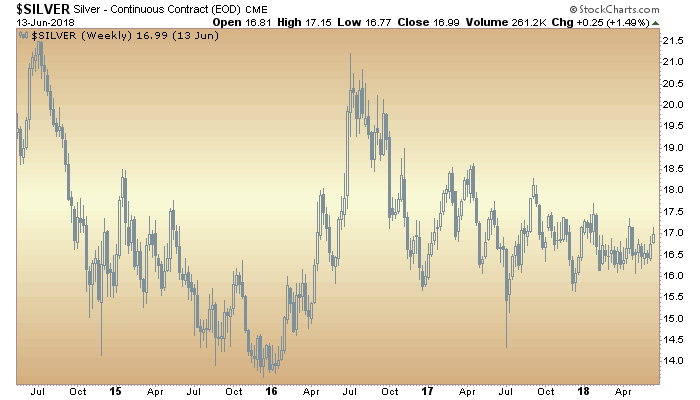

Silver on the other hand has more pro-cyclical utility and though it appears strange for silver to have been lagging gold during an inflationary economic expansion, the hysterics of the 2016 spike have needed to be worked off; and worked off they have been… for going on 2 years now.

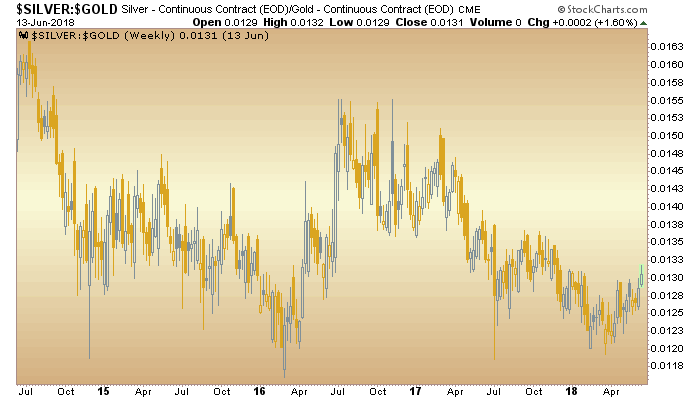

We can clearly see that silver got ahead of itself in 2016 as the inflation this ratio had sniffed out has proven very slow in manifesting. But manifest it will if the signals across various indicators (flattening yield curve notably excepted) continue on their current course. You might be able to imagine a trend line being broken on this weekly chart of the Silver/Gold ratio.

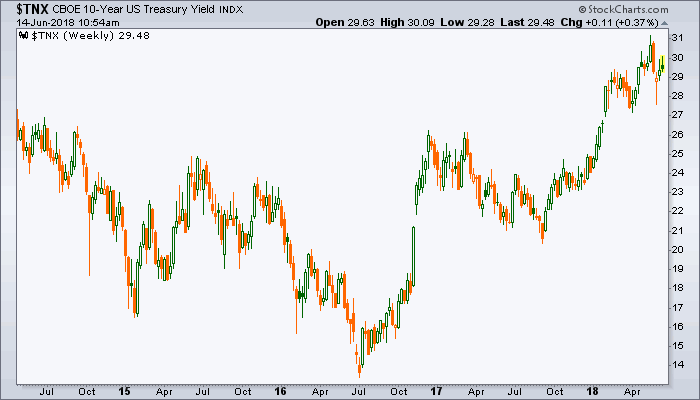

So the yield curve continues to flatten but nominal interest rates continue to rise, which is consistent with building inflationary pressures. The 10 year yield bottomed in mid-2016 and has recently hit and exceed our target of 2.9%.

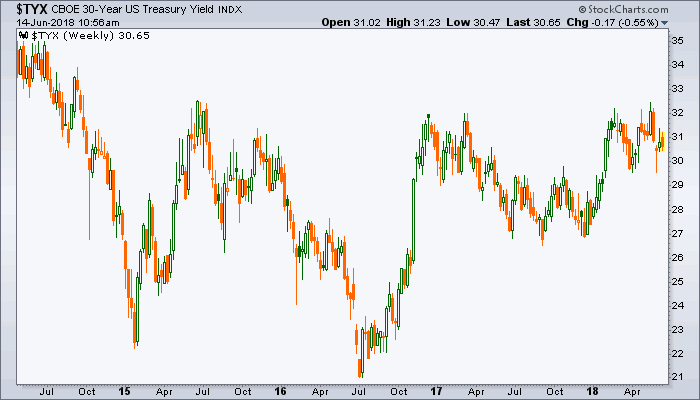

The 30 year yield bottomed in mid-2016 as well and has not quite reached our upside target of 3.3%.

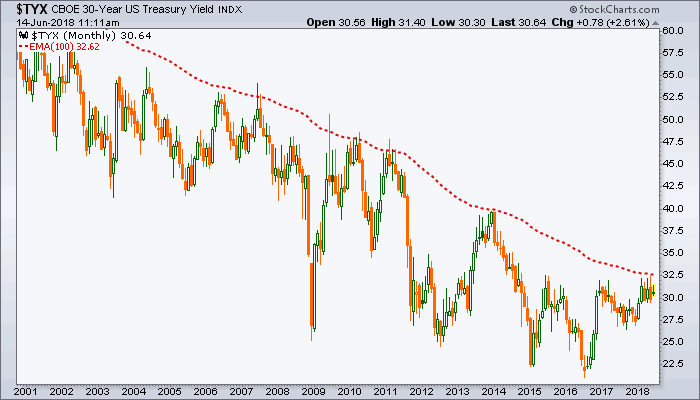

While I have beat people over the head stating that yields are not in a new secular phase until they are, well, in a new secular phase, if inflation is to take a dramatic upturn per all that Bernanke era input, the gurus that the media put in front of us like Gross and Gundlach (with a side of Tudor Jones & Dalio), may actually be right this time. Watch the NFTRH Continuum ™ (30yr yield monthly chart) for signs that it could actually be different this time (unlike all those times in years and decades past).

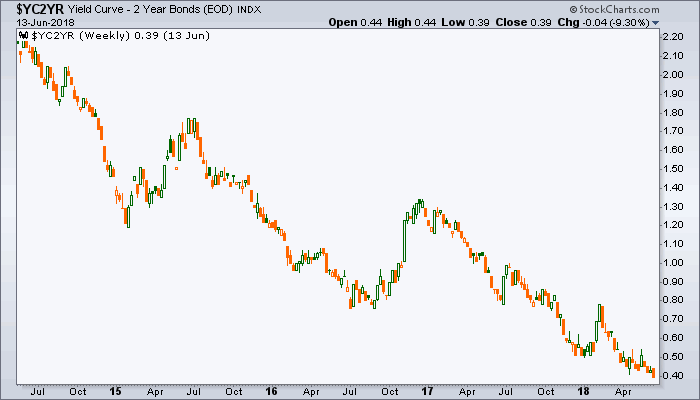

Meanwhile the 10yr-2yr yield curve is as flat as a pancake but can be watched in much the same way as the 30yr yield above. The yield curve can bottom and begin to steepen under pains of one of two conditions; deflationary stress, as money seeks liquidity in short-term Treasury instruments relative to long-term instruments; or inflationary fears, as money seeks to get the hell out of long-term bonds for fear of the debtor – good old Uncle Sam in this case – inflating away his obligations. Last I checked Uncle Sam is playing to a deficit spending playbook as costs rise across the economy.

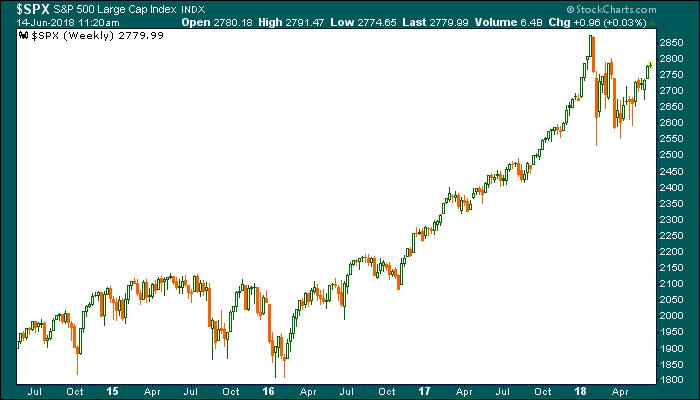

Finally, let’s take a look at the broad S&P 500. There is the Q1 2016 bottom and there is the big rally that ensued after the market realized that a fiscal inflator was elected president and that the game would be rigged left and right in favor of corporate America. Oh, but fiscal policy is working well now for the little guy, both for small business and the public. So assume the Good Ship Lollypop keeps on sailing forward; but also assume that inflationary effects and that whole raft of inflatables will keep on sailing as well. The die is cast, and the economy – if it is to move forward – will need continued inflation.

Bottom Line

If indeed we sail along to a new inflationary era, as stimulated and wooed by the Fed in its monetary policy (I know they are removing accommodation, but work with me here), and as stimulated by the government in its ongoing fiscal policy don’t be surprised by most boats being lifted on the inflationary tide, at least until the thing bloats and rolls over of its own heavy cost structures.

But as always, we have indicators and markers for a reason. So maybe it is best to keep assumptions under wraps until some of the indicators noted above actually break to new and major macro signals. For now we are managing a bounce in the precious metals (and I personally, have an interest in silver’s forward prospects like I’ve not had in years) and an ongoing rally in various other inflatables.

But even if a big time inflation is to carry the day, we are following some currently proprietary signals that indicate there will likely be a rude interruption along the way. I wish I could give a handy answer about which one or two indicators or signals to watch, or one or two simple answers to abide by. But that is not the way successful market management works. It is too complex a situation.

So I’ll leave you with this thought; prepare to do the work of defining and refining the macro all along the way or have NFTRH do it for you. A lot of work and actionable market analysis for not a lot of cost. Oh and, in the current phase our stock selections (not recommendations mind you, but my holdings per the Trade Log) are working well too. Very well on balance. Now, how long will this phase last? Beuller?

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.