TRADING THE GLOBAL FUTURE - Bad Timing

Economics / Protectionism Aug 22, 2018 - 04:11 PM GMTBy: Dan_Steinbock

This is the first of a three-part series.

This is the first of a three-part series.

In less than two years, the Trump administration has undermined more than seven decades of U.S. free trade legacies. That is both a reflection of and a catalyst for the further erosion of globalization.

Yet, these trade wars did not come out of the blue. The path to the tariff wars is becoming increasingly difficult to reverse or slow down, and the timing of the trade war could not be worse. It is taking place at a historical moment when global economic integration could further stagnate or even fall apart.

The Not-So-Fabulous Four

Today, Trump’s tariff wars are led by Peter Navarro, Director of the White House National Trade Council, and his ally and fellow Trump trade advisor Dan DiMicco, former CEO of the U.S. steel giant Nucor. They are supported by U.S. Trade Representative (USTR) Robert Lighthizer and Secretary of Commerce Wilbur Ross.

Until recently, the trade hawks in the White House had been contained by more mainstream policymakers, such as former Secretary of State Rex Tillerson, Director of the National Economic Council Gary Cohn, and Treasury Secretary Steve Mnuchin. After Tillerson lost his job and Cohn resigned, things changed. Cohn’s Goldman Sachs companion Mnuchin proved weaker, while Ross leaned on winners, regardless of the cause. As free-traders moved out, protectionists stepped in.

The key ideas evolved from mercantilist economic doctrines, the Reagan era trade wars in the 1980s and more controversial moral hazards and financial dealings by Navarro and Ross, respectively. In the protectionist camp, the key players are Navarro and DiMicco, two vocal free trade critics, who have long been determined to prioritize steel at the expense of other U.S. industries. Lighthizer is a Reagan era trade hawk who served as Deputy USTR in the '80s, sees China as Japan 2.0 to be contained and would like to have the Republican Party become a party of tariffs as it once was.

Often called the “King of Bankruptcy,” Secretary of Commerce Wilbur Ross made his estimated $700 million in assets by buying bankrupt companies, especially in manufacturing and steel. A recent Forbes report indicates that allegations against Ross — which have sparked lawsuits, reimbursements and an SEC fine - come to more than $120 million: “If even half of the accusations are legitimate, the current United States secretary of commerce could rank among the biggest grifters in American history.”

The Path to Trump’s Trade War(s)

Historically, U.S. trade deficits stem from the 1970s, three decades prior to China’s rise. Moreover, the deficits are multilateral, not bilateral. They have prevailed more than four decades with Asia; first with Japan, then with the newly-industrialized Asian tigers, and most recently with China and multiple emerging Asian nations. At the same time, starting with Deng Xiaoping’s economic reforms, U.S.-China merchandise trade soared from $2 billion in 1979 to $579 billion in 2016 as China grew to become America’s second-largest merchandise trading partner, third-largest export market, and biggest source of imports.

In the mid-1990s, the Clinton administration negotiated the North American Free Trade Agreement (NAFTA). In the early 2010s, the Obama administration touted - though failed to secure Congressional ratification for - the Trans-Pacific Partnership (TPP). On his inauguration day, Trump announced U.S. withdrawal from the TPP and pledged to renegotiate NAFTA. Following a year of tough campaign rhetoric against China, he began to walk the talk.

After their first summit at Mar-a-Lago in April 2017, President Trump and Xi Jinping announced a 100-day plan to improve strained trade ties and boost cooperation. As the Chinese side started to explore areas of reconciliation, the White House undermined its stated plan. Only days after the summit, Trump signed trade measures that were almost bound to result in a trade war by spring 2018.

In April 2018, the Trump administration introduced its first trade threats. In mid-June followed the details on its 25% tariff on $34 billion of Chinese imports effective July 6, while threatening levies on another $16 billion of imports. As the stakes have now soared to $50 billion, the US-Chinese trade war is entering a more serious phase.

The early impact of China's tariffs on US exports is likely to prove greater than that of US tariffs on China's exports because $50 billion represents 38% of US exports to China but only 10% of Chinese exports to the US (Figure 1).

Figure 1 Early Tariff War Hurts the US More than China

Source: Data from Standard & Poor’s

In the US, the share of “globalists” - those committed to free trade and international engagement - has shrunk dramatically since the Cold War. Nevertheless, Trump’s methods are alienating not only US farmers, whose revenues have been penalized by the tariff wars, but also the powerful U.S. Chamber of Commerce. In July, Chamber President Tom Donahue launched a high-profile campaign against Trump’s tariffs, arguing that “we should seek free and fair trade, but this is just not the way to do it.” Trump needs his constituencies to contain Democrats in the mid-term fall election.

The US tariff wars began bilaterally with China, but conflicts are becoming increasingly multilateral. As Trump has threatened to impose steep tariffs against the EU, German Chancellor Angela Merkel recently warned Trump not to unleash an all-out trade war. After all, the ultimate objective of the Trump administration is to target America’s deficit partners, including China, Mexico, and Japan. The proposed measures are just means to that final goal. In 2017, the US had the greatest trade deficit with China ($375bn), Mexico ($71bn), Japan ($69bn) and Germany ($64bn), followed by Vietnam, Ireland, Italy, Malaysia, India, and South Korea (Figure 2).

Figure 2 US Trade Deficit in 2017 ($ Billions)

Source: US Census Bureau

The Trump administration seems to think that if it can “break” China’s trade resistance, then that will serve as a demonstration effect to America’s NAFTA partners and other allies in Europe and East Asia. It is a misjudgment that is about to backfire and prove very costly.

The Doldrums of Globalization

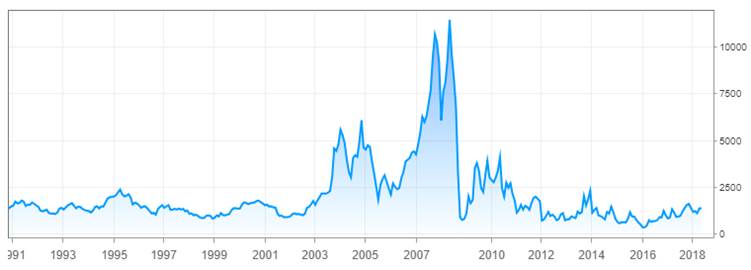

At the peak of globalization, the Baltic Dry Index (BDI) was often used as a barometer for international commodity trade. The index soared to a record high in May 2008 reaching 11,793 points. But as the financial crisis spread in the advanced West, the BDI plunged by 94 percent to 663 points. Fueled by massive fiscal stimulus and monetary easing, it climbed to 4,661 in 2009. However, as stimulus policies expired, it bottomed out at 1043 in early 2011, amid the European sovereign debt crisis. During the first Trump year, the BDI has stagnated around 1,000 to 1,800; some 85 to 90 percent below its peak, despite soaring financial markets (Figure 3).

Figure 3 The Baltic Dry Index, 1986-2018

While the BDI can serve as a short hand for international trade, broader measures of global economic engagement offer equally dire visions. Typically, global economic integration is measured by world trade, investment, and migration. By the 1870s, capital and trade flows rapidly increased, driven by falling transport costs. However, this first wave of globalization in the modern era was reversed by the retreat of the U.S. and Europe into nationalism and protectionism between 1914 and 1945. After World War II, trade barriers came down, and transport costs continued to fall. As foreign direct investment (FDI) and international trade returned to the pre-1914 levels, globalization was fueled by Western Europe and the rise of Japan. This second wave of globalization benefited mainly the advanced economies.

After 1980 many developing countries broke into world markets for manufactured goods and services, while they were also able to attract foreign capital. This era of globalization peaked between China’s accession to the World Trade Organization (WTO) in 2001 and the global recession in 2008. During the global financial crisis, China and large emerging economies fueled the international economy, which was thus spared from a global depression. But as G20 cooperation has dimmed, so have global growth prospects.

Stagnating world investment. Before the global crisis, world investment soared to almost $2 trillion. According to the UN, global FDI flows were projected to resume growth in 2017 and to surpass $1.8 trillion in 2018. In reality, global FDI flows fell to $1.52 trillion last year. That is more than 15 percent below the pre-crisis peak. In the current landscape, the only bright spots are large emerging economies, but policy mistakes in U.S. rate hikes could dampen their projections as well.

Plunging world trade. According to the WTO, merchandise trade volume growth is expected to reach 4.4 percent in 2018, as measured by the average of exports and imports, falling few percentage points below the 2017 level. Moderation looms ahead. As the WTO sees it, “there are signs that escalating trade tensions may already be affecting business confidence and investment decisions, which could compromise the current outlook.” Indeed, world export volumes reached a plateau already in early 2015, as G20 economies introduced new protectionist trade measures at the quickest pace seen since the financial crisis. Since the current cyclical recovery is slowing, strong trade gains look less likely in the foreseeable future.

From geopolitical friction to migration crises. Since the advanced West subjected migration to greater control in the early 20th century, global migration—the third leg of globalization—has shrunk dramatically. Yet, the number of globally displaced people has surged. After the terrorist attacks in 2001, the subsequent U.S.-led wars in Afghanistan and Iraq, coupled with wars and persecution elsewhere in the Middle East and Africa, have driven more than 65 million people from their homes. This represents the greatest global forced displacement since 1945.

The slump of global finance. Following the global financial crisis, there has been a dramatic fall in global finance as well: gross cross-border capital flows-annual flows of FDI, purchases of bonds and equities, lending and other investment-have shrunk by 65 percent in absolute terms, returning to the level of global flows as a share of GDP last seen in the early 2000s. The sharp contraction in gross cross-border lending and other investment flows explain half of the decline, and Eurozone banks are leading the retreat.

Beware of rising risks

As the IMF warned in a recent World Economic Outlook, the ongoing cyclical recovery in global growth prospects is likely to wind down in a year or two, which means rising risks loom on the global horizon thereafter.

It is this dire state of global economic integration that is the backdrop of Trump’s trade war, which may serve as a further negative amplifier. In such a status quo, external growth drivers are desperately needed, and are precisely what Trump’s trade war has the potential to undermine.

Global investment is likely to continue to linger at a level it first achieved a decade ago, while world trade could slump, which would effectively broaden secular stagnation in advanced economies and growth deceleration in emerging and developing economies. In such circumstances, the downfall of finance may prevail, while migration crises and the surge of globally displaced people will remain at record highs, despite peacetime conditions.

Trump's tariff wars have potential to undermine the elusive global economic recovery.

See Alexander, D. 2018. “New Details About Wilbur Ross’Business Point To Pattern Of Grifting.” Forbes, August 7.

Reints, R. 2018. “The U.S. Chamber of Commerce Is Fighting Trump's Tariffs with Facts.” Fortune, July 2.

Issued daily by the London-based Baltic Exchange, the Baltic Dry Index (BDI), is released daily by the London-based Baltic Exchange. It is seen as a proxy for dry bulk shipping stocks and s a general shipping market bellwether.

On the waves of globalization (minus centuries of colonialism), see Globalization, Growth, and Poverty: Building an Inclusive World Economy. World Bank 2002. For a discussion of the state of global economic integration, and the shift toward South-to-South globalization, see Steinbock, D. 2017. “The Great Shift of Globalization: From the Transatlantic Axis to China and Emerging Asia,” China Quarterly of International Strategic Studies (CQISS), 03:02, 193-226.

See World Investment Report by the UN Conference on Trade and Development between 2008 and 2017 (annual), and UNCTAD Global Investment Trends Monitor.

“Trade Statistics and Outlook: Strong Trade Growth in 2018 Rests on Policy Choices,” WTO, Geneva, April 12, 2018.

See Global Trade Alert Report by the Centre for Economic Policy Research between 2008 and 2017 (annual).

The World Economic Outlook: Cyclical Upswing, Structural Change, International Monetary Fund, April 2017.

Neither the zero-bound interest rate policies (ZIRP) nor rounds of quantitative easing (QE) have been adequate to rejuvenate maturing and aging economies. The Fed’s rate hikes could prove fleeting, along with efforts to ignite inflation, while the European Central Bank will have little time to tighten or exit from large-scale asset purchases. The Bank of England must cope with the collateral damage of the Brexit and the Bank of Japan has not been able to end Japan’s secular stagnation, despite massive monetary injections and sovereign debt that now exceeds 250 percent of the country’s GDP.

Dr Steinbock is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more information, see http://www.differencegroup.net/

© 2018 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.