Big Money and the Big Lie

Currencies / Fiat Currency Aug 23, 2018 - 09:09 AM GMTBy: Rob_Kirby

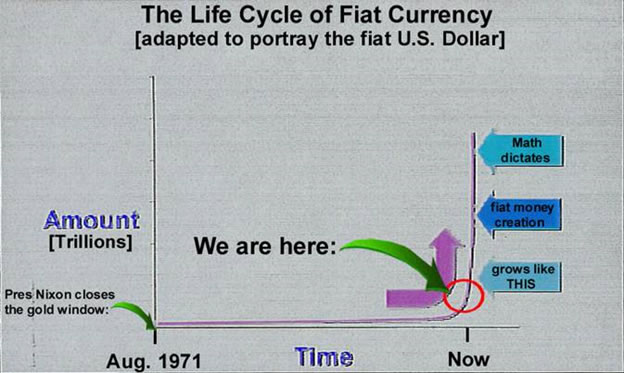

The picture below is one of the most important pieces anyone could look at to begin understanding the true nature/condition of our global financial system:

The picture below is one of the most important pieces anyone could look at to begin understanding the true nature/condition of our global financial system:

This picture depicts the life cycle of “ANY” fiat currency with compound interest. This concept is explained thoroughly by Chris Martenson on his web site under the moniker of The Accelerated Crash Course. I recommend everyone read it.

The important take-away from the picture above is that the US dollar is now on the vertical growth part of its “life curve”. Naysayers might argue, “money growth is not increasing at a vertical rate because the Fed stopped QE [Quantitative Easing] a number of years ago”.

Perhaps the Fed did “technically” stop QE a number of years ago, BUT, the folks at the Fed are well aware of the facts regarding the life cycle of fiat money depicted above. They know if the money is not created, the financial system [US Dollar] collapses onto itself. So what gives?

Connecting Dots

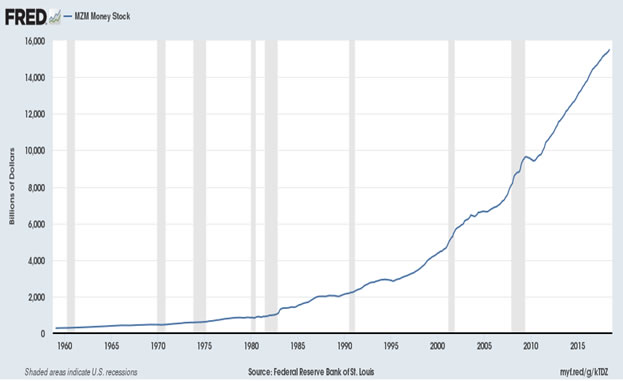

Instead of the vertical nature of the money growth chart above, the Fed would like us to believe that money growth is better reflected by their more sanguine “official” count depicted below:

Do remember folks, the chart above reflect the “officially acknowledged money supply”. The growth rate does not appear to be vertical, does it?

But what about the fraudulently created, missing 21 TRILLION identified by Dr. Mark Skidmore [PhD. Michigan St.] and Catherine Austin Fitts [former undersecretary of HUD – Bush 1 Admin]? This money is not acknowledged to exist and IS NOT part of the official monetary aggregate data depicted above. If one was to “add” the missing 21 Trillion to the 16ish Trillion depicted above – the growth rate would INDEED BE VERTICAL.

So folks, while the Fed may be able to legally claim that QE ended years ago, the REQUIRED monies have been created and they have been silo-ed in places like the ESF [EXCHANGE STABILIZATION FUND].

“The U.S. Exchange Stabilization Fund was established at the Treasury Department by a provision in the Gold Reserve Act of January 31, 1934. 31 U.S.C. § 5117. It was intended as a response to Britain's Exchange Equalisation Account.[2] The fund began operations in April 1934, financed by $2 billion of the $2.8 billion paper profit the government realized from raising the price of gold to $35 an ounce from $20.67. The act authorized the ESF to use its capital to deal in gold and foreign exchange to stabilize the exchange value of the dollar. The ESF as originally designed was part of the executive branch not subject to legislative oversight.”

The web page devoted to the ESF claims that it contains only roughly 100 billion US dollars but then again, it is NOT SUBJECT TO LEGISLATIVE OVERSIGHT, so who really knows? We also know that the ESF was created to protect the dollar. We also know that 21 Trillion US dollars are unaccounted for. We also know that money growth matter-of-factly is greater than what is reported – because it MUST BE. It is not a stretch to figure the existence of this “dark money” is the real reason why US Government Bond auctions have NEVER failed, despite the reluctance of America’s traditional financiers to purchase record amounts of additional US government debt.

So folks, while the Fed may be able to say they are not directly engaged in QE, the US Treasury [ESF] IS and has been for some time – because they MUST. Additionally, the Fed necessarily was complicit in assisting the ESF in creating the dark money.

This is why the Fed will never be audited and this is also why,

"In an apparent departure from 'generally accepted accounting principles,' federal agencies will be permitted to publish financial statements that are altered so as to protect information on classified spending from disclosure…

It’s all part of the BIG LIE, ladies and gentlemen.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2018 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.