Stock Index Support Zones In Play For Bigger Upside Move

Stock-Markets / Stock Index Trading Jul 04, 2018 - 02:31 PM GMTBy: Chris_Vermeulen

As we start the July 4th trading week, it is time to look at the current market setup for signs of future strength or weakness. Yes, there is a lot of outside economic and geopolitical factors at play right now that could cause some major market moves, yet we continue to believe the US equities markets are setting up for another upside move after retesting support and shaking out some trades.

As we start the July 4th trading week, it is time to look at the current market setup for signs of future strength or weakness. Yes, there is a lot of outside economic and geopolitical factors at play right now that could cause some major market moves, yet we continue to believe the US equities markets are setting up for another upside move after retesting support and shaking out some trades.

Recently, there has been quite a bit of chatter about foreign and US debt levels as well as credit cycle events that many industry leaders are concerned with. Overall, yes, we have to be cautious of a pricing level revaluation as a result of the credit cycles that are changing.

As the US Fed increases rates, this puts pressures on a vast array of credit market events that may cause some pricing concerns and economic concerns as foreclosures and repossessions tick higher. Yet, we believe the valuations within the stock market are currently based on a companies level of operations and ability to generate returns. Therefore, we believe the Q2 earning season, which is about to befall us, should be a very clear indication at to how well or poorly the US stock market is fairing in regards to fair pricing.

This first chart, the ES 240-minute chart, clearly shows the WEDGE price pattern that we are following. By our estimates, this pattern is nearly complete (showing the completed 5 wave setup) and this pattern should likely prompt a moderately strong upside price breakout before the end of this trading week. Of course, the July 4th holiday will interrupt trading for a bit, but we believe the 2700 bottom/support levels are already in place and as long at that support level holds, the upside is the only outcome for this wedge formation.

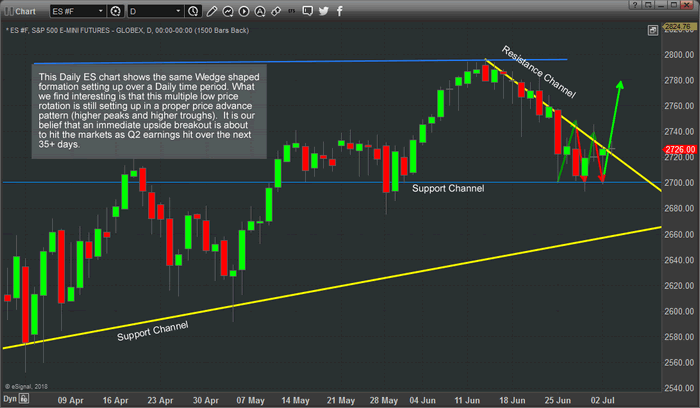

This second chart is the ES Daily chart showing the same WEDGE formation over a longer span of time. Notice the clear support channels and the resistance channel that has contained price over the past 20+ days. This has been the nexus of the price decline and the root issue of much concern regarding downside price capabilities.

The one thing that may people fail to understand is that the historical price peaks and troughs are still indicative of Upside Price Channeling with higher troughs and higher peaks overall. We believe the 2700 level will hold as support and the ES chart will begin an upside price swing that could likely result in a rally to 2800+ quickly.

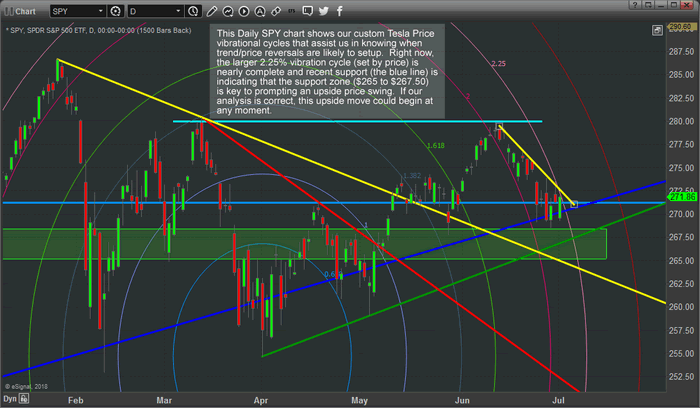

To add a bit of a kicker to this analysis report, this, our custom Tesla Price Vibrational Cycles analysis is showing us that the 2.25% vibrational cycle is nearly complete and that price is holding above the green support zone as well as holding above the blue price support channel. These Tesla Price Cycles operate as price boundaries and breakout zones. When price nears one of these levels, depending on the previous price direction and activity, we should expect a potential price reversal or breakout pattern – depending on the setup.

Right now, the setup is “strong support with rotational price channeling showing an upside potential”. This Tesla price cycle indicates that “as long as support holds, we should expect to see an upside breakout/trend with a potential for a move to $277.50 or $280+ as the final outcome.

This holiday week would be a perfect time to catch the markets by surprise with a big rally. Although it may not happen, we believe there is a strong potential for a surprise breakout rally soon and we believe these support levels are proving strong enough to prompt further upside price rallies. Even though many skills analysts are concerned about the credit cycles and global debt levels, we know the game can continue much longer than many people think it is possible to continue. As the old saying goes, “don’t ever get married to a position”. We are positioned for success if our analysis is correct and we will take small losses if support is broken and price moves lower. We believe the shorts, which there are many at this point in time, are about to feel some serious “squeeze pressure” over the next few weeks.

Visit www.TheTechnicalTraders.com to learn how we can help you find and execute better trading solutions, better research and provide a top-tier solution for active traders. If you like our research and find it helps you, then consider joining our other valued members in supporting our work and taking advantage of our solutions for active traders. Want to know where this market is headed and what to expect throughout the end of this year and beyond – our members already know what our predictive modeling systems are suggesting for the next 5+ months.

Our articles, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors to explore the tools and techniques that discretionary and algorithmic traders need to profit in today’s competitive markets. Created with the serious trader and investor in mind – whether beginner or professional – our approach will put you on the path to win. Understanding market structure, trend identification, cycle analysis, volatility, volume, when and when to trade, position management, and how to put it all together so that you have a winning edge.

BECOME A TECHNICAL TRADER WITH CHRIS VERMEULEN

AND RECEIVE HIS DAILY ANALYSIS & TRADE ALERTS!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.