The Fonzie–Ponzi Theory of Government Debt: An Update

Interest-Rates / Global Debt Crisis 2018 Jul 19, 2018 - 04:09 AM GMTBy: F_F_Wiley

This post is excerpted from my book Economics for Independent Thinkers, although with some updating. It seems relevant after the CBO’s latest long-term budget outlook, which in its optimistic “baseline scenario” called for America’s net federal debt to double over the next 30 years, rising from 76% of GDP in 2017 to 152% in 2048.

This post is excerpted from my book Economics for Independent Thinkers, although with some updating. It seems relevant after the CBO’s latest long-term budget outlook, which in its optimistic “baseline scenario” called for America’s net federal debt to double over the next 30 years, rising from 76% of GDP in 2017 to 152% in 2048.

Before reaching this chapter or even picking up this book, I imagine many of you were already loosely divided into the two major camps of the public debt debate. The first camp is already concerned and doesn’t need my research to form an opinion. These people stress the math involved in borrowing—the idea that you get do extra stuff today, but you have to somehow pay for it in the future. Meanwhile, those in the other camp ask, “So what?” They might argue that America will make good on its debt because “it always does.” Or they’ll point confidently to America’s unique advantages as a military superpower, paragon of political stability, and steward of the world’s predominant reserve currency. Confronted with the lessons of history, they’ll say, “This time is different.”

But what exactly is it that may or may not be different? It’s important to draw a distinction between two concepts of debt limits:

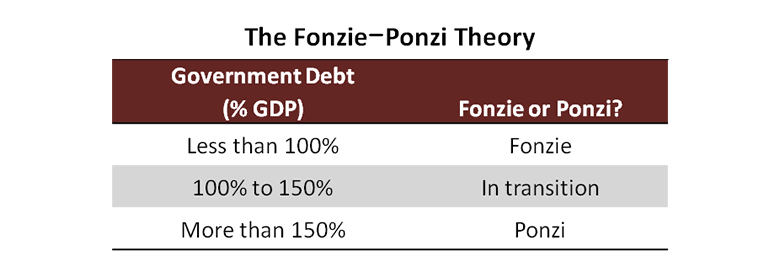

- The Fonzie–Ponzi transition. At what point does it become virtually certain that a debt problem won’t be resolved without a credit event?

- The Keynesian endgame. At what point does the ability to bear more debt break down completely and actually trigger the credit event or hyperinflationary money printing?

I’ll explain Fonzie–Ponzi first. Charles Ponzi was the perpetrator of a pyramid scheme, soon to be called Ponzi scheme, that the Boston Post exposed in 1920. It’s fair to say that Ponzi, who lived extravagantly while his scheme was underway, knew how to manipulate people. He shared that particular skill with Fonzie, although he was a scoundrel, whereas Fonzie was a well-liked sitcom character. If you watched enough Happy Days back in the day, you know that “The Fonz” had a keen understanding of human nature. You also know that impressing friends and foes with his unbounded confidence was a huge part of his alpha-male badassness. I still remember watching the “Richie Fights Back” episode and puzzling over the revelation that Fonzie’s tough-guy image was a confidence trick. Fonzie asks Richie, “In the entire time you’ve known me, have you ever seen me in a fight?” Richie’s answer: “Well no, but that’s just because the other guy always backs down first.” In other words, it was no George Foreman–like string of knockouts that made Fonzie fearsome. It was attitude, reputation, and a commanding voice, along with a self-described “majestic bearing.”

Fonzie soon became my word association for other confidence tricks. For example, paper currencies are Fonzies because their value rests entirely on confidence in the governments that back them. And where do Ponzi schemes fit in? Well, Ponzi schemes have characteristics that don’t quite fit The Fonz. Namely, they need an endless supply of participants to sustain confidence and stay alive. Once the participant pool depletes as it eventually must, Ponzi schemes are revealed as scams. Whereas Fonzies can persist indefinitely (at least in theory), Ponzis must eventually collapse.

Ideally, public debt would always cruise along in Fonzie mode. Governments would rely on the confidence of their creditors, but without taking too many liberties with those creditors. But in reality, finances sometimes deteriorate and push public debt into Ponzi territory. The precise point where this transition occurs depends on the amount of austerity that’s needed to put public debt ratios on a clear downward path, as well as the likely effects of that austerity. Instead of using numerical measures (for now), I’ll say that restoring discipline at the Ponzi point would cause the economy to break down for an unusually long period, failing to create jobs or growth. The downturn may or may not meet the textbook definition of a depression, but it would lead to depression-like joblessness. Think of current circumstances in Greece, for example.

The Ponzi characteristics of the no growth, no jobs scenario are based on politics. Politicians are sure to second-guess austerity in a depression or depression-like economy. If they didn’t, they’d be pilloried and voted out of office, replaced by populists and demagogues. Demagoguery thrives in difficult times—by whipping up a hurricane of discontent. And warnings of fiscal ruin at an indeterminate time in the future? They carry all the force of a gentle breeze. Political realities ensure that short-term thinking carries the day, whereas the Cassandras who insist on fiscal responsibility fade away.

With austerity becoming a bad word in such challenging circumstances, debt resumes its climb toward a higher threshold, one that brings a more destructive outcome. That ultimate threshold—mainstreamers call it debt tolerance, whereas I’m joining the heterodox thinkers who call it the Keynesian endgame—is when investors refuse to lend more money, forcing default or hyperinflationary money printing. It then becomes obvious that the government’s borrowing was a Ponzi scheme. It needed an endless supply of participants to stay alive, but the appetite for debt isn’t endless.

The difference between the Ponzi point and the Keynesian endgame is crucial. At the Ponzi point, the game isn’t over just yet, but it’s a foregone (if not widely recognized) conclusion that you’re on a path in that direction. The path is firmly established because measures to curb deficits would wreak havoc on the economy and change the political calculus about austerity. Also, investors remain in the game at the Ponzi point, happy to hold government debt, in the same way that successful Ponzi schemers are able to find willing participants right up to the end. Large, developed nations, such as the United States and Japan, can sail right past their Ponzi points with nary a flutter in the financial markets. As I’ll argue in a moment, Japan has already passed its Ponzi point.

Think of it this way:

You’re swimming in the ocean on a perfect, sunny day, unaware of a riptide that’s pulling you far beyond a swimmable distance from shore. Once you realize what’s happened, you’ll struggle against the current and may pay for your mistake with your life if there’s no help at hand. But the mistake was made earlier when you ignored the water conditions and drifted past your ability to swim back safely. Let’s say it was halfway between the shoreline and where the rescue helicopter pulled you out that you unknowingly let yourself drift too far. That halfway spot was your Ponzi point.

In the swimming scenario, you should have turned around well before reaching the Ponzi point, even as there were no obvious signs of danger. By the same logic, governments should take action well before public debt rises to Ponzi levels, even though they, too, won’t get a clear warning of the eventual catastrophe.

Now for my thoughts on the Ponzi point for today’s large, developed countries. Smaller and emerging countries are different, because they often lose their creditors’ confidence before the Ponzi point comes into play. Here’s my theory for the big countries:

Thresholds are notoriously inexact in economics, which is why I use big, round numbers. It’s also why I’ve chosen a wide range for the transition from Fonzie to Ponzi. At some point between 100% and 150% debt-to-GDP, I think the sovereign debt of today’s large, developed countries fundamentally changes. Bondholders who were merely perpetuating a confidence trick become participants in a Ponzi scheme.

My estimates are based on the research summarized earlier in this chapter, which I’ll tie into the Fonzie–Ponzi theory in just a moment. I’ll first add a few more qualifiers and then some data. Here are the qualifiers:

- Assumptions behind my transition range. I don’t recommend a range of 100% to 150% for all times and places. It seems sensible, though, for countries with spending commitments extending far into the future without proper funding behind them or even honest accounting. That happens to be many of today’s developed countries. My transition range is also more likely to apply to countries with heavy private sector borrowing. The amount of private borrowing is important because it determines the capacity for new bank credit and, therefore, the likely effects of fiscal policy changes. If private debt capacity is high, banks can cushion fiscal restraint by expanding credit to the private sector. Conversely, low private debt capacity means fiscal restraint can more easily swing bank money creation into reverse (see this article), leading to the stagnant or negative growth that invariably coincides with a broad-based deleveraging.

- Austerity versus anti-austerity. I’m not making blanket recommendations for austerity policies—which may or may not be helpful, depending on the circumstances—nor is this a policy-oriented book in the first place. That said, I’ll offer three brief policy conclusions. First, economic risks are lowest when governments stay well clear of their Ponzi points. Second, even though sovereign defaults are highly disruptive, debt restructuring is often the best option once the Ponzi point is breached. (If you’re headed for default anyway, there may be a case to act quickly and restore public debt capacity to healthy levels.) Third, after a restructuring occurs, it’s imperative to put public finances back on a sustainable path, one that remains below the Ponzi point. Of course, politicians often reach very different conclusions.

- Fonzie–Ponzi versus Minsky. The Fonzie–Ponzi theory is more lenient than Hyman Minsky’s financial instability hypothesis. Minsky proposed a “Ponzi finance” threshold for private debt, but we can just as easily apply it to the public sector. He said that borrowing qualifies as Ponzi finance whenever fresh issuance is needed to fund interest on existing debt. According to the common assumption that America would miss interest payments without regular increases in the statutory debt limit, we long ago triggered Minsky’s threshold.

Now here’s the data:

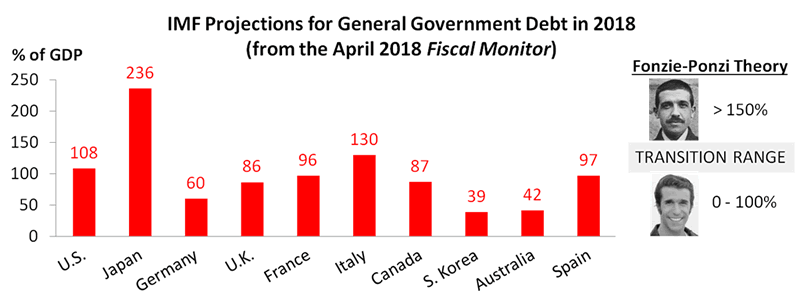

The chart shows the IMF’s projected 2018 public debt ratios for the ten largest advanced economies, ordered from highest to lowest GDP. It shows three economies in the transition range and one full Ponzi, and these include the two largest economies and three of the largest six. Meanwhile, private debt has grown nearly as fast as public debt on a global basis. The Bank for International Settlements compiled data showing global borrowing by households and corporations jumping from 126% of global GDP in 1999 to 151% in 2008 and 159% at the end of 2017. That growth in the private debt burden—33% of GDP so far this millennium—has to eventually stall or reverse. Soaring private debt makes it even more important to heed the Ponzi point for public debt.

F.F. Wiley

F.F. Wiley is a professional name for an experienced asset manager whose work has been included in the CFA program and featured in academic journals and other industry publications. He has advised and managed money for large institutions, sovereigns, wealthy individuals and financial advisors.

© 2018 Copyright F.F. Wiley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.