How Trade Wars Penalize Asian Currencies

Currencies / Protectionism Jul 09, 2018 - 06:41 AM GMTBy: Dan_Steinbock

Not so long ago, Asian currencies anticipated depreciation pressures to increase, due to monetary normalization. Yet, it is the trade wars that are now penalizing all currencies, particularly in exporting economies.

Not so long ago, Asian currencies anticipated depreciation pressures to increase, due to monetary normalization. Yet, it is the trade wars that are now penalizing all currencies, particularly in exporting economies.

In January, I gave a global economic briefing on the outlook of the Philippines in the Nordic Chamber of Commerce in Manila. At the time, the peso was still about 50.80 to U.S. dollar. Among other things, I projected the peso to soften to 54 or more toward the end of the year, which I considered largely the net effect of normalization in advanced economies, elevated trade friction worldwide, as well as fiscal expansion (the Duterte investment program).

While skeptics thought the projection was too “pessimistic,” the peso is today around 53.40 to U.S. dollar and has occasionally almost exceeded 54.00.

In this view, depreciation pressures are typical to many currencies in emerging Asia, most of which are likely to continue to soften in 2019, including the peso.

The onset of trade wars

Through his 2016 campaign, Donald Trump pledged tougher trade policies. When he arrived in the White House in January 2017, he buried the Transpacific Partnership (TPP), initiated talks about the future of the North American Free Trade Agreement (NAFTA), suspended the US-EU free trade talks (TTIP) and intensified attacks against Chinese trade and investment.

In the global markets, these moves translated to occasional fluctuations, while increasing uncertainty about the global economic outlook.

Initially, the US-Chinese Summit in April 2017 seemed to offer some trade relief. Nevertheless, things changed quickly as Trump directed his administration to take a closer look first at Chinese steel and aluminum and later at intellectual property rights and the technology sector – particularly vis-à-vis national security.

With the most hawkish administration since the Reagan rearmament era, these directives resulted in the kind of reports that were only to be expected in early 2018, when the Trump administration began a steady escalation of the US-Chinese trade war, starting in March. Last week, the White House made the “largest trade war in history” official, while starting to escalate trade friction with Europe.

Unsurprisingly, almost all Asian currencies are now taking hits not just from expected directions (rate hikes by the U.S. Federal Reserve, the anticipated end of the European Central Bank’s quantitative easing), but also from more less-expected directions (U.S.-Chinese trade war, the nascent U.S.-EU trade war, and escalating rhetoric among the NAFTA partners; U.S., Canada and Mexico).

Impact on Asian currencies

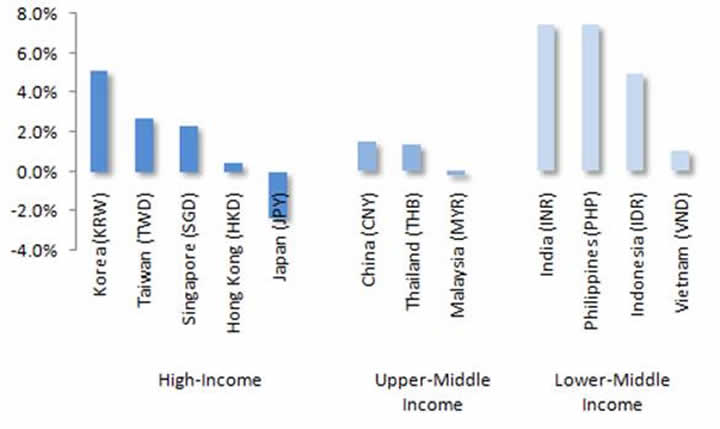

In Asia, the net effect has been as projected half a year ago. Among high-income economies, export-led currencies – Korean won (KRW, -5.1%), Taiwanese dollar (TWD, -2.7%) and Singaporean dollar (SGD, -2.3%) – have weakened relatively most against the U.S. dollar.

The same goes for the currencies of upper-middle income economies, including Chinese yuan (CNY, -1.5%) and Thai baht (, THB, -1.4%), respectively.

Among lower-middle income economies, it is those currencies that represent the relatively fastest-growing countries – Indian rupee (INR, -7.5%), Philippines peso (PHP, -7.4%) and Indonesian rupiah (IDR, -5.0%) – that have weakened relatively most against the U.S. dollar. Since these currencies also represent twin-deficit economies, they will remain relatively vulnerable in adverse scenarios (Figure).

Figure Asian Currencies: 2018 Year-To-Date Percent Change

Nevertheless, these twin deficits should not be compared with that of, say, the U.S. Unlike advanced economies that take more debt to sustain unsustainable living standards, rapidly-growing emerging economies seek to exploit twin deficits in the medium term to accelerate economic growth in the long term. Yet, twin deficits come with exposure that should keep government leaders alert.

In the early phases of the trade wars, those countries – Taiwan, Singapore, Indonesia, Korea, and Malaysia - that export relatively more to China than to the U.S. tend to be better positioned. The reverse case implies greater relative vulnerabilities, which is why Vietnam has resumed the depreciation of its dong.

Other Asian countries try to avoid U.S. trade wrath by fostering strategic ties with the White House (Taiwan, Korea). Still others seek to hedge their bets by seeking greater balance between Chinese economic cooperation and U.S. security ties (Philippines, Malaysia).

The worse is still ahead

It is a highly dynamic landscape. Among the high-income countries, the Trump administration has offered Seoul strategic relief from the trade war, thanks to Seoul’s cooperation in the Koreas’ nuclear talks, which will provide some cushion against won’s further weakening, in the short-term.

Among the upper-middle income countries, the Chinese central bank (PBOC) pledged last week it would keep the exchange rate stable, which put something of a damper on dollar increases. Since China accounts for more than a fifth of the Federal Reserve’s trade-weighted dollar index, more than any other country, it can subdue dollar rallies.

Among the lower-middle income economies, those countries that have strong domestic demand (India, Philippines) are relatively more insulated from trade wars than commodity producers (Indonesia) and exporters (Vietnam). In the long run, there is no safe haven from the trade wars, however.

Here are some unsettling scenarios for the coming months: If the trade war between the U.S. and China will continue to worsen, it could penalize both U.S. and Chinese GDP by 0.25% by the year end.

If similar trade war expands between the U.S. and Europe, the implications will be worse to the U.S. but weaken Germany, France and other EU core economies and thus undermine the fragile European recovery.

If comparable trade friction will extend to Japan, which, despite huge monetary injections by the Bank of Japan (BOJ), has already lost two decades amid secular stagnation, the adverse impact could harm global economic prospects.

If the NAFTA talks were to collapse, U.S. economy would take still another hit, but so would both Canada and Mexico, which could compel them to broaden their ties with Asian economies.

In brief, the elements of a perfect storm are now possible, if not probable yet, especially if the adverse trends will converge. Even in an incremental scenario – one that would mean continued but not disruptive deterioration – economic damage would prove far more substantial in 2019, or worse.

How the major economies will respond to trade war escalation in the coming weeks will determine what’s ahead for all of us in the next few years.

Dr Steinbock is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more information, see http://www.differencegroup.net/

© 2018 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.