Deleveraging Not Deflation Resulting In Commodities Temporary Violent Correction

Commodities / Credit Crisis 2008 Sep 15, 2008 - 08:36 AM GMTBy: Michael_Swanson

I

I  went out of town last week to the Resource Investment Conference in Las Vegas. I'll get to that in a second, but so much is happening that this is going to be a longer message than usual. This weekend we are seeing Lehman go broke, Merrill Lynch in a desperate buyout, AIG try to fend of bankruptcy, and a frightening gap down in the market this morning. And of course last weekend we saw Fannie Mae and Freddie Mac get taken over by the government last Monday. That spurred a beefy gap up that immediately got sold - and that selling pressure sparked a cascade of selling, which in turned caused only what I can describe as a crash in gold stocks.

went out of town last week to the Resource Investment Conference in Las Vegas. I'll get to that in a second, but so much is happening that this is going to be a longer message than usual. This weekend we are seeing Lehman go broke, Merrill Lynch in a desperate buyout, AIG try to fend of bankruptcy, and a frightening gap down in the market this morning. And of course last weekend we saw Fannie Mae and Freddie Mac get taken over by the government last Monday. That spurred a beefy gap up that immediately got sold - and that selling pressure sparked a cascade of selling, which in turned caused only what I can describe as a crash in gold stocks.

That drop caused a lot of gold bugs to throw in the towel and others to claim that we are now in a deflationary environment. I don't think so, I think this environment can be best described as deleveraging. Deflation is normally used to describe a decrease in the general price level or a decrease in the money supply. I do not see either one of these happening right now. In fact consumer and producer prices are still growing while the Fed is printing more money and will print enormous amounts of money in the future as a result of its buyout of Fannie and Freddie.

That event is extremely inflationary, not deflationary.

Yet, despite that fact last week the dollar rose in value while gold fell.

Commodity prices have fallen sharply off of their highs of the summer and that has caused many to claim we are now in deflation.

I disagree - I see this as a temporary and violent correction in commodities due to widespread deleveraging in the financial system and once that comes to an end we should see commodity prices and gold reassert their market leadership.

What is clear is that we are in a bear market when it comes to the broad market. Bear markets come through three main stages - in the first stage market participants fail to recognize the reality of the bear market and think that dips are just temporary corrections.

As their losses add up the second stage begins as the reality of the bear market takes hold and people begin to recognize problems in the economy and the markets. That is where we are now. In the third and final stage there is a general liquidation as people sell out in a panic in fear of suffering further losses. Each bear leg down also goes through this cycle as a panic washout ends each downtrend and causes the VIX and put/call ratio to spike up. But this cycle also runs the gamut of the whole bear market and can take two or three years to play out.

We have seen structural changes to the stock market over the past ten years that in some ways makes the market more different and dangerous than it has ever been before - and that main change can be summed up in one word leverage.

The bust in real estate and collapse of Fannie Mae and Freddie Mac are a direct result of too much leverage in the banking system. Real estate industry cheerleaders have been saying throughout this whole real estate bust that the percentage of loans that were issued as "subprime" were a small percentage of the overall mortgages and therefore were not a problem. However, the real problem isn't the number of subprime loans but the crazy leverage that banks and hedge funds went on to buy too many of them. Fannie and Freddie failed due to the wild amount of leverage that Congress allowed them to have.

When you look at the stock market itself over the past ten years hedge funds have taken on a larger and larger role - and that means so has leverage. Last year right at the market peak there was a record amount of NYSE margin debt in the market - almost 50% more than that seen at the 2000 market peak. At the same time so called "program trading," which comes from hedge funds and institutional investors reached a manic level a year ago. Back in the late 1990's about 20% of all of the trades on the NYSE came from program trading. That level gradually rose year after year as more hedge funds came into the market and reached over 50% in 2004 and hit the crazy level of 90% for a few months in 2007 right before the credit crisis erupted.

Most hedge fund managers are not market wizards - and if we have learned anything over the past year it is that hot shot institutional traders that work for investment banks are not either. What we have seen is mediocre traders that really don't know what they are doing use leverage and trading models and programs to make investment decisions that have turned out to be deeply flawed.

The problem is I don't know anyone who got rich in the market using a trading program. Almost all trading programs are created with formulas based on back tested data to match what the market did in the past. If the market patterns change - and they never last forever - then the trading program goes bust. The most famous hedge fund bust was the Long-Term Capital hedge fund that used a mathematical formula to go on margin approaching 100-1 leverage. And how many banks used mathematical models to buy mortgages based on data that came from decades of rising real estate prices? Once real estate topped and began a bear market the models no longer worked.

All of this smacks to me of pure arrogance and stupidity. In last weekend's Barrons there is an amazing letter from Anthony Piszel, the CFO of Freddie Mac. In this letter Piszel tried to claim that there is nothing wrong with Freddie. He claimed that those that think Freddie will go under need to look away from "Freddie Mac's fair-value balance sheet to ascertain our financial condition. Freddie Mac is a buy-and-hold investor- we invest in mortgages with the intent of holding them to maturity. So today's mortgage valuations are less relevant a measure of our financial condition, especially given the highly subjective nature of these valuations in today's market."

In other words the market has been wrong to lower the value of Freddie Mac's mortgage securities and we at Freddie Mac believe they deserve more value than they have right now and if they did our balance sheet would look fine so don't look at our balance sheet to figure out the financial condition of our company, but instead listen to what we tell you.

Two days after this letter was published Freddie Mac accepted a takeover by the US government.

This same sort of arrogance has also been alive and well in the hedge fund world - where there are traders that have been using massive leverage based on mathematical models and are now blowing themselves up. When I was Vegas last week I wondered into a hedge fund conference. I found hedge fund managers and sellers of program trading and accounting software milling around.

What struck me though were the titles of the seminars these people were going to. Most of them had fancy sounding titles that were designed to impress, but said nothing of substance.

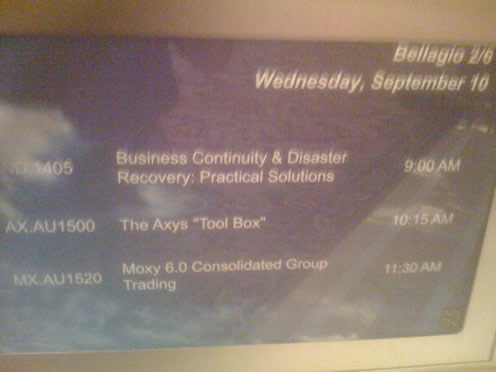

For instance look at this photo I took of the morning schedule for one of the seminar rooms. The second two titles full of hype and no descriptive value refer to some sort of program trading software while the first one is a fancy way of saying - "what do when you are F***** - or to put it politely "what to do when you get margin calls and redemptions and blow yourself up."

To me though these titles sum up what is happening right now in the financial market. We are witnessing a wave of redemptions and deleveraging coming from hedge funds that has been asserting tremendous selling pressure on commodity stocks lately.

Oil and commodities were the best performing sectors in the first half of this year and a lot of hedge fund and hot money flowed into them. As those sectors peaked in July they corrected and that correction turned into a mini-crash last week.

Forced selling was evident and at this point there are few retail sellers left in the commodity markets - the sellers that remain - and probably did most of the selling last week - are hedge fund managers who never entered their positions as investments or due to fundamentals, but because their models said to do it.

There is something attractive to using a model when you run institutional money. If you have no track record or little experience in the market you can sell your fund by talking up its fancy sounding trading program. And as you run the fund you can use the models to give yourself the confidence to go on margin and leverage the fund up to make more money. It all works though until the trend that has made the model works comes to an end.

That happened with mortgage securities last year and happened with commodity stocks this month as they reached oversold technical readings never seen before and fell anyway.

The result was forced selling and a mini-crash in gold and gold stocks that has practically caused anyone to sell to do so. And a stock market on the verge of going into a mini-crash today.

When I went to the gold investment conference it was like walking into a ghost town. I got there just as gold stocks were trading down 10% for the day. I had never seen one of these conferences like this before. There were about a quarter of the booths as there normally are and hardly anyone was there. It made me wonder if in fact everyone had actually sold out. It certainly was a good sign from a contrarian standpoint

It wasn't just the number of booths that was surprising, but the lack of people listening to the presentations that was shocking. Over half the seats were empty. Someone told me it hadn't been this empty since the gold bear market bottom around 2000.

And the people who were in attendance weren't too chipper. To top it off there was even a black bird flying around. I couldn't take the negative energy and didn't stay around long, meeting people outside of the show.

I try to use trading tactics to find entry points in larger trends. I had thought in the summer that gold stocks would breakout and run through the end of the year in part in response to the coming blow up of Freddie and Fannie Mae. Based on this belief I use technical trading tactics to pick gold stock bottoms twice in the past seven weeks. When gold stocks bounced and then turned back down to go through my buy point I realized that I was wrong to think I had bought a bottom and sold. My stop loss points got hit.

The problem is with hedge funds and big investors who don't use a good game plan when it comes to money management. They refused to recognize that their trading models were no longer working and rode out their positions for huge losses. As a result they ended up selling in panic. And then another problem is retail investors who bought with no game plan and then sold out too.

Right now I don't have a position in gold stocks, but I'm going to watch them carefully again in the coming weeks. They do appear that they may have put in a bottom. I am worried though about the broad market possibly weakening them in the short-term, because the market is in a very precarious position, but if gold stocks base and provide a good entry point I will buy them again.

This is how a trader has to think, but if you are an investor in gold stocks then it really makes no sense to sell at this point. If you held through an over 50% drop that took place in less than two months it really makes no sense to sell. Unless gold is going to $500 there simply should not be much more downside to these gold stocks even if they made new lows again.

And I don't believe gold is going to $500, because I believe this correction isn't caused by deflation, but by hedge funds and large institutional investors who were overly leveraged blowing themselves up and selling to get off margin and to meet redemptions - a process that could last into the end of this year.

To put it this way if you held through a 50% drop as an investor it makes no sense to sell out in fear of another possible 10% drop. Large producing gold stocks are not going to zero.

We may have also reached a point with gold stocks that even if these people keep selling the stocks won't make new lows and fall hard anymore, because on a fundamental basis they have reached levels that make them so cheap that a bid from industry insiders and value investors could keep them from falling further.

Looking back at what has happened I think there is a very simple fundamental story going on - that is ultimately very bullish for gold. In July it became clear to the Fed and Treasury that Fannie Mae and Freddie Mac were going to have to be taken over by the government. The market was on shaky ground at the time so they took steps to intervene ahead of a takeover.

When Paulson announced the takeover of Fannie and Freddie last weekend he said he was acting at that moment, because the market was in a calming period. In his written announcement of the takeover he said the market was in a "time out" that made acting now prudent.

The Fed, Treasury, and SEC created this short-lived "time out" period. First the SEC created new short selling rules for a host of banking stocks in July to force a short-squeeze rally in them. Then the Treasury acted with the G-8 in early August to start some sort of rally in the dollar. These two moves helped spur a short-lived rally in the stock market in August, but more importantly started a correction in commodities and gold. That correction picked up steam and took a life of its own when it reached the point that it hit stop loss points and forced leveraged players to exit the market - that forced selling created what can only be described as a crash in gold stocks last week.

These moves were necessary to make so that a takeover of Fannie and Freddie could happen in a time of relative calm in the market. Imagine if the takeover was announced in July or right now what could have happened to the market.

I do not believe that the government is constantly intervening in the gold market. To pressure gold all they have to do is work together with several central banks to knock down the price through key support levels from time to time - or do so on the opposite end in the currency markets - and the selling will naturally pick up speed. This seems to be what happened in August. But in September I see the selling coming primarily from market participants stuck with huge losses instead of from than government intervention.

As a trader though I don't factor manipulation into my decisions. I base my decision on charts and trends in order to quantify my risk and set stop loss points. If I get stopped out due to a move caused by Fed intervention that is fine, because that intervention will likely drive the market much lower than my stop loss point and I rather not get hurt by it. As an investor one has to simply decide how much of one's assets one is comfortable holding for the long-term no matter what temporarily losses could occur.

Ultimately the Fred and Fannie news is going to be bullish for gold, because it is going to mean that the Treasury Department is going to end up printing hundreds of billions of dollars over the next two years or so to pay for their losses - and that addition to the national debt will eventually be a drag on the dollar. This is why I find the deflation story hard to swallow.

That is the future. Last week and now though is a different story. In periods of deleveraging investors sell assets and go into cash. Since most margin is done through dollars that means a demand for dollars to raise cash to get off margin. And once institutional investors are in cash their money flows into money market funds and Treasury bills - hence the rising bond prices in the face of what will eventually be an even more inflationary environment.

We are now facing the potential of a panic drop in the broad market in the face of this weekend's news. I'm actually short the market and have to decide whether to cover my positions and take profits. You see every time we have had a huge gap down in the market this year like this we have seen the government cut rates or announce some sort of intervention and the market rally. Will this happen now? What do we need to take from this weekend's news?

Here is my take.

This article continues in the WSW Power Investor section of this website.

By Michael Swanson

WallStreetWindow.com

Mike Swanson is the founder and chief editor of WallStreetWindow. He began investing and trading in 1997 and achieved a return in excess of 800% from 1997 to 2001. In 2002 he won second place in the 2002 Robbins Trading Contest and ran a hedge fund from 2003 to 2006 that generated a return of over 78% for its investors during that time frame. In 2005 out of 3,621 hedge funds tracked by HedgeFund.Net only 35 other funds had a better return that year. Mike holds a Masters Degree in history from the University of Virginia and has a knowledge of the history and political economy of the United States and the world financial markets. Besides writing about financial matters he is also working on a history of the state of Virginia. To subscribe to his free stock market newsletter click here .

Copyright © 2008 Michael Swanson - All Rights Reserved.

Disclaimer - WallStreetWindow.com is owned by Timingwallstreet, Inc of which Michael Swanson is President and sole shareholder. Both Swanson and employees and associates of Timingwallstreet, Inc. may have a position in securities which are mentioned on any of the websites or commentaries published by TimingWallStreet or any of its services and may sell or close such positions at any moment and without warning. Under no circumstances should the information received from TimingWallStreet represent a recommendation to buy, sell, or hold any security. TimingWallStreet contains the opinions of Swanson and and other financial writers and commentators. Neither Swanson, nor TimingWallstreet, Inc. provide individual investment advice and will not advise you personally concerning the nature, potential, value, or of any particular stock or investment strategy. To the extent that any of the information contained on any TimingWallStreet publications may be deemed investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Past results of TimingWallStreet, Michael Swanson or other financial authors are not necessarily indicative of future performance.

TimingWallStreet does not represent the accuracy nor does it warranty the accuracy, completeness or timeliness of the statements published on its web sites, its email alerts, podcats, or other media. The information provided should therefore be used as a basis for continued, independent research into a security referenced on TimingWallStreet so that the reader forms his or her own opinion regarding any investment in a security published on any TimingWallStreet of media outlets or services. The reader therefore agrees that he or she alone bears complete responsibility for their own investment research and decisions. We are not and do not represent ourselves to be a registered investment adviser or advisory firm or company. You should consult a qualified financial advisor or stock broker before making any investment decision and to help you evaluate any information you may receive from TimingWallstreet.

Consequently, the reader understands and agrees that by using any of TimingWallStreet services, either directly or indirectly, TimingWallStreet, Inc. shall not be liable to anyone for any loss, injury or damage resulting from the use of or information attained from TimingWallStreet.

Michael Swanson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.