Stock Market Crash Even if China and the Trump Make Up? Currencies Think So

Stock-Markets / Stock Market Crash Jul 01, 2018 - 02:34 PM GMTBy: Graham_Summers

As we noted earlier this week, China, tired of the “back and forth” with the Trump administration on trade negotiations, has resorted to devaluing the Yuan.

As we noted earlier this week, China, tired of the “back and forth” with the Trump administration on trade negotiations, has resorted to devaluing the Yuan.

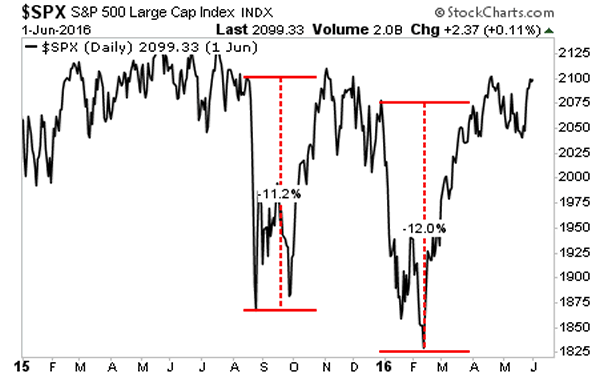

The goal here was to induce another sharp sell-off in stocks, similar to the ones induced by China’s August 2015 and January 2016 devaluations. By the way, those last two devaluations (red boxes) resulted in the S&P 500 dropping 11% and 12% in less than one week.

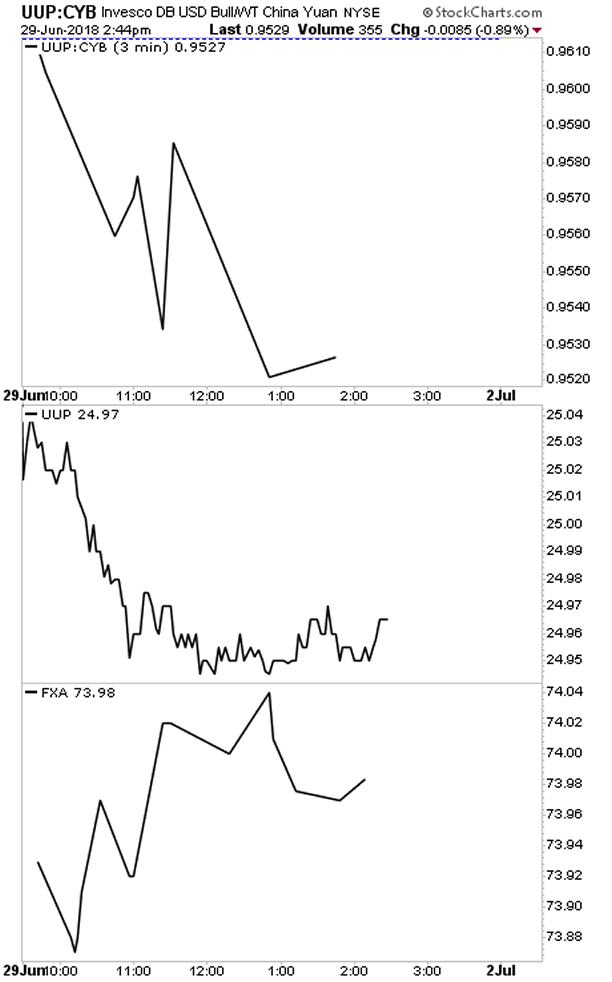

Fast forward to today and the $USD:Yuan pair is down SHARPLY. The $USD index is also sharply down. And the highly inflationary Australian Dollar is up sharply.

Of course, one day does not make a trend. But today is the best day for stocks, from a currency perspective, in several weeks.

However, underneath this good news is some VERY bad news… the Fed’s QT program is still ongoing… in fact it will increase from $30 billion to $50 billion per month starting in July.

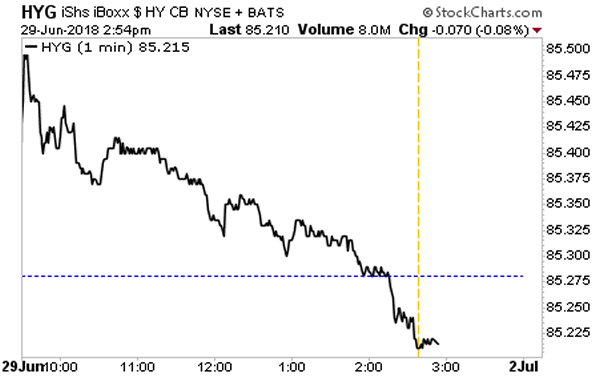

So while President Trump may have solved things with China… the Fed is still presenting the markets with a major problem. Indeed, if with the good news in currency land, various risk proxies such as High Yield Credit are DOWN for the day.

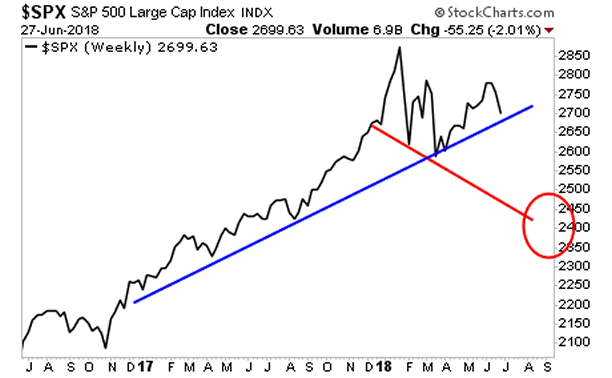

With that in mind, we stand by our current thesis that unless the Fed “pumps the brakes” on its QT programs and rate hike schedule, stocks are on VERY thing ice.

How thin?

Most Emerging Markets are already down 20% this year. If US stocks were to play “catch up” it would mean the S&P 500 at 2,300-2,400.

The time to prepare for this is NOW before the carnage hits.

On that note, we are already preparing our clients with a 21-page investment report that shows them FOUR investment strategies that will protect their capital when and if a stock market crash hits.

It’s called The Stock Market Crash Survival Guide… and it is available exclusively to our clients.

To pick up one of the 100 copies…use the link below.

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.