Trump Put to Lower US Dollar

Currencies / US Dollar Jul 27, 2018 - 10:51 AM GMTBy: Axel_Merk

Has President Trump introduced a Trump Put by lashing out about rising interest rates and calling for a weaker dollar? The market reacted swiftly - and rationally - albeit not the way Trump had intended. Let me explain.

Has President Trump introduced a Trump Put by lashing out about rising interest rates and calling for a weaker dollar? The market reacted swiftly - and rationally - albeit not the way Trump had intended. Let me explain.

Trump suggests the U.S. is put at a “disadvantage” given that the European Central Bank and Bank of Japan continue their more expansionary monetary policies. Markets reacted by selling off the dollar versus major currencies. If that were all, you might shrug this off as disruptor-in-chief rattling the currency markets a bit. Maybe there isn’t much more to it. After all, speculators had been bidding up the greenback of late and, possibly, this was as good a catalyst as any to take some profits.1 But that’s not the end of it. First, Mr. Trump appears to favor a weaker dollar and may well provide more verbal intervention should the dollar resume its climb. In that sense, Mr. Trump has introduced Trump put. But why is it that a comment by the President moves currency markets? Partially, this may be because he has shown a willingness to use executive power to interfere with trade.

However, Trump went beyond suggesting the dollar should weaken. In this interview with CNBC that aired last Friday, President Trump said, “I don’t like all of this work that we’re putting into the economy and then I see rates going up.” He qualified his statement saying, “but at the same time I’m letting them do what they feel is best.”

Yet, as Mr. Trump called for lower borrowing costs for the U.S. in an era of rising deficits, borrowing costs actually rose. In our assessment, this is no co-incidence. Here’s why:

- The cheapest form of monetary policy is verbal. If a central banker tells us “rates will be low for an extended period of time,” the bond market will reflect this, assuming that comment is credible.

- If verbal guidance (think “forward guidance”) is insufficient, the central bank needs to raise or lower rates.

- In times of crises, lowering rates may be insufficient, and the central bank may need to intervene more heavily in the markets, such as through large-scale purchases of bonds (so-called quantitative easing).

As former Treasury Secretary Hank Paulson once said, if you have a bazooka, you may not need to use it. That is, to prove my point: words are “cheaper” than action.

Here’s the rub: when politicians start chiming in on monetary policy - especially if it is someone influential who implies policy makers at the Fed could be fired (Trump is “letting them”) - it torpedoes monetary policy, diluting the message of the Fed. As a direct consequence, it is more expensive for the Fed to pursue whatever plan it has. In my view, that is why bonds sold off, yields rose: debt that needs to be refinanced will need to be financed at a higher rate.

To be clear:

- Technically, Trump could fire Powell “for cause”, but I consider the odds remote.

- I don’t consider Fed Chair Powell a pushover.

Market professionals talk about an ‘increased risk premium’ being priced into the yield curve. Differently said, the dollar just got ‘riskier’, explaining why yields rose, even as the dollar fell.

But if Powell is no pushover, does it matter what Trump says in an interview? Isn’t the Fed independent? In my humble opinion, currencies - and monetary policy - are a credibility game. Monetary policy is effective because there’s the general belief the Fed will do the right thing. Anything that reduces this effectiveness is not desirable. Note that the Fed shares responsibility for Trump’s comment. How come? Not because the Fed has raised rates several times and is expected to raise rates further, but because the Fed’s actions since the financial crisis have invited political interference as the Fed has stepped onto fiscal turf: The Fed’s buying of Mortgage-Backed Securities (MBS) is fiscal policy as it allocates money to a specific sector of the economy. The Fed’s paying of interest on excess reserves (IOER) is also a political hot potato, as the Fed is literally paying billions to banks in an effort to discourage banks from lending. Not surprisingly, political attacks on the Fed have increased.

In the 1970s, political interference contributed to stagflation. In contrast, in the early 1980s, President Reagan had Fed Chair Volcker’s back when he raised rates rather substantially. Should we care about either of these precedents when the economy is doing reasonably well? The economy may be doing well right now, but consider the following scenario:

- The economy continues to grow at a reasonable pace;

- We are near full employment;

- Wage pressures continue to rise;

- The Fed continues to raise interest rates;

- The economy starts to slow down as higher rates start to have an impact on growth;

- Wage pressures continue to rise, even as the economy slows down;

- The Fed continues to raise interest rates

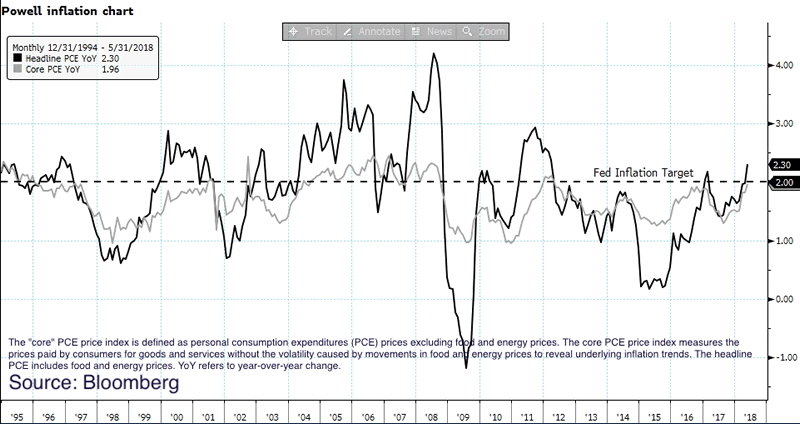

If you look at the chart above, you see inflation is already at the Fed’s target of 2%; some shrug off recent rises in inflation data due to statistical aberrations, but an economic stimulus at a time when the economy runs near full employment may well make it plausible that my scenario is realistic.

Many pundits may scream “stop” once the yield curve inverts (when short-term rates exceed long-term rates), but keep in mind the Fed’s mandate is not to prevent the yield curve from inverting.

Now put Mr. Trump into the mix. You have an economy that shows strains, yet the Fed continues to raise rates. In such a scenario, I would think it is perfectly plausible to hear more lashing out at the Fed by the President. Will the Fed set different interest rates as a result? Even if Mr. Powell is no pushover, it may be costly nonetheless as Fed policy may have gotten more expensive: more action (higher rates) may be necessary because of the political interference than otherwise would be warranted. And there you have it: a Trump put with unintended consequences.

If you are interested in learning how to take direct positions on interest rates, we might be able to be of service click here to learn more. In the meantime, please explore our chartbooks, register for our free newsletter and follow me on LinkedIn, Twitter, Facebook or Patreon.

Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.