EURCAD Remains Bearish

Currencies / Canadian $ Aug 16, 2018 - 03:23 PM GMTBy: FXOpen

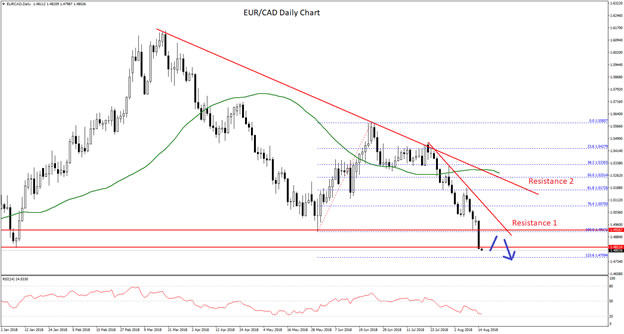

The daily chart of EUR/CAD remains in a downtrend below the 1.5000 pivot level.

Key Points

- EUR/CAD declined heavily and broke key supports near 1.5080, 1.5000 and 1.4920.

- There are two bearish trend lines in place with resistance at 1.5000 and 1.5150 on the daily chart.

EUR/CAD Technical Analysis

The Euro faced many hurdles near the 1.5500 level in July 2018 against the Canadian Dollar. As a result, the EUR/CAD pair moved down and broke many supports like 1.5200 and 1.5000.

It seems like the pair was rejected from a crucial bearish trend line with current resistance at 1.5150 on the daily chart. Moreover, the 50-day SMA also prevented gains above the 1.5400 level.

During the recent decline, the pair broke the 1.4900-1.4920 support zone as well, which is a strong bearish sign. Since, the pair is below the last swing low, it could test the 1.236 fib extension level of the last wave from the 1.4917 low to 1.5585 high.

However, there is a decent support waiting near the 1.4750 level. Should the pair bounce back from the 1.4750 and 1.4800 support levels, it could retest the 1.5000 pivot zone.

On the upside, there are two bearish trend lines in place with resistance at 1.5000 and 1.5150 on the daily chart. A break above the first trend line and 1.5050 could open the doors for a larger recovery towards 1.5150 and 1.5200.

On the flip side, if the pair fails to hold the 1.4800 and 1.4750 support levels, it may well trade towards the 1.4500 level in the medium term.

The market outlook is provided by FXOpen broker.

FXOpen - true ECN/STP Forex and cryptocurrency broker.

© 2018 Copyright FXOpen - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.